Bitcoin Price Surges Near $38,000, Driven by ETF Demand And Fed’s Rate

Key Points:

- Bitcoin is nearing $38,000, its highest level since May 2022, driven by expectations of increased demand from ETFs.

- The belief that the Federal Reserve has halted interest-rate hikes and the potential for diversification benefits are contributing to the rise in crypto prices.

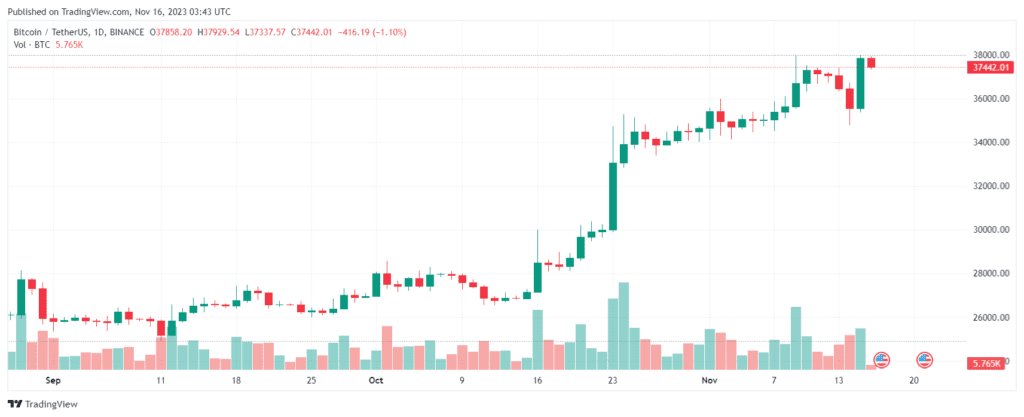

Bitcoin price surges near $38,000 powered by ETF demand expectations and a 6.5% increase in the past 24 hours. Year-to-date rebound stands at 129%.

Bitcoin is experiencing a surge in price, nearing $38,000, a level not seen since May 2022. This rally is driven by expectations of increased demand for the cryptocurrency from exchange-traded funds (ETFs).

In the past 24 hours, the largest digital asset has seen a 6.5% increase, reaching $37,976. Its year-to-date rebound stands at an impressive 129% following a downturn in 2022. Other virtual currencies, including Ether, have also risen in value.

Bitcoin price surges near $38,000

While the US Securities and Exchange Commission (SEC) has once again delayed a decision on approving the first ETF directly investing in Bitcoin, Bloomberg Intelligence predicts that a batch of such funds will receive the green light by January. These ETFs would provide easier access to Bitcoin for institutional and retail investors.

Additionally, the belief that the Federal Reserve has halted interest-rate hikes has contributed to the rise in crypto prices. Cryptocurrencies are often influenced by changes in liquidity levels in financial markets.

Investors are now contemplating whether the climb in Bitcoin’s price this year has already factored in the potential impact of spot ETFs. While the approval may already be priced in, the focus remains on how much inflow these ETFs will attract.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.