Key Points:

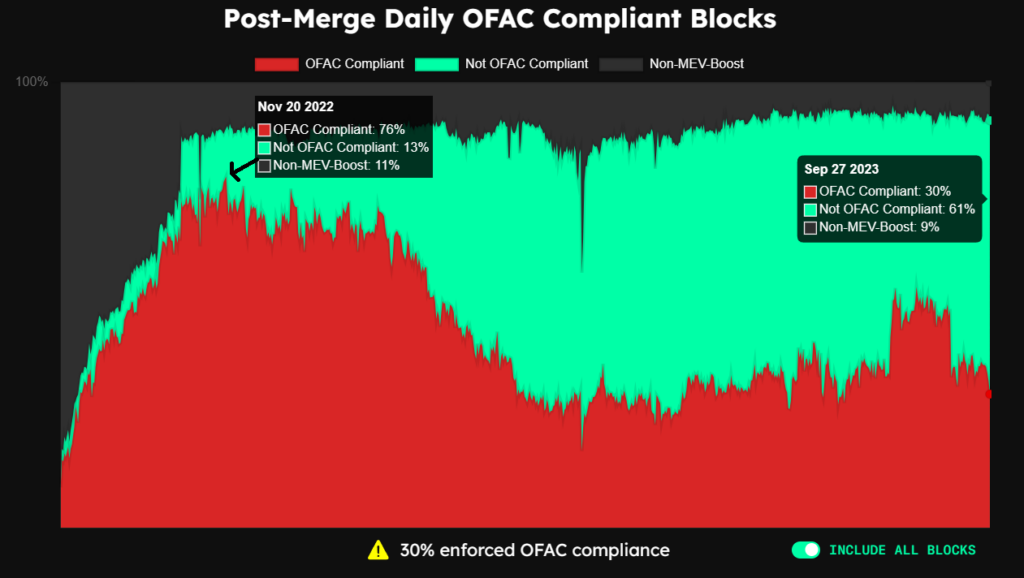

- Ethereum OFAC compliance drops to 30% post-Merge upgrade.

- 57% reduction in compliance since November 2022.

- Impact on Ethereum’s neutrality, and Grayscale’s response to the crisis.

Ethereum OFAC compliance embarked on a momentous journey with its Merge upgrade, signaling a monumental shift from the traditional proof-of-work (PoW) to the more energy-efficient proof-of-stake (PoS) consensus mechanism.

While this transition promised a greener future for Ethereum, it brought about an unexpected consequence—a decline in Ethereum OFAC compliance with the stringent standards set by the Office of Foreign Assets Control (OFAC).

Ethereum OFAC Compliance Declines

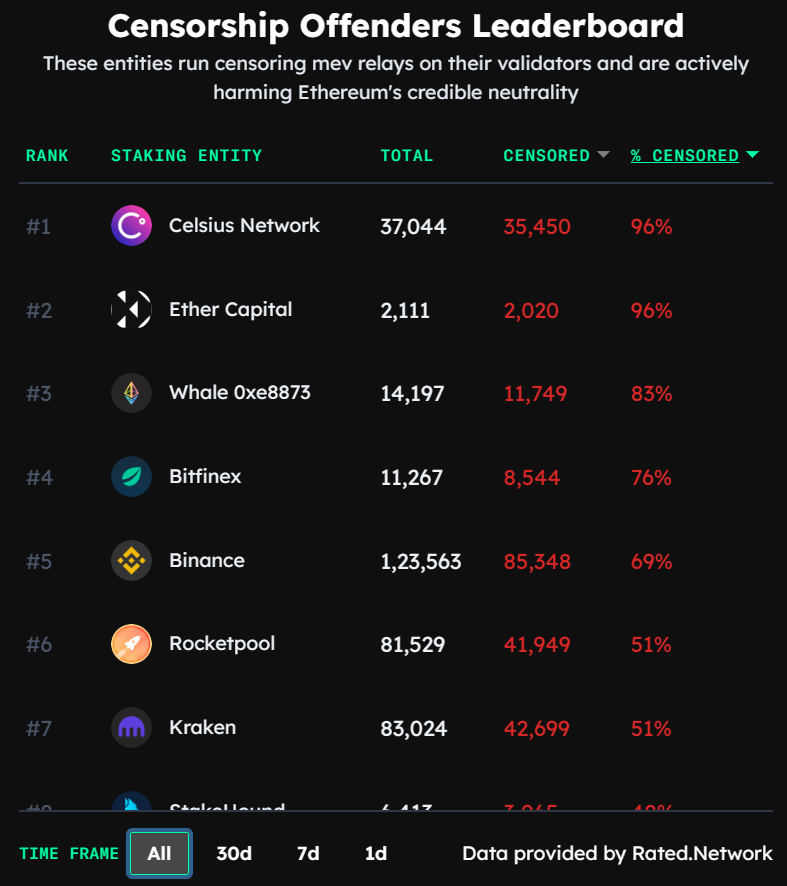

Ethereum OFAC compliance is pivotal as it determines which transactions are allowed to pass through Ethereum’s blockchain. Prior to the Merge upgrade, Ethereum’s OFAC compliance was on an upward trajectory, bolstered by the adoption of censoring MEV-Boost relays by major crypto exchanges and platforms. Notable offenders included industry giants like Binance, Celsius Network, Bitfinex, Ledger Live, Huobi, and Coinbase.

However, since the Merge upgrade, Ethereum OFAC compliance has seen a sharp decline. In November 2022, a robust 78% of Ethereum blocks adhered to OFAC regulations. As of September 27, 2023, this figure has plummeted to a mere 30%, marking a significant 57% reduction.

Addressing this compliance issue necessitates the utilization of relays that do not censor transactions in line with OFAC requirements. While there are seven major MEV-boost relays in use, only three of them do not impose OFAC-related censorship, according to MEV Watch.

OFAC Compliance Trends and Grayscale’s Response

Furthermore, it’s essential to understand that blocks built by OFAC-compliant relays will censor transactions that do not meet the compliance criteria, even though not all blocks are inherently censoring.

Although OFAC regulations primarily target U.S.-based organizations, validators worldwide must consider employing non-censoring relays for the greater good of the Ethereum network.

In response to Ethereum’s reduced Ethereum OFAC compliance, Grayscale, a prominent cryptocurrency investment firm, made the decision to relinquish all rights to PoW Ethereum tokens (ETHPoW). This move, however, was attributed to the lack of liquidity in the market, rendering the rights to acquire and sell ETHPoW tokens unfeasible.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.