Shell Protocol Review: Defi Platform With Powerful Features Built On Layer 2 Arbitrum

DeFi has a smarter home using Shell Protocol. The much anticipated Shell v2 enables you to design transactions with seamless atomic composability, construct capital-efficient AMMs that may grow, and provide customers up to 4x lower gas prices. The next wave of important DeFi initiatives is being formed by a new ecosystem of financial primitives (such AMMs, lending pools, algorithmic stablecoins, or NFT markets). In this Shell Protocol review, we will explore all of these features.

What is Shell Protocol?

Shell Protocol is a set of EVM-based smart contracts on Arbitrum One. Unlike other DeFi protocols that rely on monolithic, single-purpose smart contracts, Shell is a hub for a modular ecosystem of services. Its design makes it much simpler to bundle several smart contracts or build new ones, allowing users to batch many benefits in one transaction.

Shell aims to become a DeFi All-In-One dApp; the most prominent product currently is AMM DEX. Shell Protocol’s AMM technology is a highly innovative idea used in Uniswap V4.

Initially, version V1 was built on Ethereum, but version V2 switched to Arbitrum. Since Shell wants to take advantage of Layer 2, Arbitrum is an older platform than other Layer 2s. Arbitrum is currently the fastest-growing DeFi ecosystem in the market.

Why Shell Protocol?

With these technologies, Shell Protocol provides a reasonable trading price thanks to centralized liquidity. Transaction fees are significantly reduced thanks to routing and accounting in Ocean. This product is beneficial. Even Uniswap V4 version takes this idea of Shell Protocol.

Shell Protocol allows for one-sided liquidity provision. The provision of liquidity is made right on the swap interface; the provider only needs to select the offering asset and change it to the desired LP. On the protocol, you can convert the liquidity position. For example, if you want to switch from the position provided for the ETH – USDC pair to the USDC – USDT pair, you need to swap the LP ETH – USDC pair to the LP USDC – USDT pair.

Shell Protocol also supports NFT transactions by breaking the NFT into small pieces and adding to the AMM Pool. Thanks to that, users can trade NFT right on the protocol. This DEX supports cross-asset trading like USDC to NFT.

Shell Protocol supports anti-MEV by allowing users to choose the price at which they accept the transaction; if the price is not as expected, then the transaction will not be executed. This eliminates MEV attacks. Thanks to Ocean’s technology, only input assets and output assets are received in a single transaction.

Shell Protocol’s development plan is to become an All In One DeFi platform, so the project will soon support more lending products, Crosschain, multi-chain expansion,…

How does Shell Protocol work?

There are two major components of Shell Protocol:

Ocean

Shell Protocol poses the problem that the current tokens are all located on different smart contracts, so in many use cases, it takes time and costs to transact because it has to go through many “bridges,” then Ocean was born to solve this problem completely.

Ocean was created to build a single, smart contract so all tokens can work on it quickly. According to the shared project, this reduces transaction fees by up to 4 times.

Example: Users adopt Ocean to mint assets such as USDC, ETH, DAI, USDT into shUSDC, shETH, shDAI, shUSDT (Ocean supports all tokens with ERC – 20, ERC – 721 standards and ERC – 1155). These tokens can work on all DeFi puzzle pieces built on Shell Protocol and DeFi applications with built-in.

Proteus

Proteus is a new type of AMM platform, and Proteus was created not to be the most capital-efficient AMM, but Proteus’ goal is to be an AMM that developers can customize to suit their needs and any trading strategy. It could be a stableswap, a regular AMM, or an upgraded version of Uniswap V3.

However, the difference here is that all the above customizations do not force the developers to program the sodality code resulting in simplicity and convenience for the developers.

Although the Ocean is the central hub, Proteus is a significant component of Shell Protocol because of its role in creating fungible LP tokens, which are fundamental building blocks in many DeFi applications and the future of money.

Features Of Shell Protocol

Shell Points

Shell Points are a way of tracking contributions to the Shell Protocol guarded launch. Shell Points were originally announced in August 2022. In November 2022, the community voted to use Shell Points as a factor in the upcoming $SHELL distribution.

Shell Points are calculated off-chain but are independently calculable and verifiable for any wallet using publicly available chain data. Multipliers and other values used to calculate Shell Points are dynamic, changing as the protocol matures during new Seasons or special events.

In short, Shell Points can be earned by wrapping tokens into Shell and holding Shell-native assets. There will also be some additional ways to enhance Shell Point scoring potential occasionally, including special community events.

