Discover the Real World Assets Crypto projects: Tokenizing Off-chain Assets for DeFi. Top 5 Projects to focus on in 2023: Goldfinch, Centrifuge, MakerDAO, Maple Finance, Ondo Finance.

What are Real world assets crypto?

Real World Assets (“RWAs”) are assets that exist off-chain but are tokenized and brought on-chain for use within DeFi.

To bring real world assets into DeFi, the value of an asset must be “tokenized” – a process of converting something of monetary value into a digital token so that its value can be represented and transacted on the blockchain. Real world assets crypto are, in this way, simply tokens representing the value of a real world asset brought on-chain so that it can be utilized on a DeFi protocol.

Any real world asset with a well-defined monetary value can be represented by RWAs. RWAs can represent tangible assets, such as gold and real estate, and intangible assets, such as government bonds or carbon credits.

Top 5 Real World Assets crypto projects in 2023

- Goldfinch: Democratizing Crypto Loans – Goldfinch allows businesses in emerging markets to access crypto lending without needing crypto collateral, making crypto loans accessible to a wider audience.

- Centrifuge: Structured Credit Tokenization – Centrifuge specializes in tokenizing previously illiquid debt, offering a streamlined solution for structured credit tokenization and lending.

- MakerDAO: Governance and Stability – MakerDAO’s decentralized governance ensures transparency and the platform has successfully adopted Real World Assets (RWAs) as collateral, maintaining the stability of the DAI stablecoin.

- Maple Finance: Institutional Credibility – Maple Finance’s use of pool delegates adds credibility to the lending process, and their focus on expanding into Real World Asset (RWA) loans enhances the platform’s offerings.

- Ondo Finance: Tokenized Real World Assets – Ondo Finance specializes in tokenizing a wide range of RWAs, including US treasuries and bonds, bridging the gap between traditional finance and DeFi.

These five projects represent the vanguard of crypto initiatives, leveraging real-world assets to usher in a new era of accessibility, transparency, and financial inclusivity on a global scale. Explore their unique strengths and contributions as CoinCu delves deeper into each of these trailblazing platforms.

