Key Points:

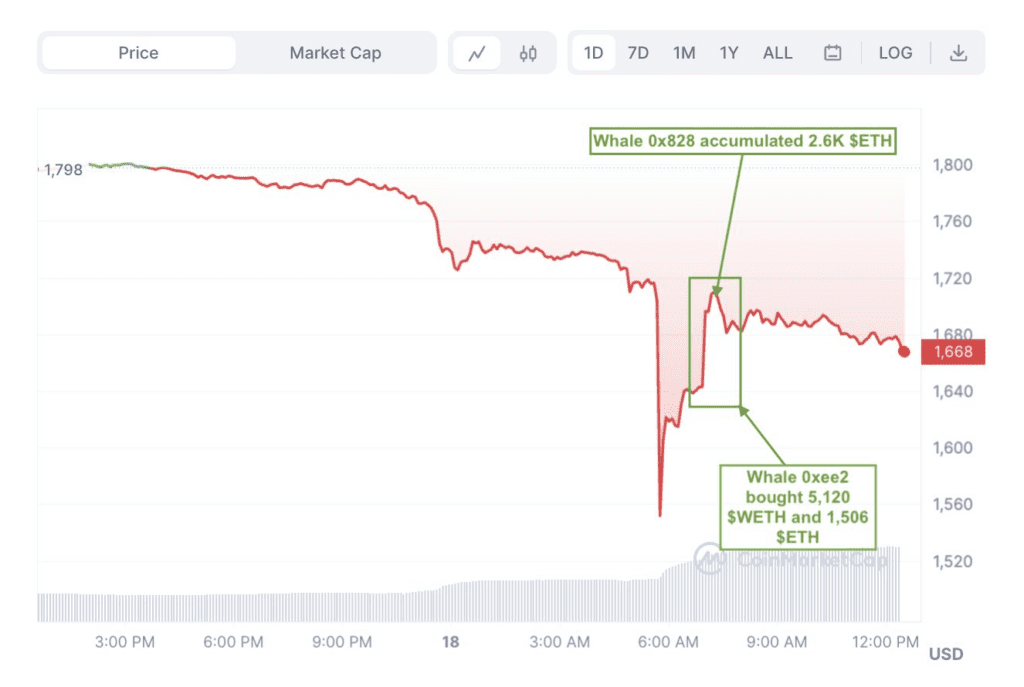

- Whale 0xee2 invests $11.15M in 6626 WETH, riding market bottom at $1683.

- 0x828 traders secure 2600 ETH ($4.38M) with precision, average price $1681.85.

- Crypto Strategy Unveiled: Insights into calculated risk and smart market play.

Spot On Chain has unveiled significant activity involving both colossal whales and shrewd traders attempting to capitalize on the Ethereum market’s fluctuation.

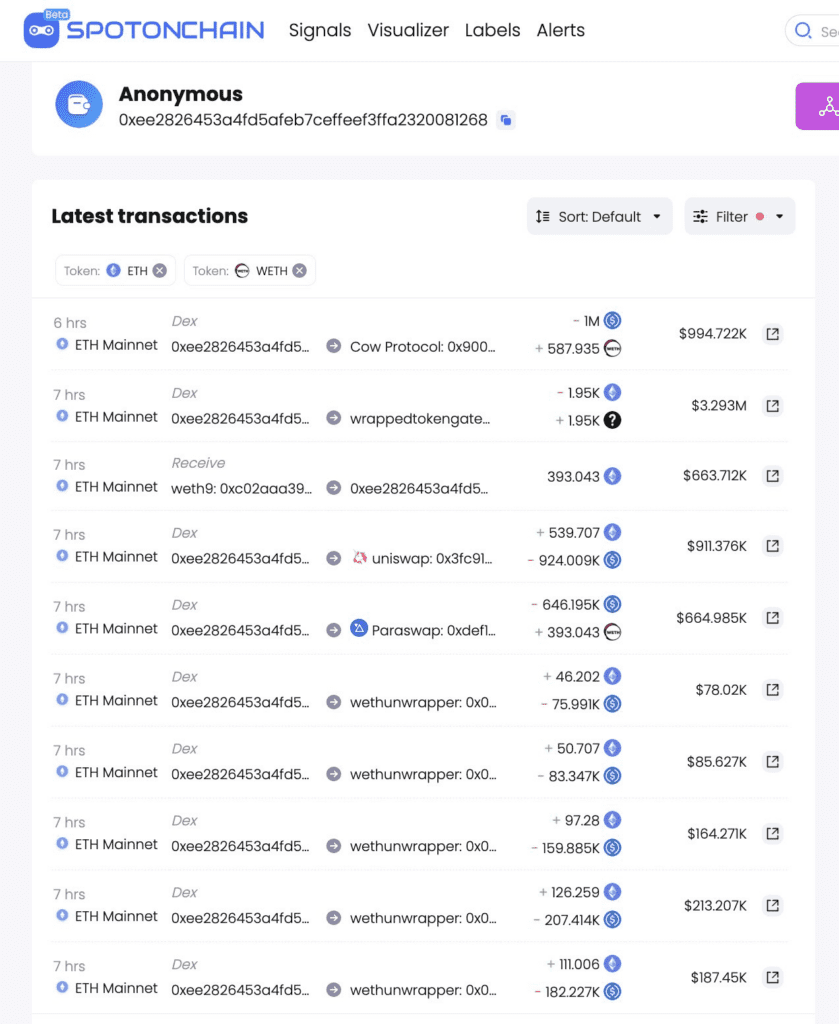

One of the monumental players in this unfolding narrative is the gargantuan whale identified as 0xee2. Displaying remarkable conviction, this entity recently deployed a whopping 11.15 million USDC to acquire a substantial amount of Ethereum. The transaction entailed the purchase of 6626 WETH, a move that has sent ripples through the digital landscape. The timing of this maneuver, approximately 6 to 7 hours ago, has raised eyebrows, strategically targeting what appears to be a market bottom. With an average purchase price of $1683, this whale’s calculated foray has set a new precedent in strategic acquisitions.

Simultaneously, astute traders operating under the banner of 0x828 have etched their presence into this unfolding saga. Evidencing a keen sense of market dynamics, these traders executed a decisive move about 7 hours ago. Their action involved the acquisition of 2600 ETH, amounting to a valuation of approximately $4.38 million. The average purchase price of $1,681.85 underscores the meticulous precision with which these traders operate, indicative of a strategy that leverages market fluctuations to their advantage.

The synergy between these two distinct but interconnected actions speaks volumes about the depth and sophistication of crypto investment strategies. As the Ethereum landscape continues to evolve, these instances illuminate the intricate dance between calculated risk-taking and informed decision-making, all while capitalizing on the inherent volatility of the market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.