Key Points:

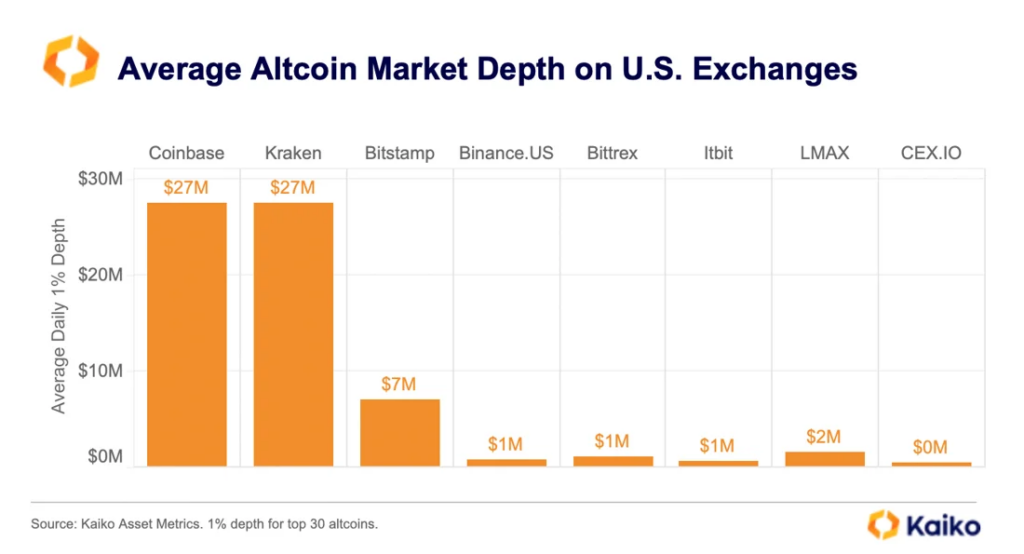

- Kaiko’s report highlights the heavy concentration of liquidity in the crypto market.

- Binance is the dominant platform with 30.7% market depth and 64.3% trade volume.

- Kraken’s altcoin liquidity has performed well, making it a strong contender with Coinbase.

Kaiko’s report shows heavy concentration in crypto market depth and liquidity. Binance dominates with 30.7% of global market depth and 64.3% of trade volume.

Kaiko, a cryptocurrency data provider, recently released a report on exchange-level liquidity. The report compiled average 1% market depth and cumulative trade volume for BTC, ETH, and the top 30 crypto assets by market cap, providing a suitable gauge for measuring exchange-level liquidity.

The report found that liquidity is heavily concentrated and has become more so over time. In 2023, Binance accounted for 30.7% of global market depth and 64.3% of global trade volume, with the top 8 largest platforms accounting for 91.7% of depth and 89.5% of volume.

The concentration of market depth has fallen for the top exchange, from 42% to 30.7%, which suggests that Binance’s zero-fee trading program had an unequal impact on volume relative to market depth. However, just 8 exchanges still account for more than 90% of global market depth.

When looking at altcoin liquidity, the report found that it is heavily concentrated on just three platforms: Coinbase, Kraken, and Bitstamp within U.S.-available exchanges. Kraken’s altcoin liquidity has performed particularly well, making it a strong contender with Coinbase. Since August 2022, Kraken has not seen any drop in market depth for the top 30 altcoins, whereas Coinbase has lost around $5mn in liquidity.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.