Mantle Network Commits 238M USD For Transformative Ecosystem Expansion

Key Points:

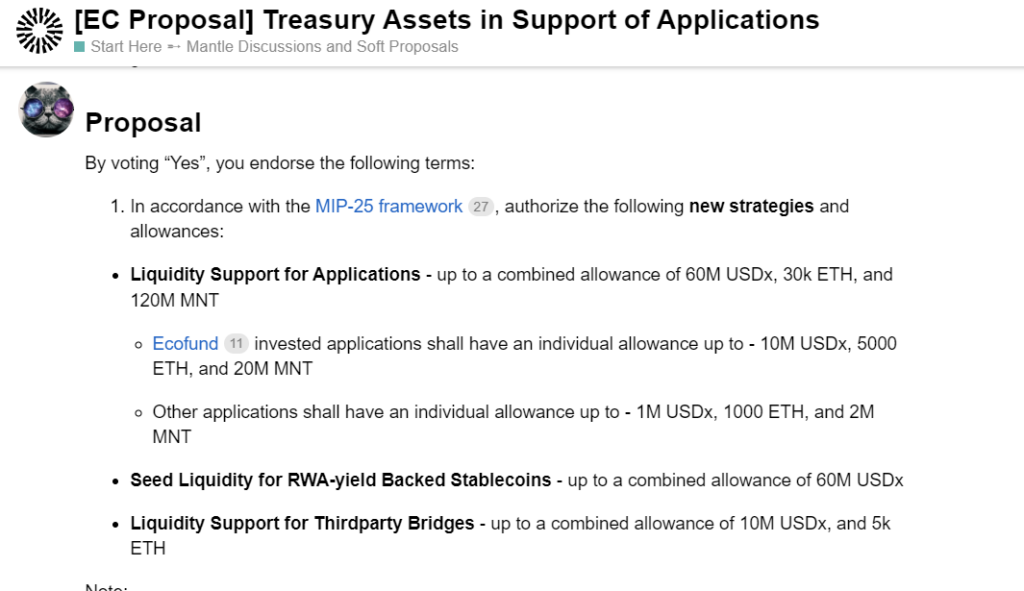

- Mantle Treasury to fuel ecosystem growth with $160M liquidity support for apps.

- $60M was allocated for RWA-backed stablecoins, enhancing the network’s reliability.

- $18M liquidity boost for cross-chain bridges, ensuring seamless connectivity.

The Mantle community has put forth a groundbreaking proposal through its admin page on the Mantle Network.

The proposal revolves around tapping into the potential of the Mantle Treasury to drive and support various developmental endeavors within the network.

The proposal is the provision of substantial liquidity support amounting to an impressive USD 160 million, specifically allocated to empower diverse applications within the Mantle ecosystem. This strategic allocation aims to invigorate innovation by ensuring ample resources for application development, ultimately enhancing user experiences and expanding the network’s capabilities.

A noteworthy facet of the proposal includes the earmarking of up to USD 60 million for the initiation of liquidity for real-world asset (RWA)-backed stablecoins. This move is poised to add a layer of stability and reliability to the network’s offerings, potentially bolstering its attractiveness to a wider audience, including institutional players seeking secure digital assets.

Mantle community’s proposal demonstrates a forward-looking vision by allocating liquidity support of approximately USD 18 million for cross-chain third-party bridges. This strategic allocation underscores the network’s commitment to interoperability and seamless connectivity between different blockchain platforms, potentially opening doors for enhanced functionalities and expanding the network’s reach.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.