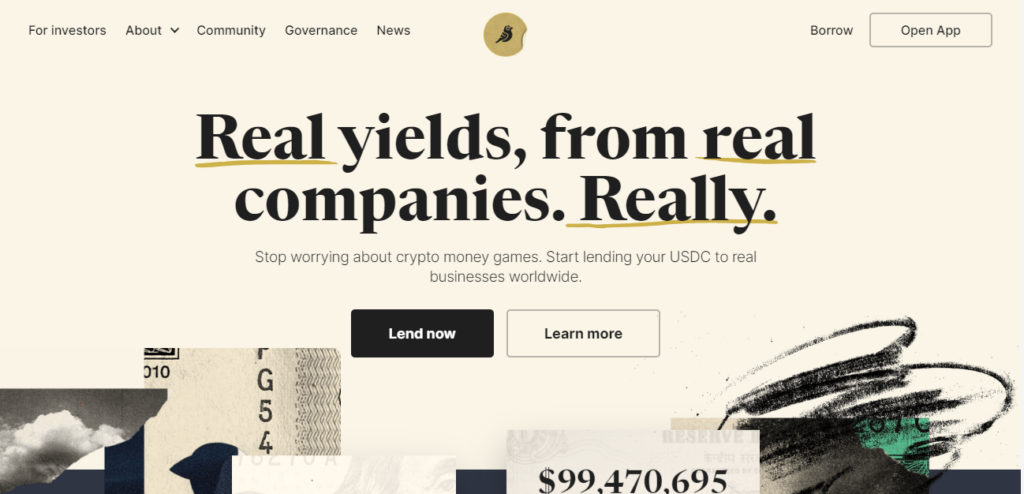

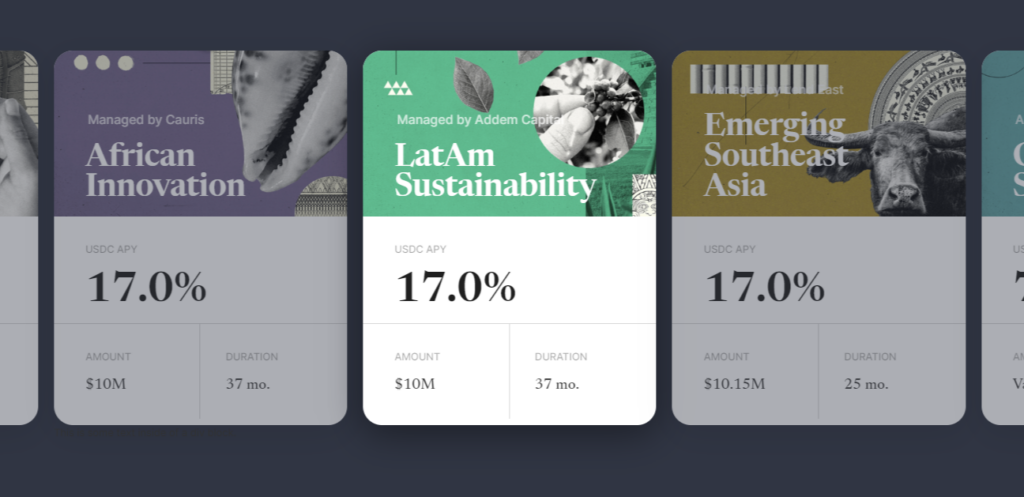

1. Goldfinch

Goldfinch is a protocol that helps businesses, primarily emerging-market-based, access crypto lending without having to post crypto collateral. Instead, loans are collateralized with RWAs. By allowing loans to be collateralized with RWAs instead of crypto, Goldfinch allows almost any business to obtain crypto loans.

Goldfinch has a unique way of vetting, which businesses can become borrowers on their platform. So-called “auditors” are users on the Goldfinch platform that stake the Goldfinch native token, GFI, so that they can vote on whether a borrower should be able to open a credit line on Goldfinch.

Goldfinch currently has originated over US$120M of RWA-based loans to emerging market businesses.

Mission and Vision

Goldfinch’s mission is to expand access to capital by establishing a unified global credit marketplace. This entails enabling small businesses in Nigeria and large institutions in New York to access capital from the same financial markets, providing equal investment opportunities for all investors.

Their long-term mission centers around establishing an open credit platform to promote financial inclusivity. They believe that, by optimizing the mechanics and economic incentives, they can create a scalable system. Such a system has the potential to facilitate the financing of economic activities on a global scale, particularly in regions where traditional capital allocation has been less efficient.

At Goldfinch, their primary focus is on democratizing access to credit and reimagining the worldwide provision of financial services. Through collaboration, innovation, and a dedicated commitment to empowering individuals across the globe, they aspire to shape a future where economic opportunities are accessible to everyone, ultimately contributing to global economic growth and prosperity.

Key Highlights of Goldfinch

- Trust through Consensus: Goldfinch introduces the concept of “trust through consensus.” It assesses borrowers’ creditworthiness based on the collective assessment of participants rather than relying solely on their crypto assets.

- Roles and Incentives: The Goldfinch protocol involves various roles such as Investors, Borrowers, Auditors, and Members. Each role has its own incentives, including attractive APYs and rewards.

- Junior and Senior Tranches: Borrower Pool smart contracts have both junior and senior tranches, ensuring alignment of incentives. Backers provide first-loss capital via junior tranches, while Liquidity Providers offer second-loss capital via senior tranches.

- Tokens: Goldfinch has two native tokens, GFI and FIDU, both following the ERC20 standard. These tokens are used for governance, staking, rewards, and protocol incentives.

- Governance: The Goldfinch protocol is community-driven, allowing for governance votes to upgrade contracts, adjust parameters, select Unique Entity Check providers, and more.

