Key Points:

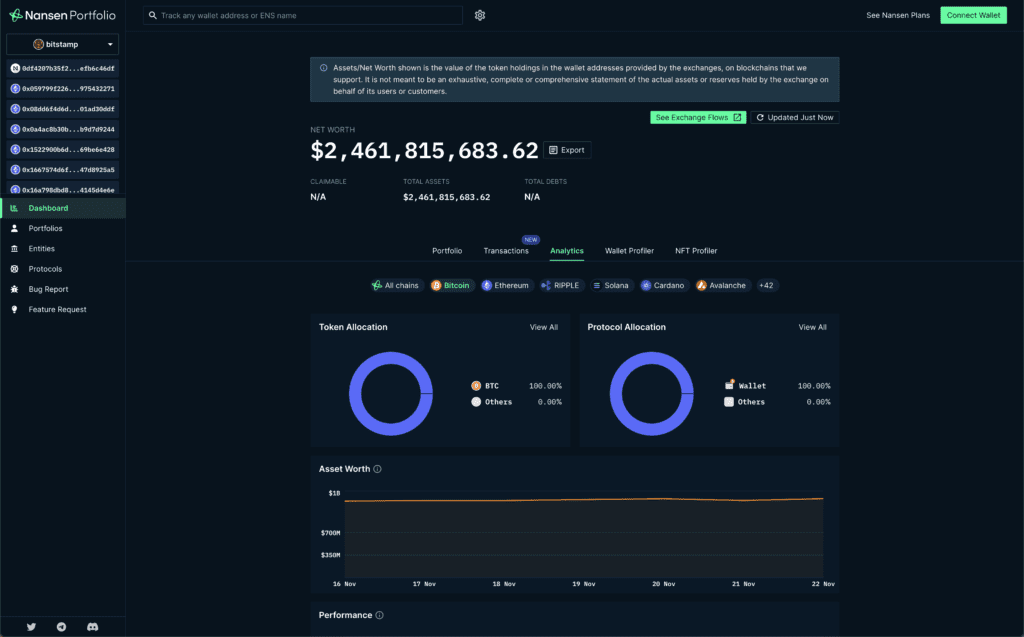

- Reports of a 38% Bitstamp Bitcoin reserves loss were inaccurate; the actual outflow was 1%.

- After CZ’s resignation on November 22, the exchange saw capital outflows and a 25% liquidity decrease.

- Market dynamics have been further influenced by the recent developments at Binance and its impact.

In a recent clarification from Bitstamp posted on the X platform, it was revealed that Glassnode had erroneously reported a 38% loss of Bitstamp Bitcoin reserves.

Bitstamp Bitcoin Reserve Loss Were Lower Than Reported

Contrary to Glassnode’s data set, Bitstamp clarified that the actual net outflow was a mere 1%. The confusion arose on November 22 when Glassnode initially reported significant cryptocurrency outflows, particularly from Binance and Bitstamp.

Following a Department of Justice (DOJ) agreement with Binance, the platform witnessed an outflow of 8,000 Bitcoins, valued at around $288 million. Meanwhile, Bitstamp experienced a notable drop, seemingly losing 38% of Bitstamp Bitcoin reserves, equivalent to approximately 16,500 Bitcoins. However, Nansen’s data confirmed the integrity of Bitstamp Bitcoin reserves, indicating a minor 1% net outflow.

Binance Faces Turbulence and Capital Outflows

Market dynamics have been further influenced by the recent developments at Binance. Following founder Changpeng Zhao’s guilty plea to money laundering and subsequent resignation as CEO on November 22, substantial capital flowed out of the exchange. Additionally, liquidity decreased by 25%, with investors withdrawing their positions, according to Kaiko.

While Binance agreed to a $4.3 billion fine and CZ’s resignation, the exchange remains the world’s largest, processing billions of dollars in transactions annually. Nansen reports Binance’s total assets surpassing $65 billion, suggesting the exchange possesses sufficient capital to weather the sudden wave of investor withdrawals. Despite the recent challenges, Binance’s dominance in the virtual currency exchange landscape appears intact.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.