Chainhop Review: Powerful Liquidity Aggregation Protocol With Seamless Experience

Due to the situation of parallel development of multiple chains has become an established fact and future narrative direction in the cryptographic world. Cross-chain DEX saves users from cumbersome cross-chain operations, processing fees, and gas fees. ChainHop emerges as a powerful liquidity aggregator integrated with a cross-chain messaging framework Celer IM is such a cross-chain aggregator. So what is ChainHop? Let’s learn about the working mechanism and outstanding features of this project combining DEX Aggregator and Cross-chain Bridge through this Chainhop review.

What is Chainhop?

ChainHop is a composable multi-chain liquidity pooling protocol that provides liquidity across different bridges and DEXs. This allows users to freely swap between chains with the highest liquidity and at the lowest level.

Furthermore, by integrating with cross-chain message frameworks, ChainHop takes the complex multi-step process of swapping tokens across different chains and simplifies it to a single transaction user experience (UX) easily. Using ChainHop, users can easily convert X tokens on chain A to Y tokens on chain B with just one transaction.

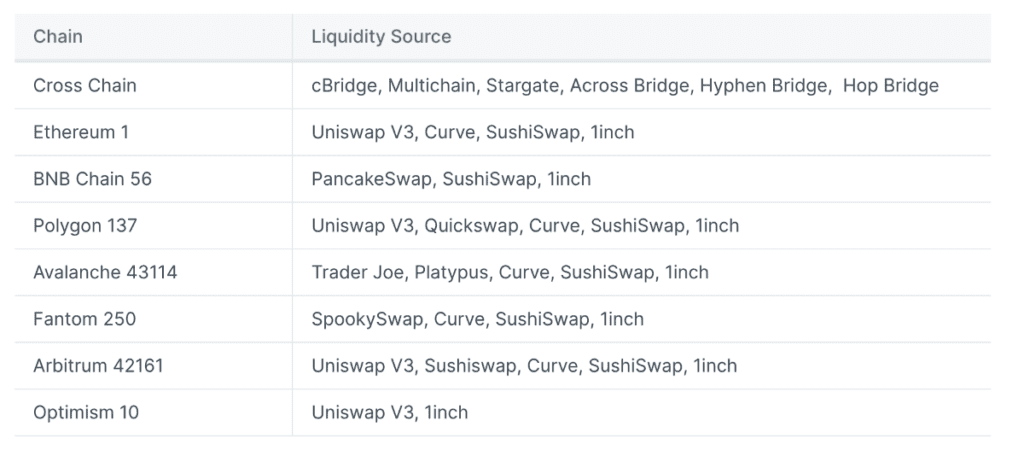

Currently, ChainHop supports seven Ethereum chains, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, Optimism, and DEX on-chain, and supports five cross-chain protocols, including cBridge, Multichain, Stargate, Across Bridge, and Hyphen Bridge.

Outstanding Features

Global cross-chain pricing

Cross-chain liquidity protocols can be explained as having two players in the protocol: liquidity providers who provide settlement liquidity on multiple chains and end-users who make the cross-chain swaps. We can say a cross-chain liquidity protocol is well optimized if:

- LP’s liquidity can be 100% utilized and therefore generate high fees for LPs

- Each user transaction can be completed with low fees given the same liquidity depth

ChainHop achieves the above properties by utilizing the Celer Network framework to build a unique Global Cross-chain Pricing (GCP) mechanism.

In addition to passing messages from one chain to another, Celer can store cross-chain states and transform cross-chain messages based on additional program logic. Therefore, this platform does not have to compute cross-chain conversion pricing based on “soft partition” and “weight adjustments” that will prevent LP’s liquidity from being fully utilized in other protocols.

For the intermediary token bridging from chain A to chain B, ChainHop computes the pricing directly based on the global visibility of liquidity on both chains using a stable swap, like Curve. This way, LP’s liquidity can be 100% utilized (i.e. work conserving). With GCP, LPs can enjoy high aggregated fees with high turnover while, at the same time, users get low per-transaction fees with 100% liquidity availability.

ChainHop currently utilizes Celer cBridge’s liquidity as an intermediary for cross-chain settlement but will transition into protocol-controlled liquidity in the future while evaluating Celer for Inter-chain Messaging and Global Cross-chain Pricing.