- Unique Entity Check: To prevent Sybil Attacks, Goldfinch uses a “Unique Entity Check” to verify the identity of participants. This verification process is currently facilitated by Unique Identity (UID) NFTs, developed by Warbler Labs.

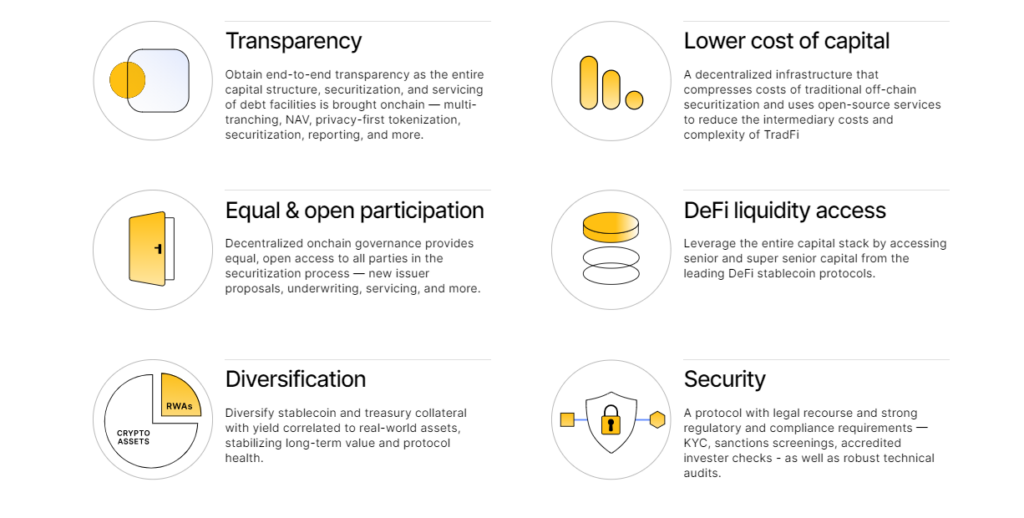

2. Centrifuge

Centrifuge—an on-chain ecosystem for structured credit—is focused on securitizing and tokenizing previously illiquid debt, with $298M in total assets already financed.

We can think of Centrifuge protocol as offering a turnkey solution for structured credit tokenization and loan origination. This streamlined approach has made Centrifuge a top choice for real world businesses looking to originate crypto loans.

Its tokenized assets have been integrated across DeFi, including $220M of RWAs on MakerDAO.

Mission and Vision

Centrifuge aims for businesses worldwide to embrace Centrifuge OS and actively participate in the decentralized economy. They envision a future where these businesses can have complete confidence in the integrity of their on-chain data and where the legal system fully supports this vision.

They focus on making the best decisions possible and progressing along this path. While they strive for a fully decentralized future, they understand the need for compromise as they introduce their initial products and gain valuable insights into user needs and network requirements.

Key Highlights of Centrifuge

- Built on Parity Substrate: Centrifuge utilizes Parity Substrate for blockchain creation on Polkadot and Kusama.

- Polkadot Integration: It will integrate with Polkadot as a parachain for enhanced security and consensus.

- Tinlake: Centrifuge’s core product, Tinlake, brings collateralized loans to the blockchain.

- Working Capital Access: It enables businesses, including small ones, to access working capital.

- Asset Tokenization: Real-world assets like mortgages and invoices are tokenized and verified on the blockchain.

- Collateralized Loans: Tokenized assets serve as collateral for loans funded by liquidity investors.

- Investor Options: Investors can choose between higher-risk, higher-reward TIN or lower-risk, stable-yield DROP tokens.

- Tranche Investments: TIN and DROP tokens mimic junior and senior tranche investments in traditional finance.

- Liquidity Redemption: Accrued interest in TIN or DROP can be redeemed for DAI when investors want to withdraw liquidity.

3. MakerDao

MakerDao is a collateralized debt platform on Ethereum that has arguably made the most progress regarding RWA adoption.

