Arbitrum Defies DeFi Turbulence: Whales Remain Optimistic Amidst Market Swings

Key Points:

- Arbitrum (ARB) stands strong in the turbulent DeFi market, with whales making strategic moves.

- A notable whale withdrew and re-deposited millions of ARB on Binance despite facing losses.

- Arbitrum’s prominence in the layer-2 blockchain space persists, driven by a $5.6 billion Total Value Locked (TVL) and recent price fluctuations tied to whale activity.

In the difficult context of the crypto market in 2023, Arbitrum defies DeFi turbulence. On-chain data reveals that despite challenging conditions, whales continue to exhibit strong support for this token.

Whale Strategy Unveiled: ARB’s Resilience in DeFi Storm

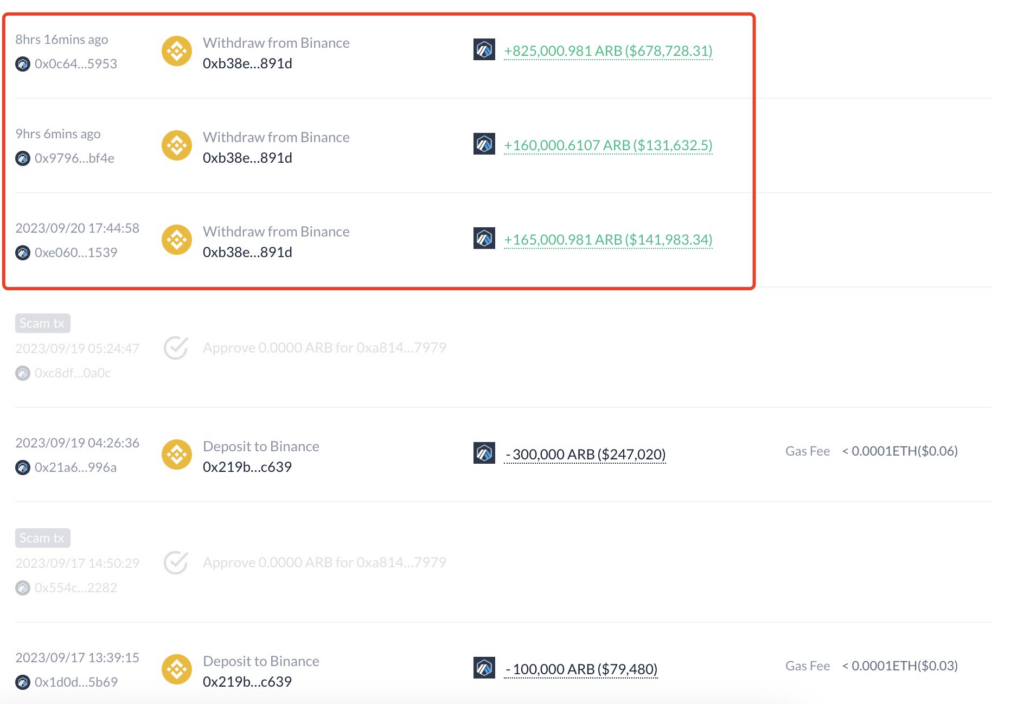

According to Lookonchain data, a notable whale, while enduring a loss on ARB, has displayed unwavering confidence in the asset. Over the past two days, this whale executed a significant move, withdrawing 1.15 million ARB (equivalent to $952,000) from Binance.

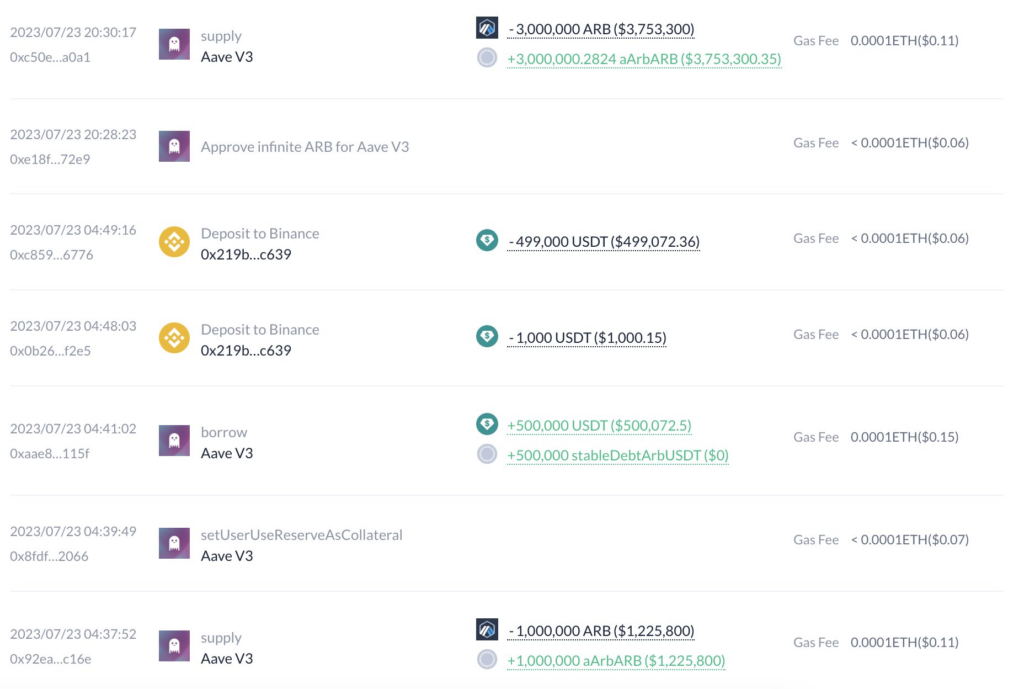

This whale initially took a bullish stance on ARB through Aave on July 23. However, as the ARB price dwindled, the whale had to sell ARB at a loss to settle debts on September 11.

The whale’s actions included withdrawing 17.53 million ARB (valued at $20.87 million) from Binance at an average withdrawal price of $1.19. Subsequently, they deposited 11.13 million ARB (amounting to $10.17 million) back into Binance at an average deposit price of $0.91. This strategic move incurred a loss exceeding approximately $3 million, leaving the whale with a current holding of 7.55 million ARB (equivalent to $6.25 million).

Arbitrum’s Rise and Whales’ Gambit: A Tale of DeFi Fortitude

Arbitrum is rapidly asserting itself as a dominant player in the ever-evolving realm of layer-2 blockchain technology. This ascent is underscored by Arbitrum’s impressive Total Value Locked (TVL) of $5.6 billion, outpacing competitors like Optimism, Mantle, and ImmutableX.

The recent dip in ARB’s price can be attributed to a flurry of market activity by ARB whales in the last few days. Notably, on September 11, 2023, three whales collectively transferred over 10 million ARB tokens, amounting to roughly $8 million, to Binance.

Arbitrum’s resilience and strategic moves by its supporters continue to shape its position in the DeFi landscape, defying market turbulence.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.