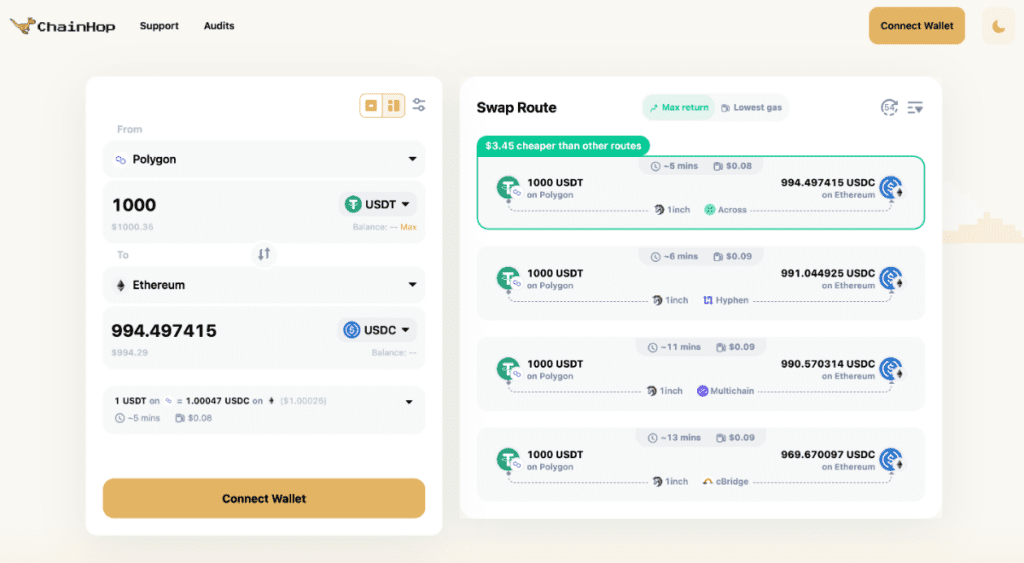

Intelligent Routing Algorithm

With the help of the intelligent routing algorithm established by ChainHop in the product, users can even enjoy more cost-effective exchange rates and slippage compared to some single-chain DEXs.

For example, when a user wants to exchange a large amount of ETH for USDC on Fantom, ChainHop can first connect ETH to Ethereum and then complete the ETH-USDC exchange on Ethereum (because of the better liquidity on Ethereum, the rate is better exchange slippage will be lower), and finally connect USDC to Fantom. And users can complete such complex operations with just one click.

Optimal cross-chain swaps in a single transaction

When a user bridges and wants to buy something on another chain, the time consumed between swapping for a bridge-compatible coin, approving that coin, waiting for the bridge to complete the transaction, and then repeating the same process on the target chain is a long time. ChainHop takes this process and compresses it into a transaction.

Below is a list of blockchains, DEXs, and Bridges at ChainHop chains that are connecting to integrate liquidity sources. More protocols will be integrated in the future.

- Ethereum: Uniswap v3, Curve

- BSC: Pancake Swap

- Polygons: Quick Swap, Curve

- Avalanche: Trader Joe, Curve

- Arbitrum: SushiSwap, Curve

- Fantom: Spooky Swap, Curve

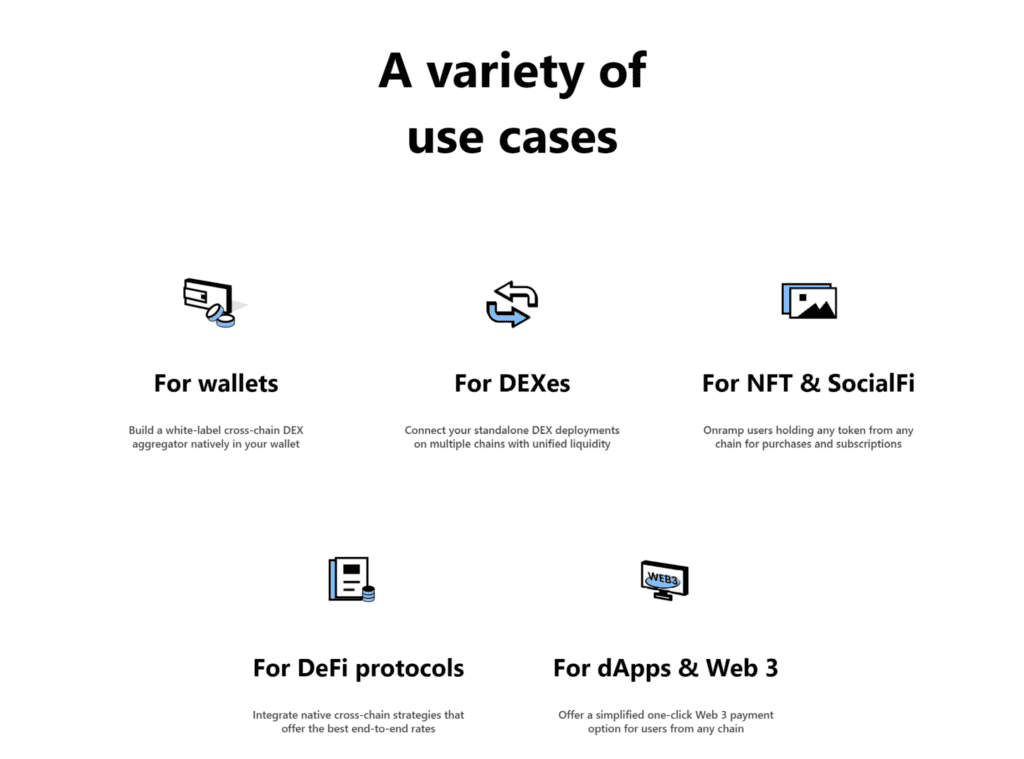

Allows integration into dApps

Applications on the market can integrate ChainHop’s interface to serve the needs of exchanging tokens between chains to users, allowing these applications to take advantage of the liquidity pooled by ChainHop to build cross-chain apps, NFTs, GameFi, or Launchpads.

