DAI Pool Surpasses $400M As MakerDAO’s Dai Savings Rate Increases To 8%

Key Points:

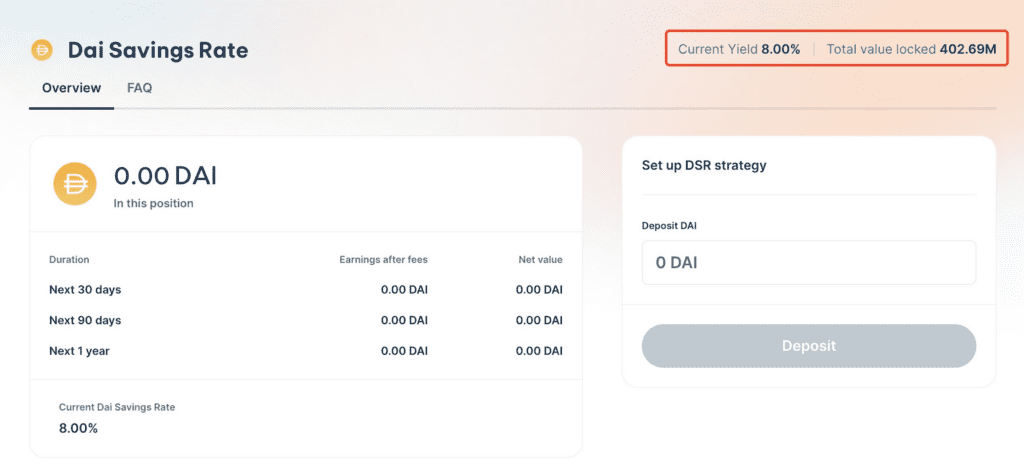

- MakerDAO Dai Savings Rate (DSR) increased to 8%.

- TVL of the DAI pool has exceeded $400 million, with large transactions observed.

MakerDAO Dai Savings Rate increased to 8%, TVL of DAI pool exceeds $400M as large transactions were observed, including a whale selling 5640 ETH for DAI.

MakerDAO, one of the most popular Decentralized Finance (DeFi) platforms, recently introduced the Enhanced DAI Savings Rate (EDSR) to combat the shrinking circulation of its stablecoin, DAI. The EDSR system temporarily increases the effective DSR available to users in the early bootstrapping stage when DSR utilization is low.

The EDSR is determined based on the DSR and the DSR utilization rate and represents over time as the utilization increases until it eventually disappears when utilization gets high enough.

The MakerDAO community conducted a governance vote to introduce the EDSR, which could temporarily increase the interest rate of DAI holders up to 8%. The proposal received 99.93% of the votes in favor, indicating strong support for the EDSR and confidence in MakerDAO’s ability to stabilize the circulation of DAI. As a result, the MakerDAO Dai Savings Rate (DSR) has been increased to 8%, which is expected to stimulate demand for DAI and stabilize its circulation.

MakerDAO has been taking decisive actions to stimulate demand for its DAI stablecoin, which currently holds a total value of $4.6 billion. According to reports, a whale sold 5640 ETH yesterday for DAI, used 5400 wstETH to borrow 4 million DAI and then deposited 14.32 million DAI into MakerDAO.

The total value locked (TVL) of the DAI pool has exceeded $400 million. The increase of the DSR to 8% is intended to increase demand for DAI and stabilize its circulation, which would help maintain the stablecoin’s value and ensure its long-term growth.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.