Key Points:

- Interactive Brokers Hong Kong secures license for retail clients to trade Bitcoin and Ether.

- The move comes amid a surge in crypto activities, with the region witnessing increased industry attention and licensing.

- Survey reveals only 47% of Hong Kong retail investors are familiar with local virtual asset regulations, signaling a need for education in the evolving crypto landscape.

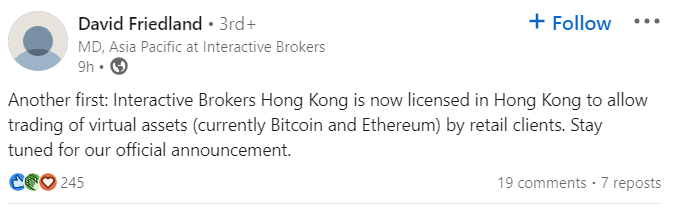

Interactive Brokers Hong Kong has secured a pivotal license, enabling the trading of virtual assets by retail clients, as confirmed by David Friedland, the Managing Director for Asia Pacific at Interactive Brokers.

The announcement on LinkedIn highlights the inclusion of Bitcoin and Ether trading, with an official statement on the horizon.

This development aligns with the burgeoning crypto landscape in Hong Kong, positioning the region as a thriving hub for crypto activities. Recent months have witnessed a surge in companies seeking local licensing, underscoring the region’s growing significance in the crypto space.

Interactive Brokers’ Licensing Unveiled!

Hashkey set the precedent in August, becoming the inaugural crypto exchange in Hong Kong to obtain a license for offering crypto assets to retail investors. Following suit, Swiss crypto bank SEBA received approval from the Hong Kong Securities and Futures Commission (SFC) in November, enabling the provision of diverse crypto-related services.

However, the Hong Kong crypto scene encountered turbulence in September with the scandal involving JPEX, an unlicensed crypto exchange allegedly defrauding investors of nearly $165 million. Responding to industry developments, the SFC updated its crypto policies, restricting certain digital currency offerings to professional investors and emphasizing the evaluation of clients’ knowledge in virtual asset investments.

A recent survey by the Investor and Financial Education Council of Hong Kong sheds light on the awareness levels among retail investors. Only 47% are cognizant of local virtual asset regulations, emphasizing the need for enhanced education and awareness programs in the evolving crypto landscape.

This licensing breakthrough for Interactive Brokers contributes to the evolving narrative of Hong Kong as a dynamic and evolving center for crypto innovation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.