Key Points:

- Massive traders sold off Tether USDT late August 3 in key stablecoin pools on Curve and UniSwap.

- Paolo Ardoino, Tether’s Chief Technology Officer, thinks this is foul play.

- The current imbalance shows that investors are increasingly inclined to hold DAI or USDC.

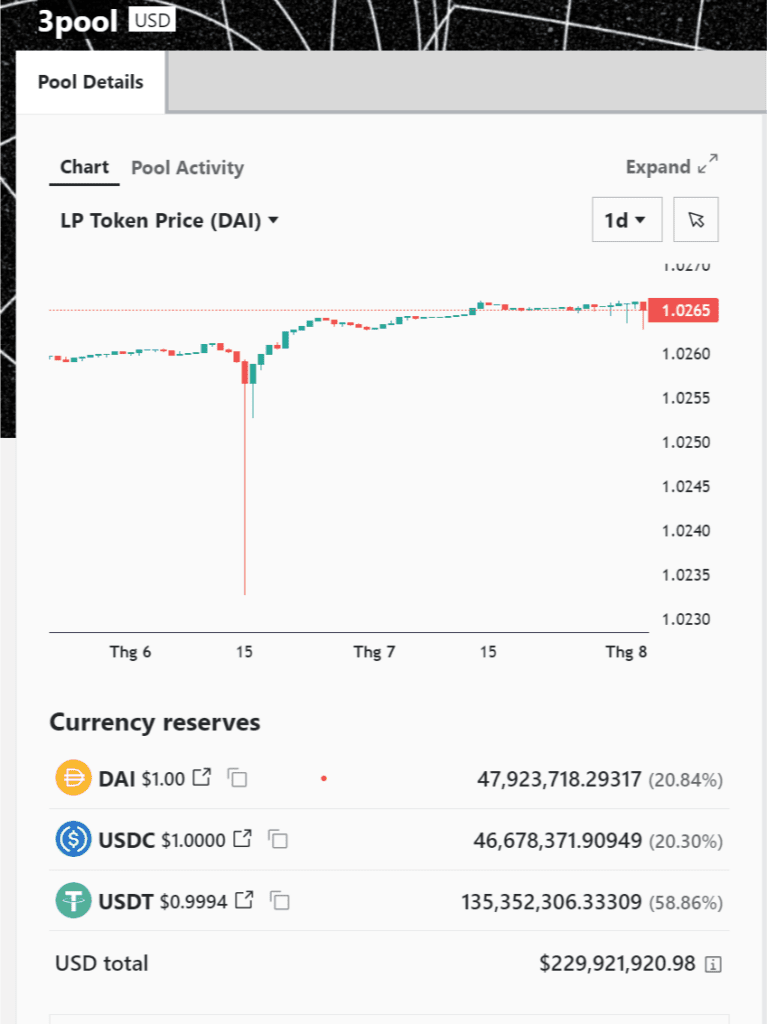

Asset allocation in Curve 3pool was unbalanced as a series of traders sold off USDT in favor of USDC and DAI.

Massive traders sold off Tether in key stablecoin pools on Curve and UniSwap yesterday. Shortly after, USDT recoiled to $0.9976 and was depeg below the $1 anchor for a long time.

Many people have exited/sold USDT to run to other stablecoins, causing the pools to fall into a severe imbalance. According to 3pool data, the USDT balance has now skyrocketed to 59.3% in Curve 3pool, which includes USDT, USDC, and DAI, while USDC and DAI account for only 20.3% and 20.8% of total assets in the pool.

Right after USDT went strong, Paolo Ardoino, Tether’s Chief Technology Officer, suggested that this may be a foul play. The community is also eyeing Hong Kong-based First Digital’s new stablecoin FDUSD, which Binance quickly backed recently.

“Isn’t it interesting that USDt is being pressured down (slightly, within 10bps, just to push market makers to react), and USDc, the main competitor that you would expect to gain from the situation, is redeemed nevertheless heavily, while suddenly a competitor born 2 hours ago is getting it all? Exactly! It feels definitely organic and not manipulative at all. Some people never learn.” He wrote.

The Curve and Uniswap pools are popular places for traders to swap stablecoins quickly. Most of the time, the tokens are balanced in the pool. The imbalance shows that the market is in trouble as investors seek to dump an asset in bulk. Similar imbalances occurred when Terra crashed in May 2022 and the Silicon Valley banking crisis hit USDC Circle Issuers in March of this year.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.