The types of collateral borrowers can use are determined by the protocol’s governance DAO, MakerDAO. In 2020, MakerDAO voted to allow borrowers to post RWA-based collateral to vaults. In addition to this vote, MakerDAO elected to fund oracle development so that the value of RWA-based collateral on the platform could be seamlessly priced with the collateral’s value off-chain.

Today, the value of MakerDAO’s RWA vaults is over US$680M. This means that through RWA-backed loans, MakerDAO has been able to scale the amount of DAI issued into the market. Furthermore, this means that US$680M+ worth of RWAs is helping maintain MakerDAO’s $1 peg stability.

Mission and Vision

Maker’s mission is to create a “fair world currency” and the vision behind MakerDAO is to create a decentralized, transparent, and accessible platform to level the economic playing field for everybody worldwide.

Key Highlights of MakerDao

- The MakerDAO is a protocol that establishes the rules for the stablecoin cryptocurrency token DAI on the Ethereum network.

- The MakerDAO protocol, which governs the operation of DAI, is managed by a decentralized community of MKR token holders. Each holder has an equal say in determining adjustments to the protocol.

- DAI is a stablecoin cryptocurrency, meaning its value remains consistent at a rate of 1 USD to 1 DAI token. DAI is compatible with over 400 apps and services, including video games, digital wallets, and DeFi staking platforms.

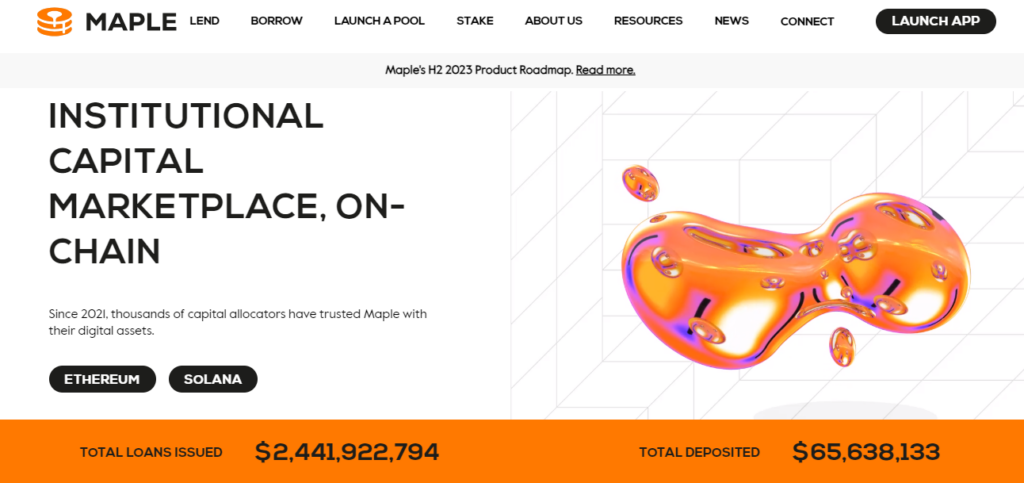

4. Maple Finance

Maple Finance—a blockchain-based credit marketplace with nearly $2B in total loans issued—plans to expand to receivables financing, which can scale up to $100M in size and support US treasuries and insurance refinancing.

Maple hosts “pool delegates,” which are credit professionals who rigorously assess creditworthiness, set loan terms with borrowers, and actively manage loan books. Otherwise, the borrowing/lending process is standard. Maple LPs allocate capital to permissioned liquidity pools and receive back MPL interest.

While Maple protocol previously focused on uncollateralized lending to crypto native firms, it is increasingly venturing into more RWA-based loans. Previously, uncollateralized crypto lending to crypto trading firms left Maple with US$52M in bad debt and up to 80% losses for select Maple LPs.

These losses came after last year’s centralized contagion spread to Maple’s crypto-native borrowers. In efforts to diversify their offerings, Maple’s pool delegates are looking to originate loans with real world asset collateral instead of crypto collateral. For example, in January, Maple created a US$100M liquidity pool that is backed by tax receivables.

