Analyzing The Potential Impact Of Lawsuit On GBTC: Bloomberg ETF Analyst

Key Points:

- Most ETFs have multiple authorized participants, reducing the significance of potential impact on GBTC, which had a unique Genesis-DCG relationship.

- Genesis is no longer an authorized participant for GBTC, eliminating direct impact of lawsuit on GBTC, but the situation may change with new evidence.

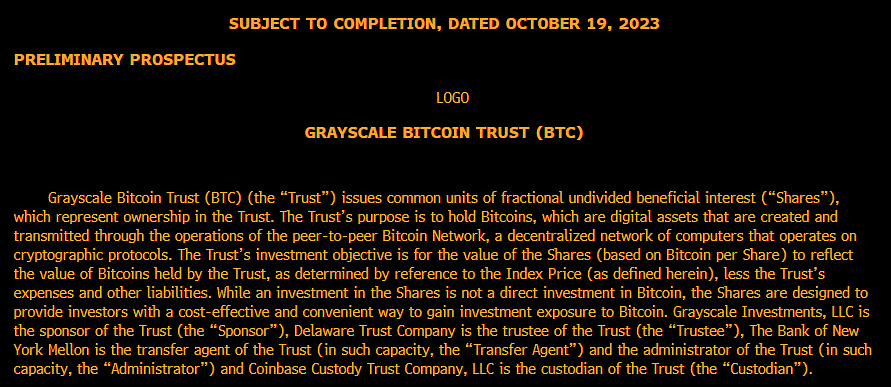

Bloomberg ETF analyst explains that the impact of lawsuit on GBTC due to Genesis being the sole authorized participant until 2022. However, this doesn’t imply significant consequences.

In response to the recent lawsuit filed by the New York State against Gemini and DCG, there has been speculation about the potential impact on Grayscale’s conversion of GBTC into ETFs.

Bloomberg ETF analyst James Seyffart explains that the only aspect that may affect GBTC, as opposed to other filers, is the fact that Genesis, a sister company to DCG, was the sole authorized participant (AP) of GBTC until the end of 2022.

Being an authorized participant means that Genesis played a crucial role in facilitating the creation and redemption of fund shares. When investors handed over Bitcoin to Genesis, they would receive an equivalent value of GBTC shares in return.

Potential Impacts Of The Lawsuit On GBTC

This close relationship between Genesis and GBTC was due to their affiliation with DCG. However, Seyffart emphasizes that this should not be seen as a smoking gun that would drastically impact GBTC.

In fact, ETFs typically have multiple authorized participants, often big banks like Goldman Sachs or Bank of America. Therefore, any legal issues that may arise with these financial institutions would not necessarily have a direct effect on the ETFs where they operate as authorized participants.

Furthermore, Genesis is no longer an authorized participant for GBTC, as they were removed from this role in October 2022. This means that any potential legal issues or controversies surrounding Genesis would not directly impact GBTC moving forward.

However, Seyffart acknowledges that his perspective may change if new information or evidence of impropriety emerges. As of now, there is no solid evidence suggesting any misconduct or wrongdoing related to GBTC and its authorized participants.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.