Key Points:

- Sui Network’s TVL doubles to $31 million in two months, driven by DeFi strength.

- The SUI token faces a sharp downtrend, falling below $0.6.

- The network’s standout features include parallel transaction processing and stable 24-hour gas fees, solidifying its blockchain presence.

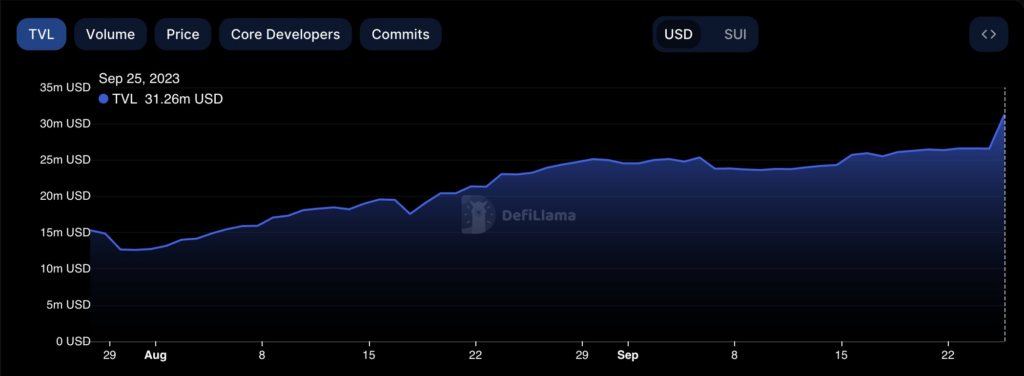

In a remarkable feat, Sui Network has witnessed its Total Value Locked (TVL) doubling in just two months, surging from approximately $15.3 million to an impressive $31 million.

Sui Network’s TVL Skyrockets, Defying Market Trends

This surge reflects the network’s robust capabilities, boasting top-tier security, consistently low gas fees, and remarkable throughput, positioning it as a frontrunner in the burgeoning DeFi ecosystem. Over the past 90 days, the Sui Network’s TVL has surged by over 30%, underscoring Sui’s growing influence.

However, the SUI token has experienced a pronounced downtrend, marking lower lows since reaching its annual high of $0.45 on September 11. The crypto’s price broke through the formidable $0.6 support level and found a new foothold near $0.47.

Sui Network’s Advantages and Blockchain Standing

Sui Network distinguishes itself as a smart contract platform managed by a consortium of validators, aligning with traditional blockchain systems in function. An exceptional feature of this platform is its capacity to process the majority of transactions in parallel, ensuring scalability and minimal latency for uncomplicated transactions like payments and asset transfers.

Another noteworthy advantage offered by the Sui Network lies in its gas fee management. The network provides stable gas fees per epoch, each lasting 24 hours and overseen by the Validators council. This departure from minute-to-minute fluctuations ensures price stability within daily cycles.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.