Mission and Vision

Maple is a blockchain-based financial technology provider on a mission to reshape debt-capital markets by combining industry compliance standards with the transparent and frictionless lending enabled by blockchain technology.

At its core, Maple Finance is a groundbreaking on-chain corporate credit market that caters to institutional borrowers. The platform enables these borrowers to access undercollateralized loans through meticulously managed lending pools overseen by accredited pool delegates. Simultaneously, Maple empowers lenders by providing them with sustainable yields on their assets.

Key Highlights of Maple Finance

- Staking: Stake MPL tokens to earn rewards and gain voting rights on platform decisions. MPL tokens convert to xMPL tokens at a 1:1 ratio, with MPL distributions monthly.

- Lending and Borrowing: Users can lend assets and earn interest while borrowers can access funds from lending pools. Minimum borrowing amount is $1,000,000. Fees include a 0.99% annual loan origination fee, with rewards going to lenders and delegates.

- Supported Countries: No list of unsupported countries, but discretion may apply to borrowers from sanctioned regions.

- MAPLE Token (MPL): MPL is the governing token with roles in governance, pool cover, and fee sharing. Over 4.4 million MPL tokens in circulation out of a maximum supply of 10 million, with tokenomics tied to platform usage.

5. Ondo Finance

Ondo Finance – a DeFi platform for tokenized RWAs—recently tokenized short-term US treasuries, investment grade bonds, and high-yield corporate bonds.

To do this, Ondo has created three different investment funds, OUSG (Short-term US Government Bond Fund), OSTB (Short-term Investment Grade Bond Fund), and OHYG (High-Yield Corporate Bond Fund), which own the underlying institutional assets. They then tokenize these investment funds to become RWAs (called “fund tokens”). After users engage in a KYC/AML process, they are able to trade fund tokens and use those fund tokens in permissioned DeFi protocols.

Ondo also launched Flux Finance, a DeFi lending protocol for borrowing permissionless stablecoins against the tokenized US treasuries.

Mission and Vision

Ondo Finance’s mission is to provide institutional-grade, blockchain-enabled investment products and services. Ondo Finance has both a technology arm that develops decentralized finance technology, and an asset management arm that creates and manages tokenized funds.

They are the first (and so far, only) company to tokenize exposure to US Treasuries. They are also focused on incubating protocols that can support both tokenized real world assets and traditional crypto. We’re fully remote, with team members across the U.S.

Key Highlights of Ondo Finance

- Ondo Finance enhances the existing DeFi-to-TradFi infrastructure and provides gateways to real world assets, bringing high-quality institutional products to the blockchain.

- USDY is the latest offering from Ondo, and this stablecoin that generates interest enables direct and fully compliant access to yield denominated in US dollars.

- The protocol has specifically prioritized bringing US Treasury yields to the blockchain, and its OUSG Fund has already attracted over $165 million in Total Value Locked (TVL), demonstrating the strong demand for a tokenized version of the leading risk-free asset in traditional finance.

Conclusion: Real World Assets Crypto Projects

Real World Assets (RWAs) are making a significant impact in the world of cryptocurrency and decentralized finance (DeFi). These assets, tokenized from various real-world assets such as gold, real estate, bonds, and more, are unlocking new opportunities for businesses and investors.

The top five RWAs projects in 2023 – Goldfinch, Centrifuge, MakerDAO, Maple Finance, and Ondo Finance – are pioneering innovative solutions, from collateralized lending to structured credit tokenization. They share a common vision of democratizing access to financial services and bridging the gap between traditional finance and blockchain technology.

These projects are not only expanding access to capital but also promoting financial inclusivity, trust through consensus, and sustainable yields. With their unique features, governance models, and partnerships, they are shaping the future of finance by bringing real-world assets into the blockchain ecosystem, ultimately contributing to global economic growth and prosperity.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.