Ethereum-Powered Base TVL Trumps StarkNet, Locks $146M in Success

Key Points:

- Base TVL rockets to $146M, outpacing StarkNet’s $112M, fueled by 87% ETH dominance.

- Layer-2 race intensifies as Base’s TPS at 5.61 lags Optimism, Arbitrum, and zkSync.

- Ethereum community’s trust in scalability and reduced costs drives Base’s surge.

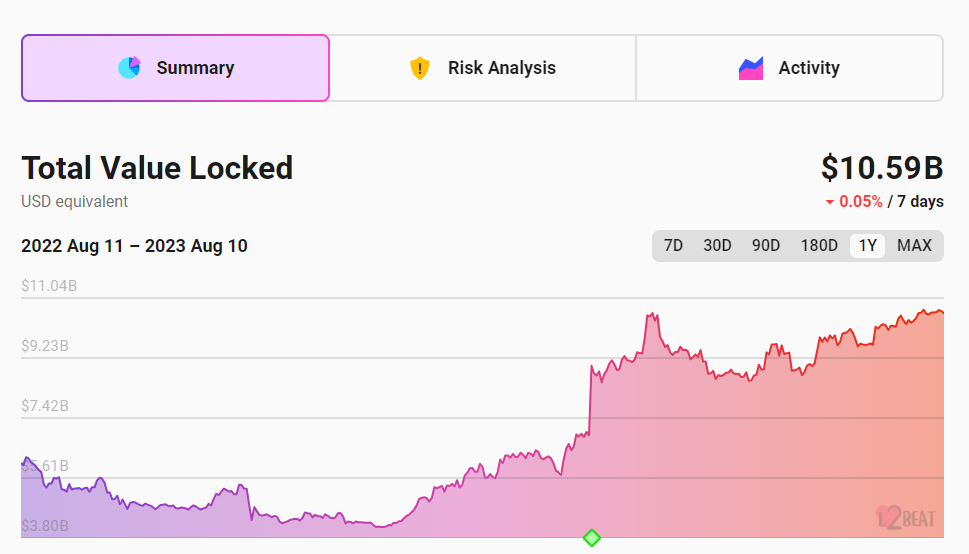

Base TVL (Total Value Locked) has surged to a staggering 146 million US dollars, outpacing the previously dominant StarkNet with its 112 million US dollars TVL.

These figures were reported by L2BEAT, a platform that provides insights into layer-2 scaling solutions for Ethereum.

What makes this achievement even more noteworthy is that approximately 87% of the TVL on Base is accounted for by Ethereum (ETH). This substantial support from the Ethereum ecosystem underscores the community’s confidence in the platform’s capabilities to enhance scalability and reduce transaction costs.

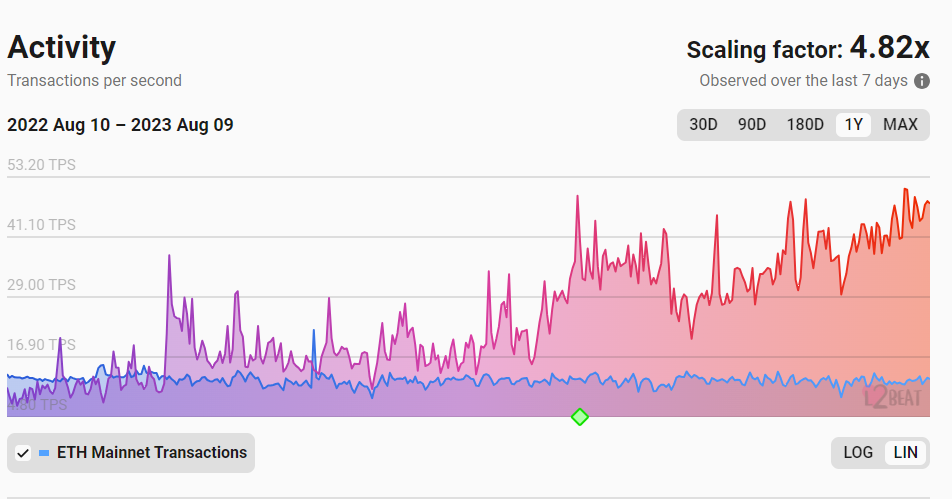

While Base TVL’s meteoric rise is certainly grabbing attention, it’s crucial to consider the transaction performance of these platforms. The recent statistics reveal that Base’s Transactions Per Second (TPS) stands at around 5.61. This places it in a slightly slower position compared to other major layer-2 solutions. For instance, Optimism boasts a TPS of 6.88, Arbitrum One at 7.07, and zkSync Era leads the pack with an impressive 10.44 TPS.

The competition in the layer-2 scaling sector is undeniably heating up. Each solution is vying to offer the most seamless and efficient experience for users, while also addressing the pressing concerns of high fees and network congestion that have plagued the Ethereum network. This intensifying competition is expected to drive further innovation and improvements in the space, benefiting both developers and end-users.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.