Chainlink Price Surges 20% From Beginning Of Month With Active Accumulation Of 81 Whales

Key Points:

- Chainlink price surges 20%, indicating a strong bull market, driven by increased whale accumulation.

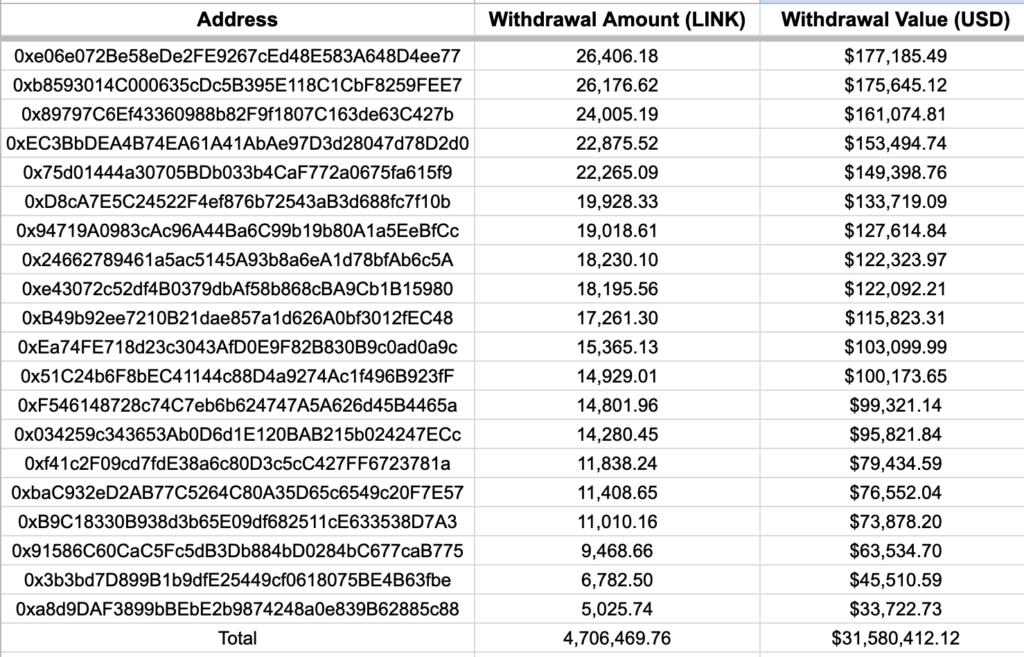

- 81 new wallets withdrew $31.58 million worth of LINK from Binance on September 15.

- The Chainlink Cross-Chain Interoperability Protocol (CCIP) underpins the rally, offering secure multi-blockchain application development.

Chainlink (LINK) is experiencing a remarkable surge, with its price up 20% from the September 12 low of $5.8. This substantial increase indicates the imminent onset of a strong bull run, accompanied by a significant accumulation of LINK by prominent investors, often referred to as “whales.”

Chainlink Price Surges 20% as Bull Run Gains Momentum

Data from Lookonchain reveals a noteworthy development: on September 15, a total of 81 new wallets were created, which began withdrawing LINK from the popular exchange Binance on September 18. These wallets have successfully withdrawn a total of 4.7 million LINK tokens, valued at approximately $31.58 million.

The resurgence in Chainlink’s price has pushed it above the crucial $6.50 resistance level. While the token is currently undergoing a correction, its upward momentum is evident, with a new support level forming around $6.62.

Whales Flock to LINK Amidst CCIP-Driven Price Rally

However, Chainlink is now at a pivotal juncture, as it faces a decisive moment following a rejection from the supply zone at $7.05. This recent surge in LINK‘s price can be attributed to the Chainlink Cross-Chain Interoperability Protocol (CCIP), a groundbreaking development that provides Web3 developers with a secure and seamless interface for creating applications that can operate across various blockchains.

The CCIP leverages the robust Chainlink decentralized oracle networks, renowned for safeguarding substantial capital and facilitating over $8 trillion in transactions. This protocol was meticulously designed with the developer community in mind, incorporating advanced security features through the Risk Management Network and backed by Chainlink’s well-established oracle infrastructure.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.