So NFT Marketplaces can use ChainHop to overcome this. Merchants can still list their NFTs on Chain A but can also accept tokens from buyers in Chain B. The token swap from chain B to chain A will be post-processed by ChainHop, thereby helping to enhance the user experience with just one click when transacting.

Revenue

ChainHop’s revenue will come from users’ multichain token swap fees. Of which, the fee is only charged if there is a destination swap, and the fee collected will be divided partly for intermediate Bridges and partly for the platform.

Tokenomics

At the time of writing this platform has yet to launch a token.

Roadmaps

ChainHop’s development journey is summarized as follows:

- April 2022: ChainHop Official Mainnet

- December 2022: ChainHop reaches 196 million USD in trading volume and reaches nearly 106,000 users after almost 8 months of development.

Project team

The ChainHop team has yet to announce its identity to the community.

Investors & Partners

Investors and funding rounds

The ChainHop team has yet to announce specific funding rounds and investors to the community.

Partner

Most of ChainHop’s partners will be Bridge and DEX projects on the market that ChainHop is supporting. Some typical projects include Hop Protocol, Stargate, cBridge, Curve, QuickSwap…

Cross-chain Swap Guide

In this tutorial, we will guide you through the process for making a cross-chain swap on ChainHop.

Connect Your Wallet

Before exploring the different features offered by ChainHop, you will need to connect your wallet.

Click “Connect Wallet”, and you will be prompted to select a wallet.

ChainHop currently supports MetaMask and WalletConnect in desktop browsers. This tutorial will use Metamask as an example. After connecting your wallet, you should now see your wallet address and your current chain in the top right corner of the page.

Swap Tokens Across Chains

Let’s say, you want to swap 0.1 BNB from BNB Chain to USDC on Polygon. The steps are made simple in ChainHop

- Select “BNB chain” in the dropbox under “From” and “Polygon” in the dropbox under “To”. Under the token button you can see your current balance of the token.

2. You will be prompted to switch your wallet to BNB Chain if it’s not already connected.

Select tokens to swap.

3. Enter the amount you want to swap. You should see the estimated amount you will receive on the destination chain.

4. You can adjust the Slippage Tolerance of the cross-chain swap. Your swap may fail with a very low Slippage Tolerance. The minimum slippage tolerance you can set is 0.15%.

Note that fees will incur for each swap, which will cover the cost of cross-chain message passing and gas fees on the destination chain.

You can also see the best route that ChainHop provides for cross-chain swaps.

5. Review your swap details and click “Swap”. You will receive a popup for swap confirmation.

6. You will be prompted on ChainHop to confirm the cross-chain swap. Review the swap details and click “Confirm Swap”.

7. Then you will be prompted to confirm the transaction in MetaMask. Click “Confirm”.

8. After confirming on MetaMask, you have submitted the transaction. You can check the transaction status in “Pending” in the top right corner of the page, which shows the estimated time of arrival.

It takes some time for the funds to arrive at your wallet on the destination chain. On MetaMask, you can switch to the destination chain, which in our case is Polygon, to check if you have received the funds. Alternatively, you can also view your transaction status via Binance Blockchain Explorer, which can be accessed via a link.

9. When the swap is completed, the transaction status will turn to “Completed”.

You can also view your transaction history in “My Trades”.

Conclusion – Chainhop Review

ChainHop takes the complex multi-step process of swapping tokens across different chains and simplifies it into an easy single transaction (UX) user experience. Using ChainHop, users can easily convert X tokens on chain A to Y tokens on chain B with just one transaction.

The advantage of this type of cross-chain aggregator is that it doesn’t rely on its own internal liquidity, has smaller security risks, better user experience, and more flexible protocol choices.

In addition, ChainHop was created as a means to solve the current cross-chain exchange burden on users and developers. It is highly interoperable with other dApps allowing developers to easily access the cross-chain liquidity protocol to build cross-chain DeFi, NFT marketplace, IDO launch platform, and more.

It is built with a unique smart cross-chain pricing mechanism and supports the largest number of exchanges, tokens and decentralized blockchains, making it a must-have tool for users. as well as developers.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.