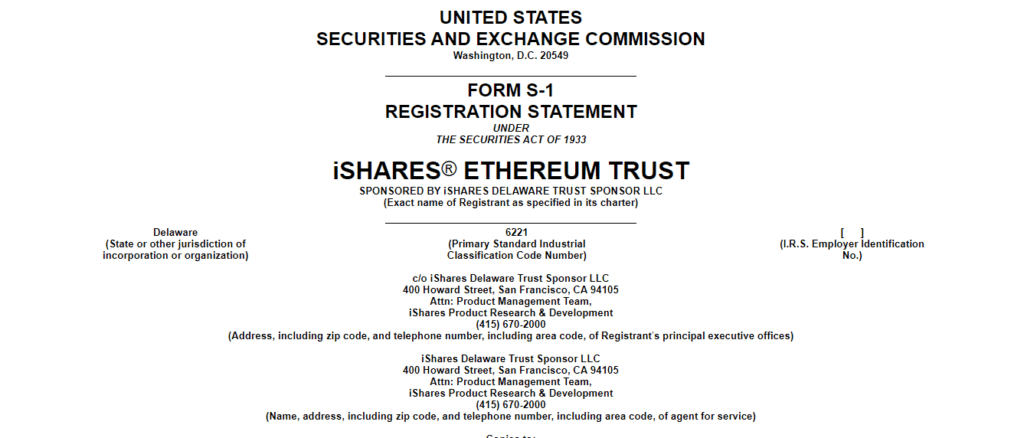

BlackRock Seeks SEC Approval For Spot Ethereum ETF With A New S-1 Application

Key Points:

- BlackRock has filed an application for its Spot Ethereum ETF, which, if approved by the SEC, could open the doors to the cryptocurrency market.

- Bitcoin and Ethereum saw price increases after the filing, with the potential approval of the Ethereum ETF expected to bring more investments and significant price gains.

BlackRock has filed an S-1 prospectus for its Spot Ethereum ETF with the SEC, appointing Coinbase as the Custodian for the underlying ETH.

BlackRock, the $9 trillion asset manager, has filed an S-1 application for its Spot Ethereum ETF. If approved by the US Securities and Exchange Commission (SEC), BlackRock will offer Spot Ethereum ETF services to institutional clients, potentially opening the doors to the cryptocurrency market.

Shortly after the filing, both Bitcoin and Ethereum experienced price increases. Bitcoin was trading at the $37,500 mark, while Ethereum was increasing to above $2,080. The potential approval of the Ethereum ETF by the SEC could bring even more investments into the cryptocurrency market, resulting in significant price gains.

Implications of SEC Approval and Potential Price Surges for Bitcoin and Ethereum

According to Watcher.Guru, Institutional investors see Ethereum as the new silver and Bitcoin as the new gold. The combination of a Spot BTC ETF and a Spot ETH ETF could initiate a bullish trend between 2024 and 2025. In 2004, when the SEC approved the Spot Gold ETF for BlackRock, the price of gold spiked by almost 350%.

BlackRock’s application for a Spot ETH ETF, backed by its trillions of dollars in managed assets, is positive news for the cryptocurrency market. However, the scale of the potential price surge for Bitcoin and Ethereum following SEC approval should be monitored closely. While gold experienced a 350% increase after the approval of the Spot ETF in 2004, the performance of BTC and ETH will require careful observation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.