Xapo Secures European Broker License, Expanding Stock Offerings Beyond Apple

Key Points:

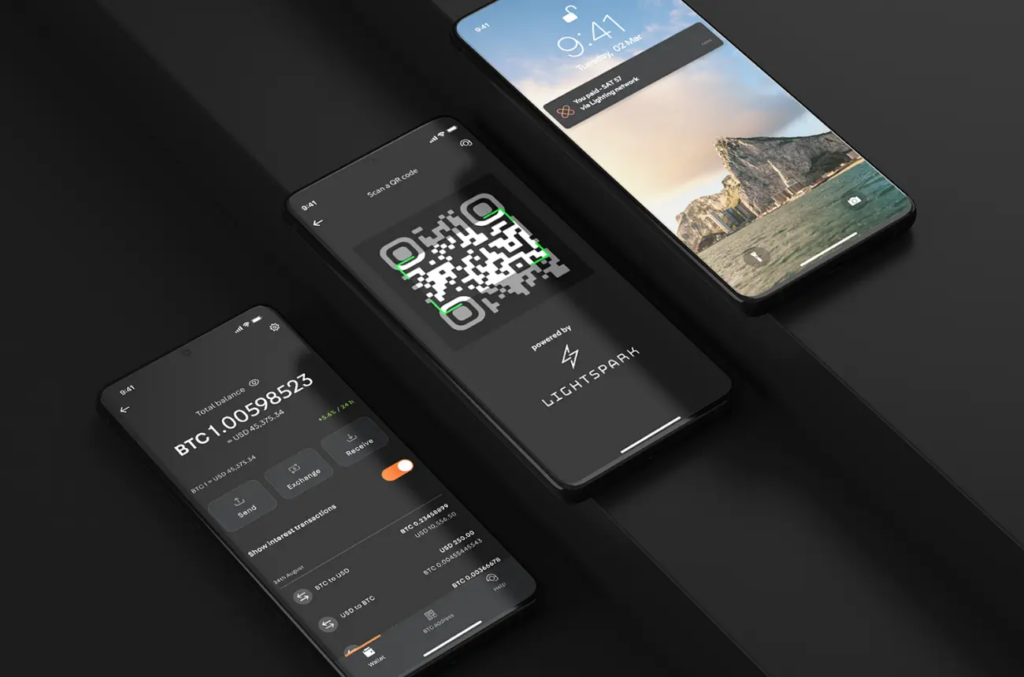

- Xapo, a Gibraltar-based digital asset bank, has acquired a European broker license.

- The license allows Xapo to offer European customers the ability to trade S&P 500 stocks alongside crypto wealth management services.

- Xapo’s focus is on long-term, diversified investments, targeting older investors looking for financial stability and Bitcoin allocations.

Xapo has obtained a securities broker license, enabling it to offer European broker license customers the opportunity to trade S&P 500 stocks like Apple alongside the company’s crypto wealth management services.

Xapo’s recently granted European broker license adds another dimension to the firm’s vision, which is more focused on straightforward, long-term investing as opposed to the speculative trading often associated with cryptocurrencies.

Seamus Rocca, CEO of Xapo, highlighted their target demographic, which differs from the typical young crypto trader: “Our target customer is not your stereotypical 25-year-old Gen Z, who wants to trade crypto. It’s a slightly older demographic who bought Bitcoin a few years ago to hold and to be like a pension pot, or perhaps to buy a property when the price is right. They want a diversified portfolio perhaps with some stocks, a savings account that earns interest, as well as a bitcoin allocation.”

Xapo’s Unique Approach

Xapo began its journey in 2013 with a wallet, cold-storage custody vault, and a reserve of 30,000 Bitcoin (BTC). After setting up in Gibraltar under its virtual asset service provider (VASP) framework, the company has made significant progress. It has obtained a banking license, achieved principal membership with Visa and Mastercard, and secured membership in SWIFT, allowing direct interactions with correspondent banks.

Xapo’s decision to offer brokerage services in European broker license aligns with the growing interest in cryptocurrencies among traditional financial institutions. However, unlike many banks that focus primarily on institutional services, Xapo remains dedicated to retail customers and the core principles of financial freedom associated with Bitcoin.

Seamus Rocca emphasized the need for a bank that bridges the gap between cryptocurrencies and traditional financial transactions, filling a void left by traditional banks. He believes that holding cryptocurrencies in non-custodial wallets can be risky and that integrating cryptocurrencies with traditional financial services provides a safer and more practical solution for users.

Xapo’s European broker license marks the beginning of a new phase for the company as it expands its services to cater to investors seeking a balanced and diversified portfolio that includes traditional assets and cryptocurrencies.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.