Key Points:

- KuCoin’s report shows that 52% of Turkish adults are now investing in crypto within the next 18 months.

- Rising interest is linked to the Turkish lira’s 50% loss against the USD, signaling crypto’s appeal as an inflation hedge.

- The survey underscores diverse motivations and cryptographic applications across different age groups.

KuCoin, a prominent cryptocurrency exchange, has launched its latest report, “Into The Cryptoverse: Understanding Crypto Users,” focusing on Turkish investors. This report provides a comprehensive overview of the crypto landscape in the country, delving into the behaviors, preferences, and trends among adult crypto investors.

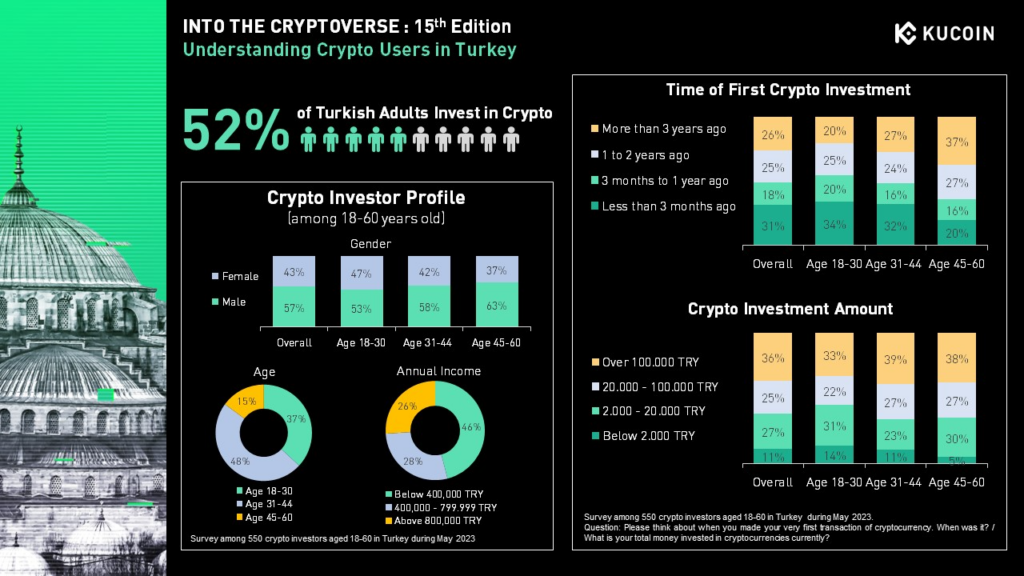

A notable surge in Turkish adult participation in crypto investment has emerged from the survey findings. More than half of Turkish adults, a significant 52%, have ventured into crypto investments.

Impressively, this figure has escalated by 12% over the past 18 months, soaring from 40% in November 2021 to the current 52% as of May 2023, defying market challenges.

This surge signifies a growing enthusiasm for cryptocurrencies as a hedge against inflation, especially with the Turkish lira’s depreciation of over 50% against the US dollar. The report serves as a valuable resource for crypto enthusiasts, investors, and businesses seeking insights into the Turkish crypto market.

Of note, young women aged 18 to 30 stand out, with 47% holding cryptocurrencies. Bitcoin leads the preferred digital assets with a 71% holding rate, followed by ETH at 45% and stablecoins at 33%.

Motivations driving Turkish adult crypto investors vary. An impressive 58% strive for long-term wealth, a sentiment spanning all age groups. However, distinctions emerge when examining different age brackets.

Older investors prioritize value preservation and diversification, while younger generations lean towards quick transactions and short-term gains.

The survey also underscores crypto’s multifaceted utility. Around 70% actively trade cryptocurrencies, 22% explore NFTs, and 19% engage in HODLing and staking. Engagement in these activities increases with age, aligning with older investors’ inclination toward long-term strategies.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.