Base Ecosystem Lending Protocol SwirlLend Detected As Scam Project

Key Points:

- Base’s SwirlLend protocol vanishes amidst plummeting TVL and token values, raising suspicions.

- SwirlLend is hit by exploitation, Rocketswap’s DEX is hacked, and LeetSwap halts trading, spotlighting security risks.

- Ongoing breaches spark worries about the Base ecosystem’s safety and invite scrutiny of preventive measures.

The Base ecosystem’s lending protocol, SwirlLend, is facing allegations of disappearing from the scene, leaving investors concerned.

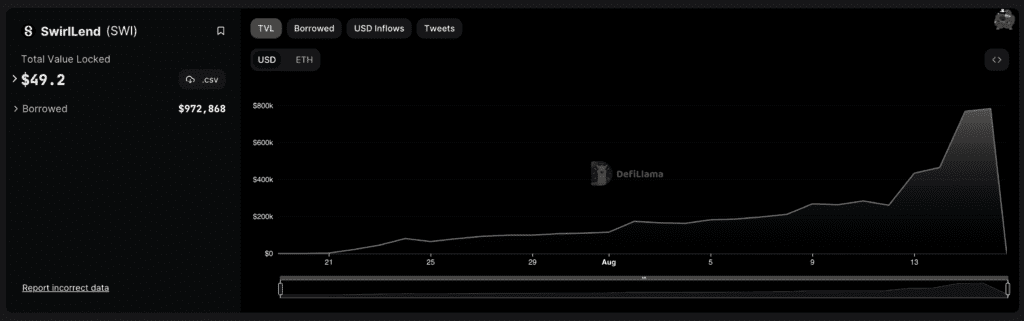

According to data from DeFiLlama, SwirlLend’s Total Value Locked (TVL) has plummeted from $784,000 to a mere $49.2, accompanied by the suspension of its official Twitter account. The native token of the protocol, SWI, has also suffered a sharp decline, nearly touching zero.

Compounding the unease, SwirlLend has wiped its presence from various social platforms, raising questions about its intentions.

The deployer of the protocol has reportedly transferred approximately $289.5K worth of cryptocurrencies from Base to Ethereum, including 140.68 ETH and 32.6K USDC. Yet, a stash of approximately 92 ETH on Base remains in their possession.

Troubles continue as SwirlLend has been exploited on both the Base and Linea platforms. The attacker has transferred about 94 ETH from Linea to Ethereum via the Orbiter Finance bridge.

The attacker’s Ethereum address currently holds 165.6 ETH and 32,641 USDC, indicating their successful maneuvers. This unsettling event marks the third attack on a Base project, raising concerns about the platform’s security measures and vulnerability to phishing.

In a related incident, Rocketswap, a decentralized exchange (DEX) on Base, recently faced a breach that led to losing control over the platform. The breach exploited a proxy contract within the farm contract, resulting in the unauthorized transfer of assets.

Adding to the concerns, LeetSwap, another decentralized exchange, had to halt trading earlier due to a mining incident that resulted in a loss of 340 ETH for liquidity providers. These successive security breaches overshadow the Base ecosystem’s reputation and prompt a closer look at its underlying security infrastructure.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.