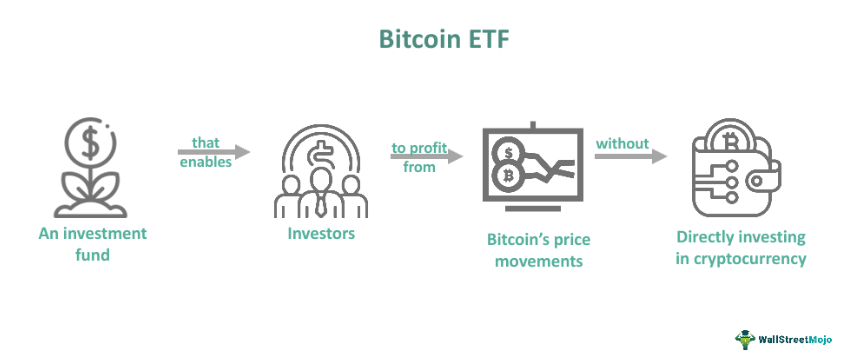

Bitcoin Spot Exchange-Traded Fund (Bitcoin Spot ETF) represents a new investment opportunity that allows investors to gain exposure to the price movements of Bitcoin without having to directly purchase or store the cryptocurrency.

This financial product provides a simplified and regulated avenue for investors to add Bitcoin to their portfolios, mirroring the price of the cryptocurrency on various exchanges.

Investing in a Bitcoin Spot ETF offers several advantages, including increased liquidity, regulatory oversight, and ease of trading, making it an attractive option for traditional investors seeking to diversify their portfolios with exposure to the cryptocurrency market. Unlike traditional Bitcoin investments, Bitcoin Spot ETFs provide a convenient and regulated way to gain indirect exposure to the cryptocurrency’s price movements, mitigating some of the security and regulatory concerns associated with direct Bitcoin ownership.

What is a BTC Spot ETF?

A BTC Spot ETF, or Bitcoin Spot Exchange-Traded Fund, represents a financial product that enables investors to gain exposure to the price movements of Bitcoin without requiring them to directly hold the cryptocurrency. This type of ETF is designed to track the price of Bitcoin on various cryptocurrency exchanges, allowing investors to benefit from its price fluctuations without the need for ownership or management of the digital asset itself.

The BTC Spot ETF functions similarly to traditional exchange-traded funds, providing investors with a regulated and accessible avenue to invest in Bitcoin through their brokerage accounts. By investing in a BTC Spot ETF, individuals can diversify their investment portfolios and potentially capitalize on the performance of Bitcoin, which has garnered significant attention as a volatile yet potentially lucrative asset within the financial markets.

The introduction of BTC Spot ETFs is seen as a significant milestone in the integration of cryptocurrencies into mainstream financial markets. It provides a simplified and more familiar investment vehicle for traditional investors who may have been hesitant to directly engage with the complexities and uncertainties of the cryptocurrency market. BTC Spot ETFs offer increased liquidity, transparency, and regulatory oversight, addressing some of the concerns that have historically surrounded cryptocurrency investments.

While BTC Spot ETFs have garnered attention for their potential to bridge the gap between traditional finance and the cryptocurrency space, it is crucial for investors to exercise caution and conduct thorough research before considering any investment in this evolving asset class. Understanding the risks and volatility associated with Bitcoin investments, as well as staying informed about regulatory developments and market dynamics, is essential for making informed investment decisions in the realm of BTC Spot ETFs.

Bitcoin Spot ETF Explained

Spot Bitcoin Exchange-Traded Fund (ETF) is an investment fund that tracks the price of Bitcoin directly, allowing investors to gain exposure to the cryptocurrency without needing to hold the underlying asset. Unlike futures-based ETFs, which derive their value from Bitcoin futures contracts, a Bitcoin Spot ETF provides investors with direct exposure to the actual price movements of Bitcoin on various cryptocurrency exchanges.

The introduction of a Bitcoin Spot ETF has garnered significant attention within the investment community, primarily due to its potential to simplify and broaden access to Bitcoin for a wider range of investors, including those who may be reluctant to directly invest in cryptocurrencies. This investment vehicle offers a regulated and transparent way for investors to add Bitcoin to their portfolios, providing them with the opportunity to benefit from potential price appreciation while minimizing the complexities associated with purchasing and storing the cryptocurrency.

A key advantage of a Bitcoin Spot ETF is its liquidity and ease of trading, as it allows investors to buy and sell shares on major stock exchanges throughout the trading day, similar to traditional stocks. This feature enhances the accessibility and convenience of investing in Bitcoin, making it more appealing to institutional and retail investors seeking to diversify their portfolios with a digital asset that has demonstrated significant growth potential over the years.

What Happens If BTC Spot ETFs is Approved?