Wrap Token

Wrapping tokens is the simplest way to get started with Shell Protocol. Wrapping a token does not affect its value or your balance. It simply switches the ledger on which ownership of the token is recorded. (In this case, ownership of Shell-wrapped tokens is recorded on the Ocean, Shell’s accounting hub.)

You can earn Shell Points with relatively low risk simply by wrapping tokens into Shell during the guarded launch. Wrapping tokens will make it easier and cheaper to use them with Shell primitives later.

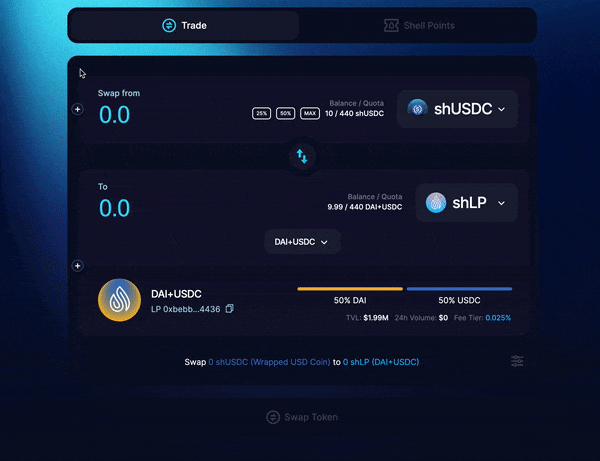

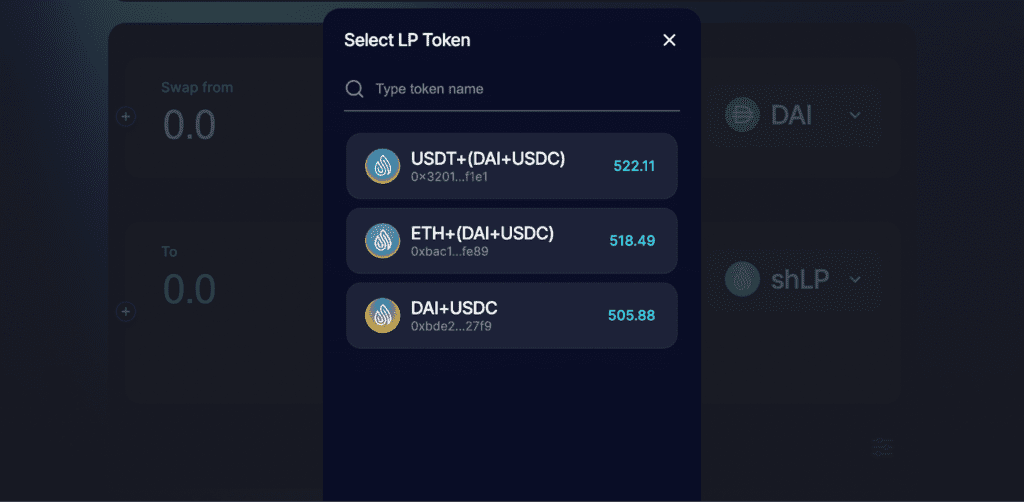

LP

In the Shell app, the way to LP (provide liquidity) into pools is by ‘swapping’ from any supported token to a Shell LP token (aka ‘shLP’ token). You can earn Shell Points by LPing in Shell pools during the guarded launch. You can also earn a portion of the AMM’s revenue whenever the pool is used for swaps.

LP tokens on Shell are fungible, acting like any other token. Also, since Shell AMMs support single-sided liquidity provision, you can LP using only one token type or an uneven split of assets.

