BNB Bridge Hacker Triggers $5.5 Million Partial Liquidation on Venus Platform

Key Points:

- BNB Bridge hacker’s maneuver resulted in the liquidation of 1,104,936.45 vBNB, causing losses of around $5.5 million.

- The hacker’s address still holds an arsenal of assets—912,235.14 BNB collateral and debt positions of 112M USDT and 36.75M USDC.

- BNB Chain team now shoulders the responsibility of handling liquidation control for the hack address.

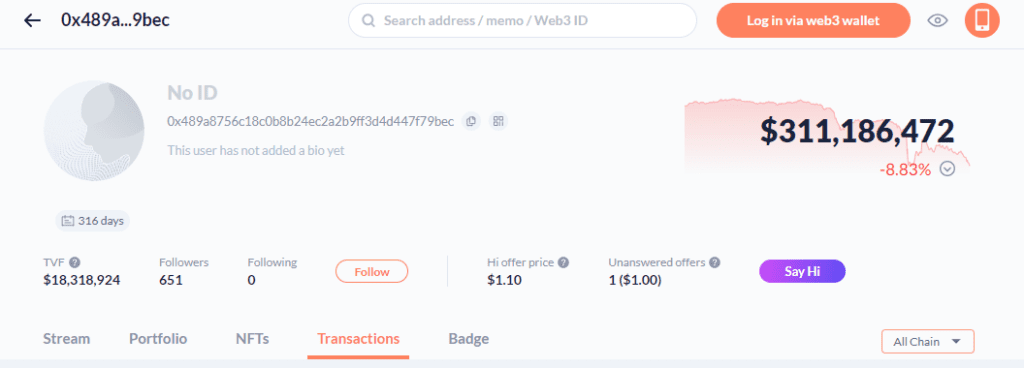

The infamous BNB Bridge hacker, identified by the address 0x48…9bec, has managed to execute a partial liquidation within the Venus position.

This exploit has resulted in the liquidation and repayment of a staggering 1,104,936.45 vBNB, which translates to approximately $5.5 million in losses. The incident has once again raised concerns about the vulnerabilities present within the decentralized finance (DeFi) ecosystem.

The hacker’s address still retains control over a considerable amount of assets. With 912,235.14 BNB collateral, along with debt positions of 112 million USDT and 36.75 million USDC within the Venus platform, the hacker remains a formidable force within the DeFi space. These holdings not only underscore the scale of the breach but also pose a significant risk to the platform’s stability and user confidence.

The responsibility for managing the liquidation control of the BNB Bridge hack address falls upon the BNBChain team. This incident has not only prompted Venus platform users to reevaluate their exposure to risk but has also led to discussions about the wider implications for the security of DeFi protocols. The event serves as a stark reminder that despite the immense potential of DeFi, security concerns continue to be a major challenge.

Analysts and experts within the blockchain and cryptocurrency community are closely monitoring the situation. The incident has sparked conversations about the need for better security mechanisms and audits for DeFi platforms. While the BNBChain team grapples with managing the aftermath of the hack, the broader community is hoping for increased collaboration and transparency to address the security gaps that can be exploited by malicious actors.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.