Russia Launches Digital Ruble Pilot Testing For CBDC Innovation On August 15

Key Points:

- Russia’s Central Bank initiated testing for its digital ruble project on August 15, involving 13 banks and select clients.

- The digital ruble aims to enhance cross-border payments and domestic usage.

- Russia paves the way for digital ruble adoption, emphasizing phased testing and widespread implementation.

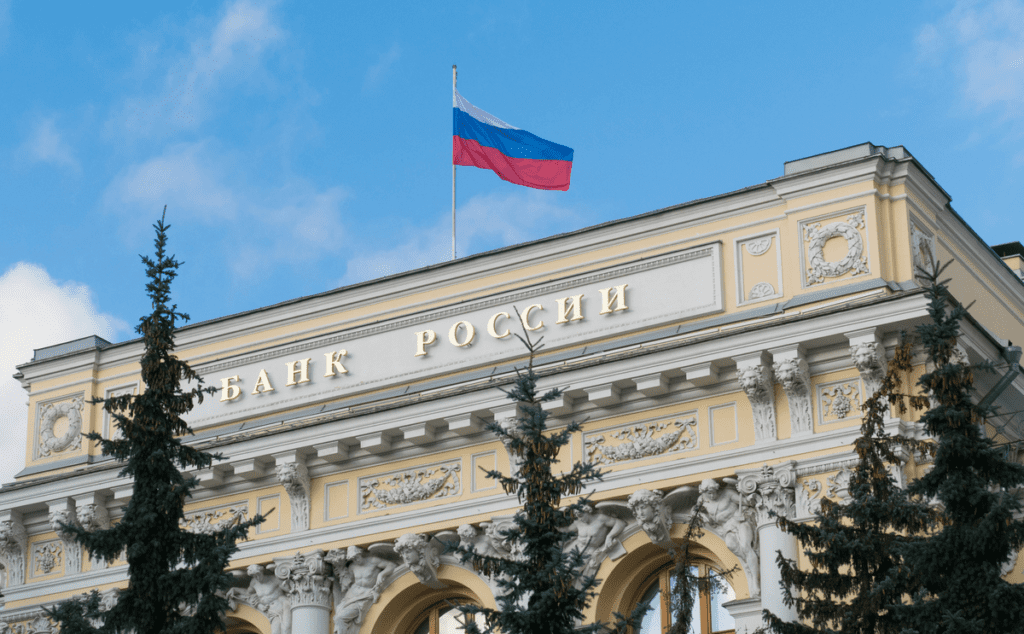

The Bank of Russia (BoR) has unveiled its plans to commence testing the country’s central bank digital currency (CBDC), the digital ruble.

Set to initiate on August 15, the pilot tests will involve 13 banks and a select group of clients. This move signifies Russia’s progress in developing its CBDC as it transitions from extensive bank testing to consumer trials.

The digital ruble aims to enhance cross-border payments and expand its application within Russia’s economy.

First Deputy Governor of the Bank of Russia, Olga Skorobogatova, noted that this step is a pivotal phase, allowing the examination of the digital ruble platform’s functionality, collaboration with clients, process adjustments, and user experience refinement.

The pilot program encompasses diverse activities, such as creating digital wallets, conducting transactions with digital rubles, and facilitating transfers between nearly 600 clients and 30 businesses across 11 cities.

While the digital ruble is planned to officially launch by 2025, the pilot’s first phase focuses on refining fundamental processes, including digital wallet establishment, individual transactions, automated payments, and QR code-based transactions.

Skorobogatova emphasized the bank’s strategy to gradually test and eventually bring the digital ruble into widespread use. Despite varying reactions to CBDCs worldwide, as highlighted by a Bankinform survey, Russia remains committed to realizing the digital ruble’s potential.

As the CBDC landscape evolves globally, Russia’s steadfast approach underscores its determination to drive innovation in its financial system. However, according to Bankinform’s survey, 34% of respondents indicated curiosity about the new ruble but had no plans to use it.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.