Bitcoin Bull Market Support Band Is At Resistance And Potential Price Drop

Key Points:

- Bitcoin Bull Market Support Band is being rejected, risking a retest at $26k.

- The current cycle mirrors 2019, signaling a potential turning point.

- Ownership dynamics show non-whale wallets at 41.1%, whales at 55.5%.

The Bitcoin Bull Market Support Band shows the price is facing resistance, with a potential drop to $26k. Bitcoin’s current cycle is compared to 2019, and non-whale wallets are increasing.

Rekt Capital, a renowned expert in Bitcoin analysis, recently shared insights that suggest an intriguing development in the current crypto landscape.

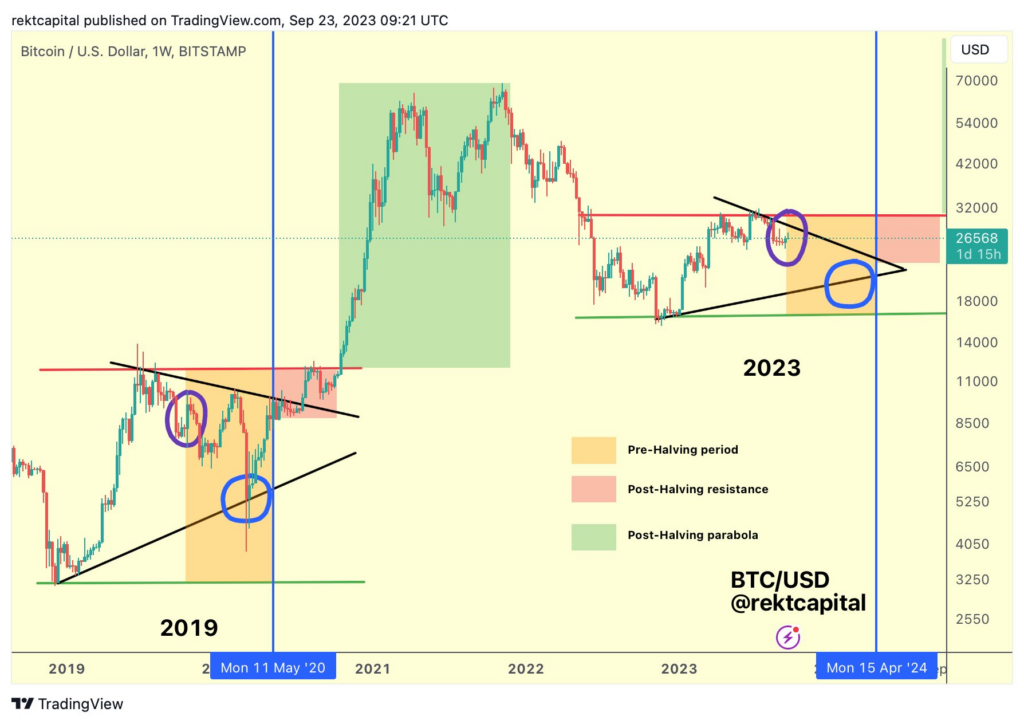

Bitcoin is presently facing a significant challenge as it appears to be rejecting the Bull Market Support Band cluster of moving averages. A weekly candle close below these levels could cement them as new resistances, potentially causing a price retest around the $26,000 mark.

Rekt Capital also pointed out an intriguing comparison to Bitcoin’s past cycles. It’s currently at a juncture similar to that of 2019, indicating a potential turning point in its trajectory. As of this writing, BTC is trading at around $26,600, according to CoinMarketCap data.

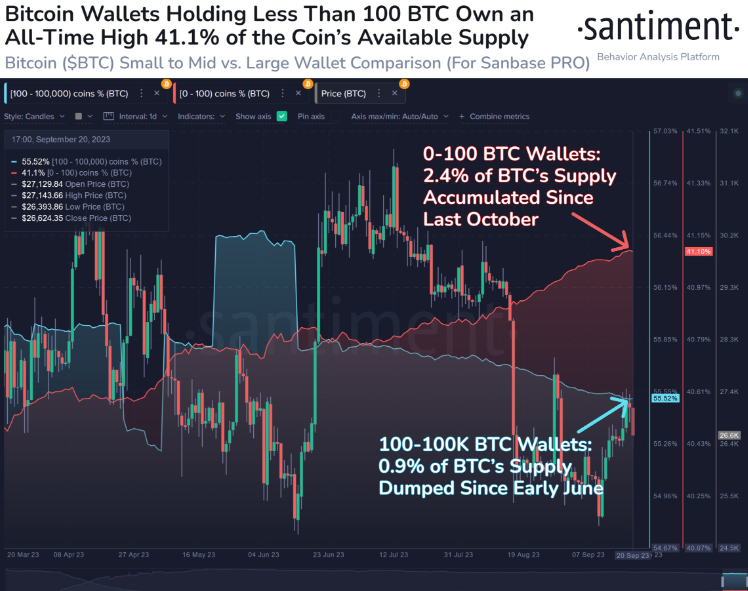

Santiment, on the other hand, has contributed valuable data regarding Bitcoin ownership. Their recent report highlights a notable shift in ownership dynamics. Non-whale wallets with less than 100 BTC now hold a significant 41.1% of the available supply. In contrast, whale addresses, possessing 100 to 100,000 BTC, now hold 55.5% of the supply, marking their lowest level since May.

This data suggests that smaller holders are increasingly participating in Bitcoin ownership, potentially indicating a democratization of the cryptocurrency landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.