Key Points:

- FDUSD introduction broadens trading horizons with enhanced margin options.

- Cross Margin pairs (BTC/FDUSD, ETH/FDUSD, FDUSD/USDT, YGG/BTC) open versatile strategies.

- Isolated Margin pairs (BTC/FDUSD, ETH/FDUSD, FDUSD/USDT, OP/BTC) for focused trading.

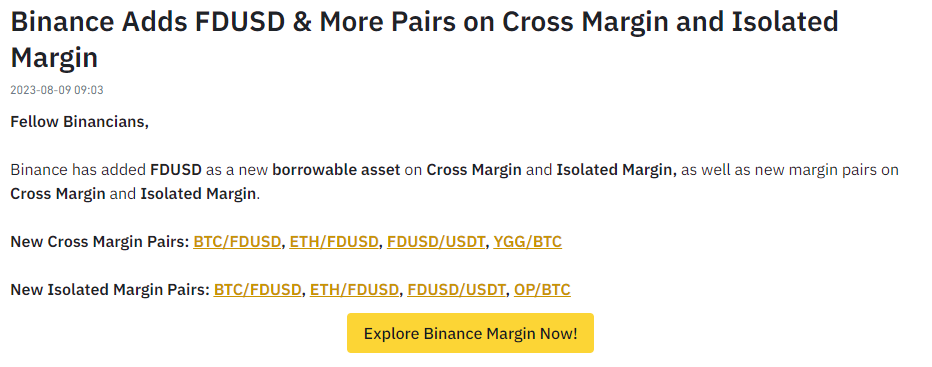

Binance has unveiled exciting updates for its Cross Margin and Isolated Margin platforms.

The addition of FDUSD, a new borrowable asset, marks a significant expansion of Binance’s margin offerings. This move is set to provide users with increased flexibility and enhanced trading opportunities.

The newly introduced Cross Margin pairs include BTC/FDUSD, ETH/FDUSD, FDUSD/USDT, and YGG/BTC. These pairings enable traders to engage in diverse trading strategies by leveraging the combination of major cryptocurrencies and the innovative FDUSD asset.

On the Isolated Margin front, Binance has introduced similar pairs to amplify trading possibilities. The newly added Isolated Margin pairs encompass BTC/FDUSD, ETH/FDUSD, FDUSD/USDT, and OP/BTC. These pairs cater to traders who prefer a more focused and controlled approach to margin trading.

The addition of FDUSD, coupled with the expanded margin pairs, showcases Binance’s commitment to providing its users with a comprehensive range of options to optimize their trading experience. The introduction of FDUSD as a borrowable asset offers traders the opportunity to diversify their strategies and explore new avenues within the cryptocurrency market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.