Doubling Impacts Of Bitcoin Halving And Spot ETFs On Supply And Demand

Key Points:

- Impacts of Bitcoin halving and spot ETFs: reduces the supply, doubles the demand.

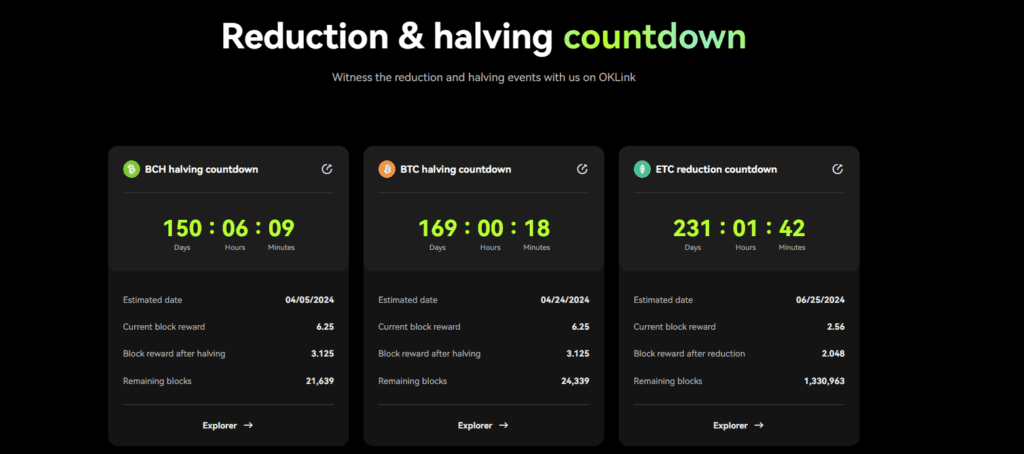

- The next halving is scheduled for April 24, 2024, and it ensures a controlled monetary inflation rate for Bitcoin.

- Spot Bitcoin ETFs allow indirect investment in Bitcoin, providing access to its value while mitigating risks.

Michael Saylor expects the impacts Of Bitcoin halving and spot ETFs, in which Bitcoin’s supply to be cut in half after the halving, and with the introduction of spot ETFs, he predicts a doubling of demand.

Michael Saylor, in an interview on Fox Business, mentioned the impact of the halving on the Bitcoin supply and the potential doubling of demand once the spot ETFs are launched. The halving event reduces the supply, while the spot ETFs are expected to attract more investors and increase demand for Bitcoin.

“After the halving, the supply gets cut in half, and after the spot ETFs come online, demand’s going to at least double”

Michael Saylor said on Fox Business

Potential Impact of Halving on Bitcoin Supply

The Bitcoin halving is a significant event that occurs approximately every four years, where the block reward provided to miners is reduced by half. This event ensures a controlled monetary inflation rate, distinguishing cryptocurrencies from traditional fiat currencies with infinite supply.

The next halving is expected to occur on April 24, 2024, and the current block height is less than 6 months away from it. Once all 32 halving events have taken place, the maximum supply of Bitcoin will be reached, and no more Bitcoin will be created.

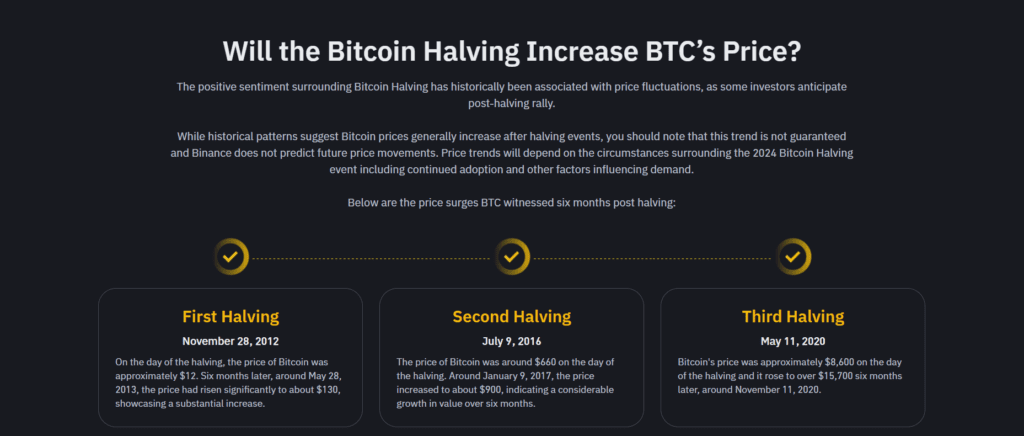

The halving plays an essential function in the Bitcoin protocol, and the code can be found on the Bitcoin Core Github. According to the report from Binance, previous halving events occurred on November 28, 2012, and July 9, 2016, with Bitcoin prices of $12.31 and $650.63, respectively.

The Role of Spot ETFs in Doubling Demand

Spot Bitcoin ETFs, also known as Bitcoin Physical ETFs, are investment funds that operate similarly to traditional ETFs. These funds allow investors to access Bitcoin without owning it directly.

Instead, the fund management company purchases Bitcoin and issues shares in the ETF, representing ownership of the underlying Bitcoin. This indirect investment enables investors to benefit from the value of Bitcoin while mitigating the risks associated with the crypto market.

In summary, the upcoming halving in April 2024 and the potential launch of spot ETFs are expected to have a significant impact on the Bitcoin market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.