Key Points:

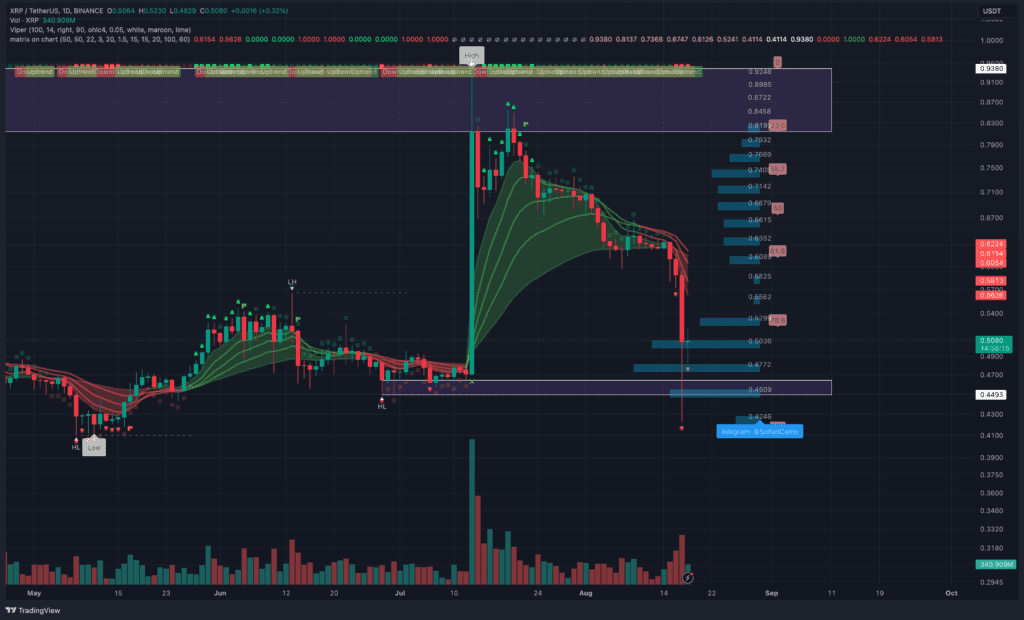

- XRP’s value plunges to $0.42, hinting at a possible recovery around $0.5, amid market volatility and regulatory uncertainty.

- Ripple faces market-wide pressures due to Tesla’s rumored Bitcoin sale and concerns over rising interest rates combating inflation.

- Its setback worsens due to the US SEC’s interlocutory appeal approval, casting doubt on the previous verdict.

XRP, the cryptocurrency tied to Ripple, experienced significant turbulence as it saw a rapid drop to $0.42, compounded by ongoing regulatory uncertainties and market-wide pressures.

Analysts suggest this downturn might signal a potential for recovery, with traders advised to consider fresh long positions once the price hits around $0.5.

The crypto market encountered a steep decline following widespread speculation that Tesla had offloaded its $377 million worth of Bitcoin holdings.

Furthermore, apprehensions deepened due to indications from the Federal Open Market Committee’s meeting minutes that interest rates would rise further to counter inflation, adding to the market’s downward spiral.

Ripple’s XRP struggled to breach the $0.65 resistance level and consequently initiated a downward trajectory against the US Dollar. Like Bitcoin and Ethereum, it experienced a significant drop below the crucial $0.5 support threshold.

With a staggering 20% drop in price, a brief plummet to $0.42 was observed before showing signs of recovery towards the 78.2% Fibonacci retracement level at $0.52.

Macro factors also contributed to XRP’s setback, erasing its gains from July. The news of the US Securities and Exchange Commission (SEC) being granted an interlocutory appeal caused XRP’s value to plummet.

Concerns emerged over the possible reversal of Judge Analisa Torres’ July 13 verdict, which had ruled that XRP was sold as a security primarily to institutional investors rather than retail buyers.

Judge Torres, during the afternoon of August 17, approved the SEC’s request to appeal her earlier decision, highlighting that the trial’s core aspects are yet to be settled.

As of now, XRP is trading at $0.5, marking a critical zone for investors’ forthcoming choices. A potential recovery beyond $0.55 could signify a brighter outlook for the coin in the short term.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.