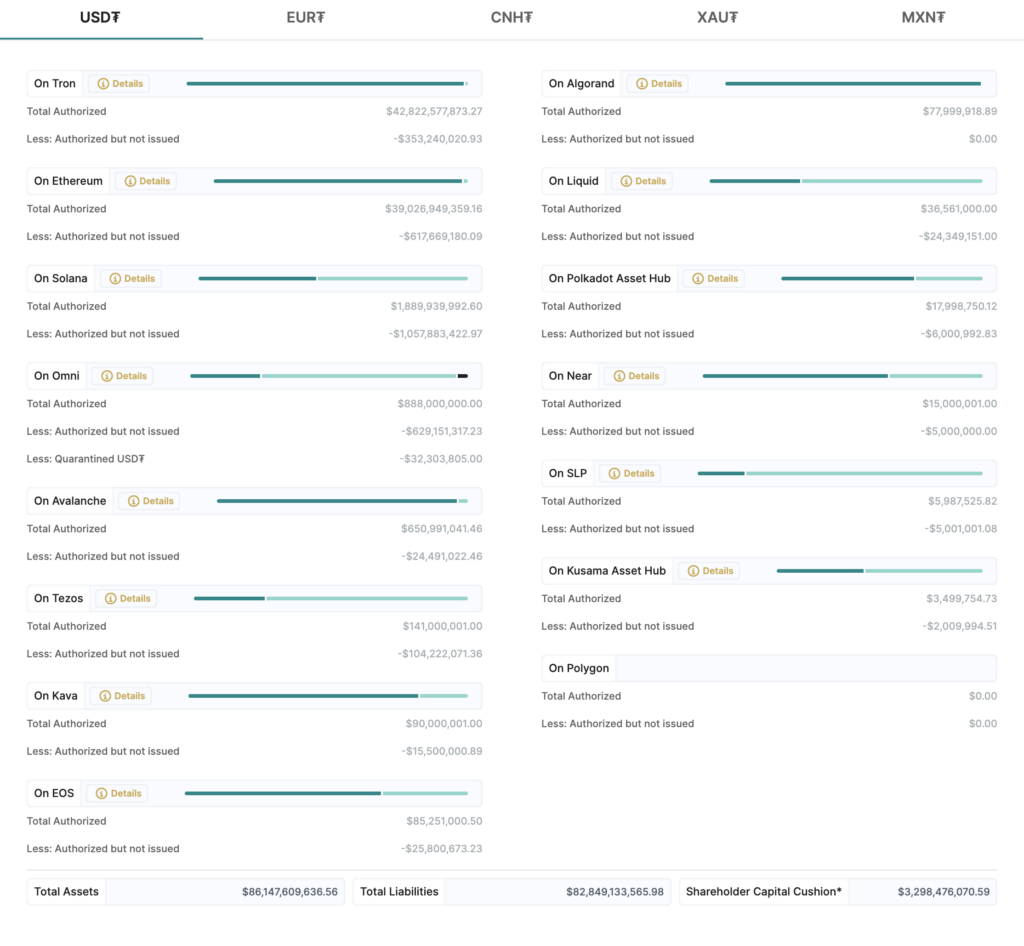

Tether’s Transparency And Trust Amidst Crypto Controversies: $86.1B In Assets

Key Points:

- Tether’s transparency report reveals $3.3 billion in liquidity and $86.1 billion in assets.

- Solana leads with $1.057 billion in pre-authorized issuance.

- Tether’s transparency efforts have restored trust despite past controversies.

Tether, a prominent stablecoin issuer, has unveiled a transparency report showcasing its robust liquidity position.

As per the report, Tether presently boasts liquidity reserves of approximately $3.3 billion. The recent data, dated August 24, discloses the company’s overall assets at $86.1 billion against liabilities of $82.8 billion, yielding a reserve ratio exceeding 100%.

Within its realm, the Solana ecosystem emerges as the forerunner, with a pre-authorized issuance value of $1.057 billion. Ethereum trails closely with pre-authorization amounts of $617 million.

Regrettably, the same liquidity cushion isn’t extended to other stablecoins under Tether’s umbrella. The report indicates that these non-US dollar-pegged stablecoins lack sufficient balances to uphold a 1-1 peg during turbulent periods.

Coinbase, a major crypto trading platform, is slated to halt trading of three stablecoins, including Tether, effective August 31. This move arrives despite the stablecoin’s transparency report countering prevailing concerns about liquidity and asset backing.

Tether had previously faced a $41 million fine from the Commodity Futures Trading Commission in 2021 for disseminating false information about its reserve holdings. However, no recent discrepancies have been flagged in the past two years.

The company’s history is marked by controversies, particularly surrounding its backing and transparency. Its claim of $1 backing per USDT unit was debunked, leading to an $18 million fine by the New York Attorney General and mandatory reports on actual reserves.

The stablecoin has also faced scrutiny due to its ties with the Bitfinex exchange, notably over fund mingling. Despite this, the company’s efforts to provide regular reserve breakdowns have helped rebuild community trust. Amidst the controversies, it continues to hold a pivotal role in the cryptocurrency landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.