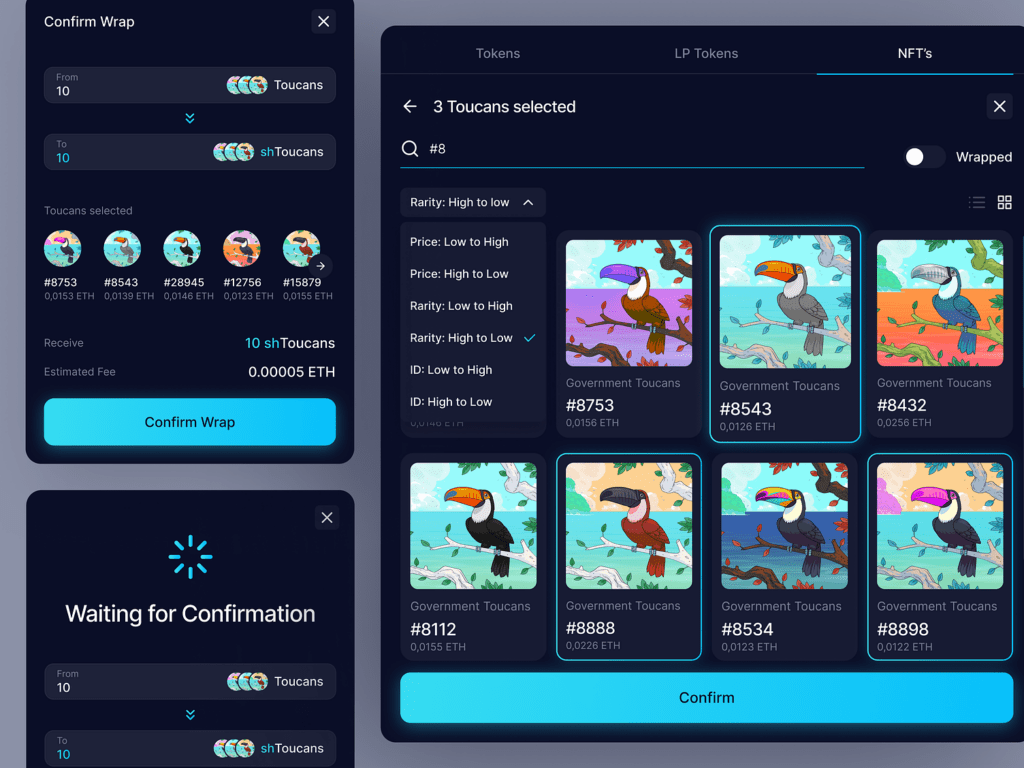

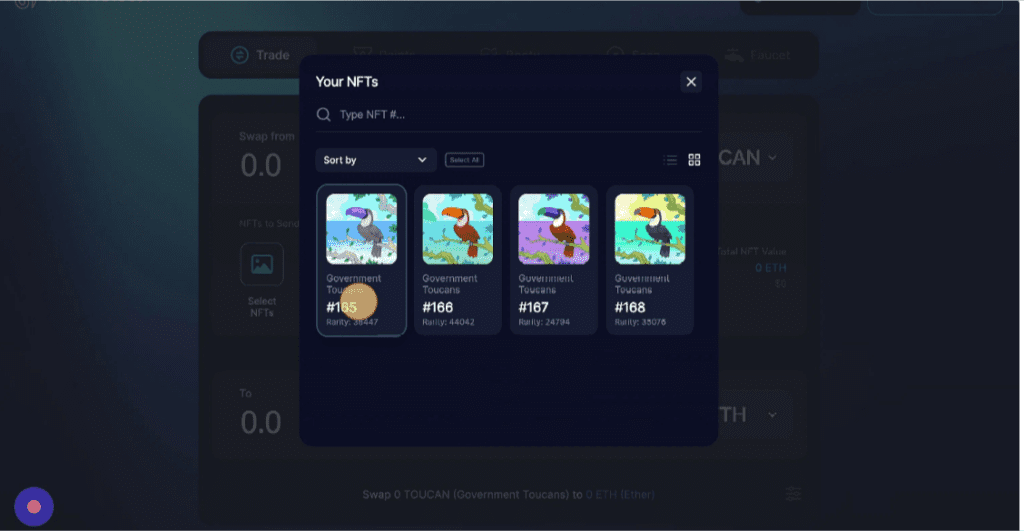

Wrap NFTs

Government Toucans are an exclusive set of Arbitrum NFTs released by Shell Protocol. They were available to mint for one day only on April 1 2022. Holding a Toucan grants users access to the #toucan-lounge on the Shell Protocol Discord, with other secret benefits to come.

Imagine you have 100 or so unique Government Toucan NFTs you want to trade for their lowest value on the open market. Instead of listing and selling them one at a time, NFT wrapping makes it easier by bundling them together. This way, you can trade all your Government Toucan NFTs in a single transaction, making the process faster and simpler. To get started, the initial step is to wrap your Government Toucan NFTs.

Swap

Shell is a next-generation DeFi platform with powerful features like multi-swaps and funded NFT on a growing liquidity network. With Shell Swap, many Tokens in just one transaction (Multi Token Swap), you need to connect the wallet successfully.

