Lido Finance Validator Reveals Corrupt ETH Deal in USDC-WETH Swap

Key Points:

- Lido Finance validator claimed 64.77 ETH ($103k) via Beaver Build relay.

- MEV bot was bribed with 78.8 ETH for a USDC-WETH swap.

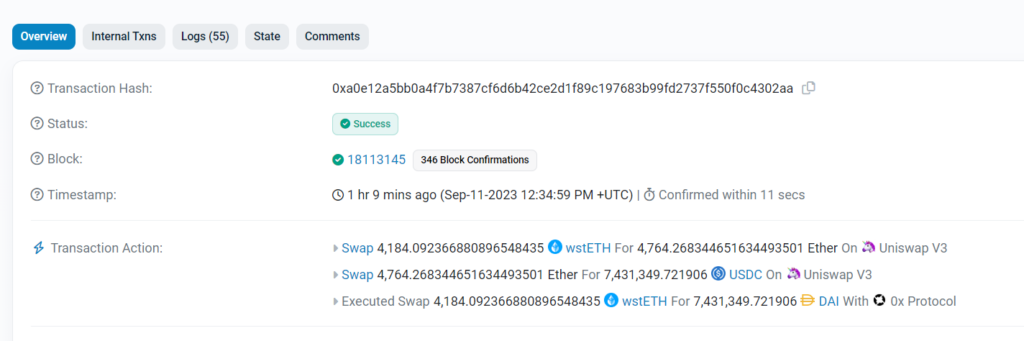

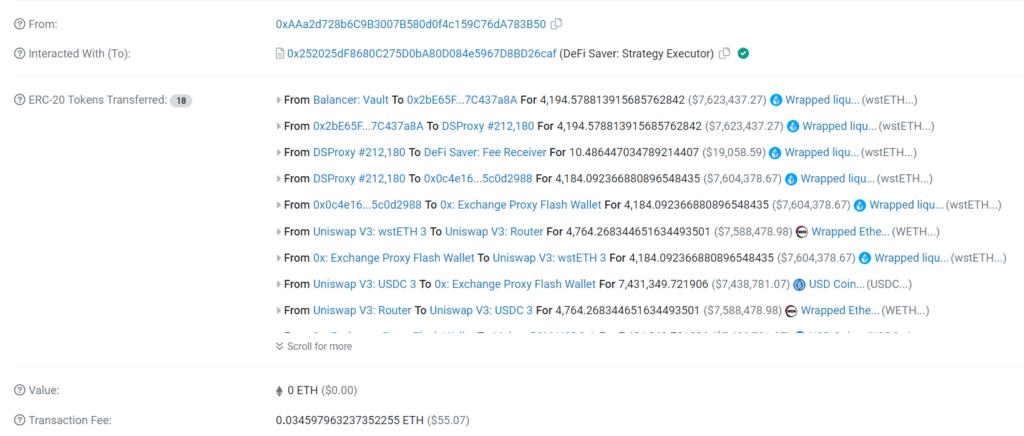

Lido Finance validator claimed a substantial reward of 64.77 ETH (equivalent to $103,000) via the Beaver Build relay at block #18113145.

However, the story took a dark turn when it was disclosed that a MEV (Miner Extractable Value) bot had been bribed with a whopping 78.8 ETH to backrun a large USDC-WETH swap, casting a shadow over the integrity of the transaction.

This incident has not only raised concerns about the security and fairness of decentralized finance (DeFi) platforms but has also highlighted the persistent challenges faced by validators in the crypto space.

Lido Finance has been at the forefront of staking solutions for Ethereum. Its validators play a crucial role in securing the network and ensuring the smooth operation of Ethereum 2.0. The substantial reward claimed by one of its validators initially seemed like a triumph, but it quickly turned into a cautionary tale.

The MEV bot, enticed by the 78.8 ETH bribe, engaged in back running, a practice where miners manipulate transactions to gain an unfair advantage. In this case, it targeted a large USDC-WETH swap, potentially causing significant financial losses to other users.

Crypto enthusiasts and investors are expressing growing concerns about the security of DeFi platforms and the need for stricter measures to prevent such incidents. The crypto community is eagerly awaiting updates from Lido Finance on how it plans to address this issue and ensure the trustworthiness of its validators.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.