The potential approval of a Bitcoin Exchange-Traded Fund (ETF) has been a subject of significant speculation and discussion within the financial and cryptocurrency communities. If a BTC Spot ETFs were to be approved, it could have several profound implications for the cryptocurrency market and the broader financial landscape.

Firstly, the approval of a BTC Spot ETFs could lead to increased mainstream adoption and acceptance of Bitcoin as a legitimate investment asset. This could attract a broader base of traditional investors, including institutional and retail investors, who may have been previously hesitant to invest in cryptocurrencies due to regulatory concerns or technical complexities.

Additionally, the introduction of a BTC Spot ETFs could potentially contribute to greater price stability and liquidity in the cryptocurrency market. By providing a regulated and transparent investment vehicle, a Bitcoin ETF could mitigate some of the price volatility traditionally associated with the cryptocurrency, thereby making it a more appealing option for risk-averse investors.

Moreover, the approval of BTC Spot ETFs could potentially pave the way for the introduction of additional cryptocurrency-related financial products, further bolstering the integration of cryptocurrencies into mainstream financial markets. This could include the development of ETFs for other cryptocurrencies, as well as the introduction of cryptocurrency-based derivatives and other investment instruments.

However, it is essential to note that the approval of a BTC Spot ETFs may also bring about regulatory challenges and heightened scrutiny from regulatory authorities. Regulators may impose strict compliance requirements and monitoring measures to ensure investor protection and market stability, potentially leading to increased oversight and scrutiny of the cryptocurrency market as a whole.

While the approval of a BTC Spot ETFs could signify a significant milestone in the maturation and integration of cryptocurrencies into the mainstream financial system, it may also introduce new regulatory complexities and challenges that would need to be carefully navigated by market participants and regulatory authorities alike.

How Does a Bitcoin ETF Work?

Bitcoin Exchange-Traded Fund (ETF) operates as a financial product that enables investors to gain exposure to the price movements of Bitcoin without needing to directly purchase, store, or manage the cryptocurrency. The functioning of a Bitcoin ETF is similar to that of a traditional ETF, with the key distinction being that it tracks the price of Bitcoin rather than a conventional asset such as stocks or commodities.

The operation of a Bitcoin ETF involves a financial institution or asset management firm purchasing and holding a specific quantity of Bitcoin. This institution then issues shares of the ETF to investors, with each share representing a portion of the Bitcoin held by the fund. The price of these shares corresponds to the current market value of Bitcoin, and their value fluctuates in tandem with the price movements of the cryptocurrency.

Investors can purchase or trade these ETF shares on traditional stock exchanges, making them more accessible and convenient for a broader base of investors, including those who may not be well-versed in the technical intricacies of cryptocurrency trading. This indirect exposure to Bitcoin allows investors to capitalize on potential price gains without the need to manage digital wallets or navigate cryptocurrency exchanges.

Moreover, the creation of a Bitcoin ETF brings regulatory oversight and transparency to the investment process, ensuring that the fund operates within the established regulatory framework. This regulatory oversight provides investors with a greater sense of security and confidence when participating in the cryptocurrency market, as the ETF must adhere to the regulatory requirements imposed by the relevant financial authorities.

Bitcoin ETF serves as a convenient and regulated investment vehicle that allows investors to diversify their portfolios by incorporating exposure to the dynamic and potentially lucrative world of cryptocurrencies, thereby bridging the gap between traditional financial markets and the rapidly evolving landscape of digital assets.

Why is a Bitcoin ETF Important?

The significance of a Bitcoin Exchange-Traded Fund (ETF) stems from its potential to democratize and simplify access to the cryptocurrency market for a broader base of investors. The introduction of a Bitcoin ETF would represent a crucial milestone in the evolution of the cryptocurrency ecosystem, offering several key benefits and opportunities for investors and the financial industry as a whole.

One of the primary advantages of a Bitcoin ETF is its ability to provide investors with a regulated and secure avenue to gain exposure to Bitcoin without the need for direct ownership or management of the cryptocurrency. This accessibility could potentially attract a wider array of traditional investors, including institutional investors and retail traders, who may have been previously deterred by the complexities and uncertainties surrounding cryptocurrency investments.

Moreover, the introduction of a Bitcoin ETF could contribute to increased market liquidity and price stability for Bitcoin and the broader cryptocurrency market. By facilitating the seamless and regulated trading of Bitcoin on traditional stock exchanges, a Bitcoin ETF could help mitigate some of the volatility traditionally associated with the cryptocurrency, making it a more appealing and viable investment option for risk-averse investors.

Bitcoin ETF could pave the way for the integration of cryptocurrencies into mainstream financial markets, fostering greater acceptance and recognition of digital assets as a legitimate investment class. This increased acceptance could spur further innovation and development within the cryptocurrency space, leading to the introduction of new financial products and investment instruments tailored to meet the evolving needs of investors in the digital age.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.