DeFi Competition Decline: Only 30 Projects Achieve $1M Revenue In The Last 6 Months

Key Points:

- DeFi competition declines after FTX’s collapse, with a few dominant participants and high capital concentration.

- Security and risk failures of newer protocols lead to a “flight to quality” and decrease in total cryptocurrency value sent to DeFi.

DeFi competition decline after FTX’s collapse, with dominant players and concentrated capital. Security failures and investor spooking lead to a flight to quality. Only a few projects generate significant revenue as per BBG.

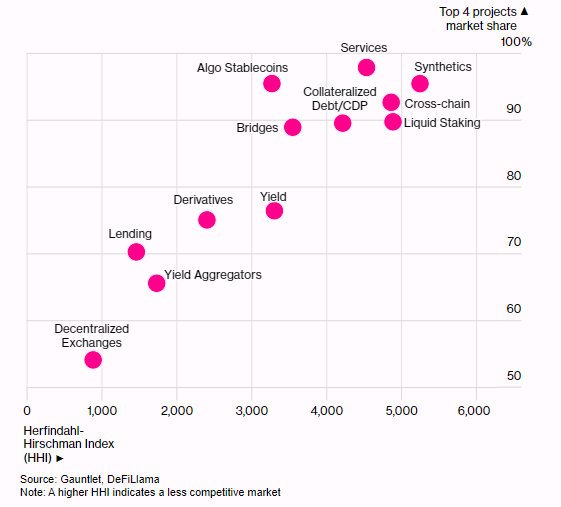

A year after FTX’s collapse, the DeFi sector is still struggling to recover, with a few dominant participants. Data from Gauntlet, a crypto-risk modeling company, shows that capital concentration is prevalent in most DeFi categories, including peer-to-peer lending and decentralized exchanges.

The Herfindahl-Hirschman Index reveals that decentralized finance exchanges are the most competitive, with the top four venues holding about 54% of the market share. Other categories like decentralized derivatives exchanges, DeFi lenders, and liquid staking are less competitive, with the top four projects holding about 90% of the market share.

This concentration of capital is due to security and risk failures of some newer protocols, leading to a “flight to quality,” according to Tarun Chitra, the CEO of Gauntlet.

Defi Competition Declines Significantly

Hacks and blowups in the broader crypto industry have spooked investors, resulting in a decrease in the total value of cryptocurrency sent to DeFi. Additionally, rate hikes by the Federal Reserve have made traditional markets more appealing, offering higher yields without venturing into riskier corners of finance.

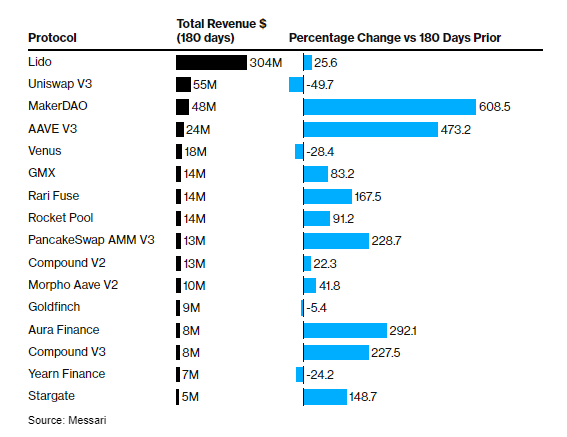

Unlike the rapid growth in 2021, the current landscape favors projects with good risk management and a clean security track record. Only about 30 DeFi projects have generated revenue of over $1 million in the past 180 days, despite a recent market rally, as reported by blockchain research firm Messari.

While the recent jump in crypto prices could benefit smaller projects and allow them to survive longer, Rune Christensen, the founder of MakerDAO, expressed concerns about potential side effects. He believes that if the bear market is truly over and a massive rally occurs, it may hinder the industry’s healthy process of eliminating unsustainable businesses. This reality is inherent to startups, where most fail.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.