Key Points:

- Whale sells 18k ETH worth $29.4M after SEC delays Bitcoin ETF decision.

- 0x1E7F borrows $11.6M, repays loan and could have made $0.8M in profit.

- Lookonchain reports whale affected by FOMO, panic-sells ETH at a loss.

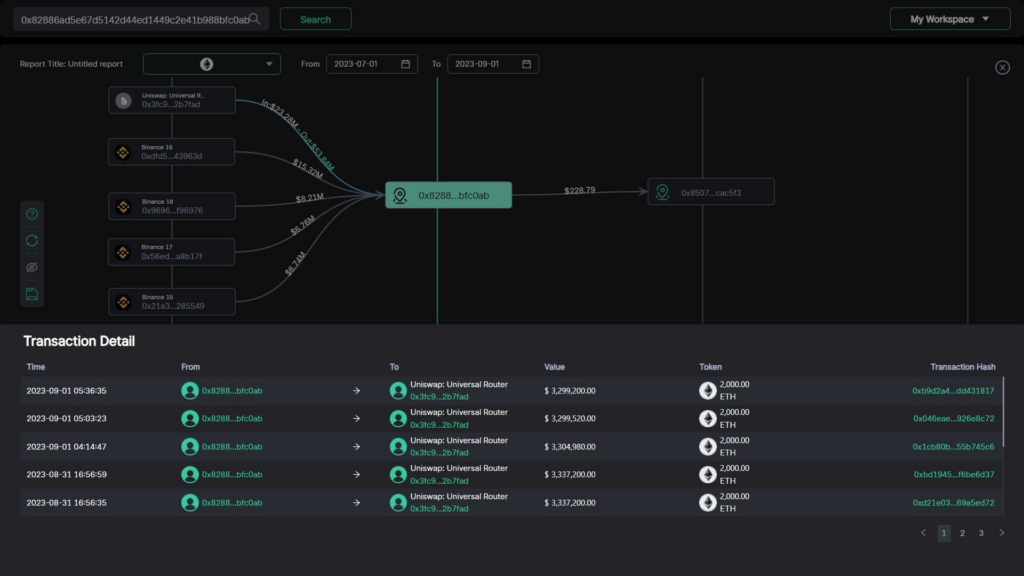

Scopescan reports a whale sold 18k ETH worth $29.4M after SEC delayed the Bitcoin ETF decision. Whale still holds 4k ETH worth $6.5M.

A recent report from Scopescan has revealed that a whale has sold 18,000 ETH worth $29.4 million on-chain after the SEC delayed its decision on Bitcoin’s ETF. The whale had received these ETH back in July when ETH was valued at around $1,850. Currently, the whale still holds 4,000 ETH worth $6.5 million.

On August 16, the whale known as 0x1E7F borrowed 50,000 BNB worth $11.6 million from VenusProtocol and sent it to Binance. Five hours ago, 0x1E7F withdrew the BNB from Binance and repaid the loan. If 0x1E7F had shorted BNB on August 16 and bought back today, they would have pocketed around $0.8 million in profit.

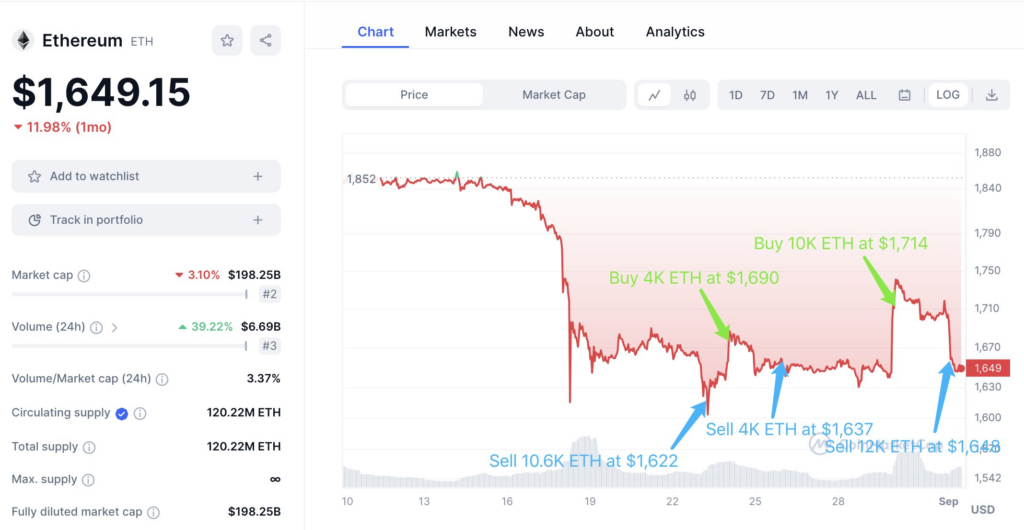

According to Lookonchain, a recent report revealed that a whale in the cryptocurrency market seems to be affected by FOMO during recent market volatility. The whale has been panic-selling ETH after the market falls and buying ETH after the market rises. The whale sold 12,000 ETH worth $19.77 million at a loss again after the market dropped nine hours.

Meanwhile, another whale has not been good at perpetual contracts, as evidenced by the liquidation of their ETH-long positions in the last two market crashes, resulting in a loss of approximately $5.1 million.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.