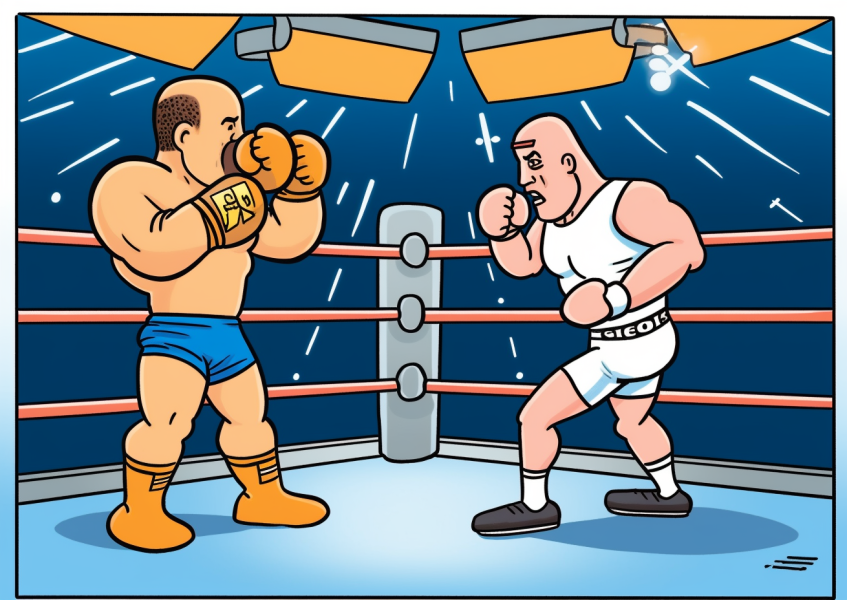

Coinbase SEC Lawsuit: Against SEC Unregistered Securities Violation Escalates!

Key Points:

- Coinbase’s resolute defense challenges the SEC’s classification of transactions as unregistered securities, citing the absence of concrete evidence.

- The imminent legal battle, scheduled for Tuesday, will see Judge Katherine Polk Failla preside over the critical dispute, with implications extending beyond Coinbase’s case.

- The outcome of this high-stakes conflict has the potential to set regulatory precedents and significantly impact the broader cryptocurrency market, capturing the attention of crypto enthusiasts worldwide.

Coinbase is set to embark on a critical legal battle against the U.S. Securities and Exchange Commission (SEC) this Tuesday (Coinbase SEC lawsuit), aiming to resolve the lingering accusations regarding its alleged involvement in unregistered securities.

The company remains resolute in its defense, asserting that the Coinbase SEC lawsuit has failed to substantiate the classification of the transactions as investment contracts or securities due to the absence of concrete covenants.

Legal Battle Outcome’s Ripple Effect on Crypto Industry

Citing the “material question doctrine,” Coinbase SEC lawsuit’s legal stance pivots on the argument that federal government agencies lack the jurisdiction to regulate nascent areas without congressional authorization. A source familiar with the matter emphasized Coinbase’s unwavering commitment to this legal strategy, signaling the company’s preparedness to challenge the Coinbase SEC lawsuit’s regulatory overreach.

The upcoming legal showdown will take place before Judge Katherine Polk Failla at the U.S. District Court for the Southern District of New York. While the possibility of the judge aligning with Coinbase’s legal contentions remains, the likelihood of outright dismissal of government enforcement actions remains relatively low at this stage.

The SEC’s initial enforcement action against Coinbase was initiated back in June, igniting a protracted legal battle that has significant implications for the broader cryptocurrency industry. The outcome of this case is poised to shape the regulatory landscape governing digital assets and could potentially establish precedents for similar disputes in the future.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.