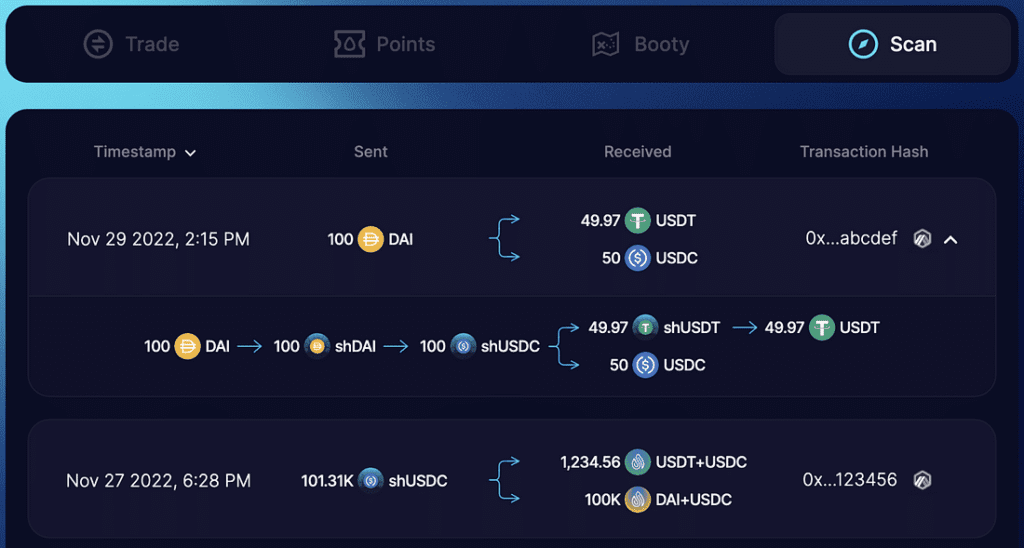

Shellscan

In the Shell Application, Shellscan is a user-friendly block explorer for Shell Protocol transactions only. With Shellscan, you can now easily view every Shell transaction you’ve ever sent. You can even view a breakdown of sub-transactions, giving you a better understanding of the inner workings of the original Ocean and Shell instances you used. For example, you can now view the transaction path of a swap.

It allows users to get all the necessary information to maintain responsible oversight of their assets. In the coming months, as new native versions roll out and the Shell ecosystem grows, we will add more features. Ultimately, Shellscan will become a powerful, dynamic tool for discovering what’s happening in Shell World.

Tokenomics

$SHELL is the ticker for the upcoming (but not yet released) token governing Shell Protocol. A community vote decided the token name and ticker $SHELL. Earning Shell Points will make you eligible for receiving the $SHELL token when released, as a Toucan vote decided. $SHELL token holders will collectively control the Shell DAO (not yet live) via voting.

At the time of the token generation event (TGE), 200 million SHELL tokens will be created. These will be apportioned as follows:

- 80M – Investors, Core Team, and Development Company

- 40M – Initial Airdrop

- 50M – Post-TGE Incentives

- 30M – DAO Treasury

The Shell DAO will be able to mint more tokens beyond the 200 million supply apportioned above, but that would require a governance vote.

Roadmap in 2023

- January 11: ETH+USD and wBTC+USD fractal pools are deployed.

- January 23: First Shell community challenge, the Lunar New Year Crafting event.

- February 10: Mobile support for Shell app goes live.

- February 24: wstETH+ETH pool is deployed.

- March 17: Second Shell community challenge, the St. Patrick’s Day Crafting event.

- March 22: ShellDrop DAO is launched.

- March 27: Toucan wraps go live. Discord role for Toucan holders is frozen, as determined by Snapshot vote.

- March 31: ARB+ETH pool is deployed.

- April 1: Part 1 of Shell Tokenomics is announced.

- April 7: The Mindmeld Live community call, formerly only on Discord audio, has its first video episode.

- April 15: First NFT AMM is deployed, for Government Toucan NFTs.

- May 5: Part 2 of Shell Tokenomics is announced.

- May 22: Conclusion of guarded launch: $CRAB claims go live and Season Two begins.

- Q3: Live leaderboard, $COLLAB airdrop distributed, Evolving Proteus launch. Release of liquidity bootstrapping pools for NFTs, Release of IL loss-protected pools.

- Q4: MEV harnessing, Lending pools

- TBA: $SHELL TGE, Launch of Shell DAO

Conclusion – Shell Protocol Review

Shell Protocol has a big dream with the DeFi All-in-One ecosystem at the product’s core. However, the Shell Protocol vision takes a lot of time to build and develop, so we must monitor and observe the project before making investment decisions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.