Key Points:

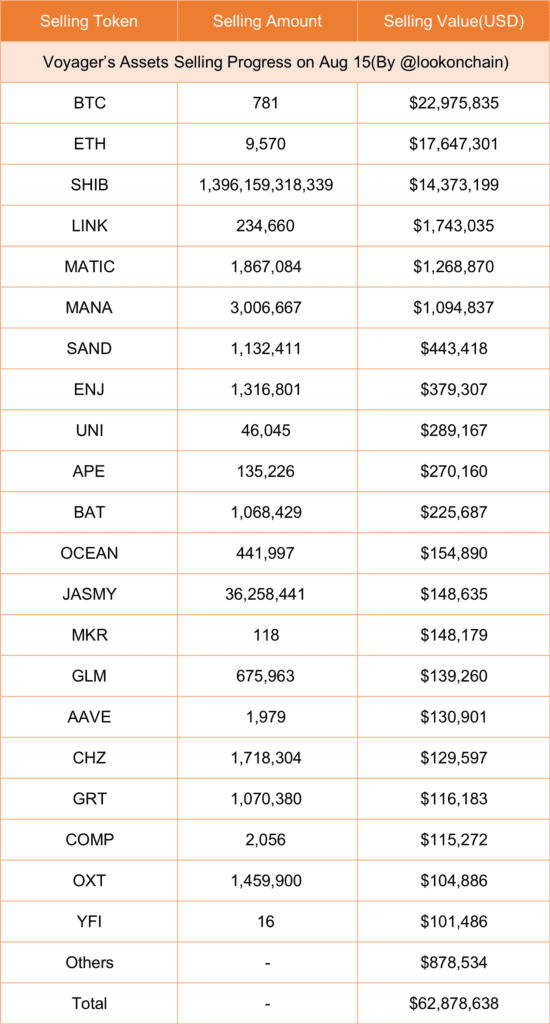

- 49 tokens liquidated, including BTC, ETH, SHIB, LINK, MATIC, MANA.

- Strategic move garners $63 million amid intense crypto interest.

- Discussions ignite over Voyager’s tactics, market impact, and implications.

Voyager has executed a four-day spree of asset sales on Coinbase.

Over this period, the company has managed to sell an impressive 49 tokens, reaping approximately $63 million in the process.

The breakdown of the assets sold presents an array of prominent cryptocurrencies. Among them, a total of 781 BTC, valued at around $23 million, has found its way into the hands of eager buyers. Additionally, the sale included 9,570 ETH, contributing $17.6 million to Voyager’s balance sheet.

The company’s strategy extended to other tokens as well. Notably, a staggering 1.4 trillion SHIB tokens, equivalent to $14.4 million, were part of this massive transaction. In addition, 234,660 LINK tokens were sold for approximately $1.74 million, reflecting the diverse nature of Voyager’s asset portfolio.

The asset sale spree also encompassed tokens from various projects. Voyager sold 1.87 million MATIC tokens, securing around $1.27 million. Similarly, the sale included 3 million MANA tokens, amounting to approximately $1.1 million.

This calculated and strategic sale of assets on Coinbase underscores Voyager’s shrewd approach to managing its holdings and optimizing its financial position. The decision to liquidate such a substantial quantity of assets within a brief period reflects the company’s assessment of market conditions and its readiness to capitalize on favorable opportunities.

The revelation of these transactions has prompted discussions and speculations within the cryptocurrency community. The volume and variety of tokens involved in the sale have sparked debates about market trends, Voyager’s motivations, and potential implications for the broader crypto landscape.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.