SEC Slows Hashdex Bitcoin ETF Dream, Testing Investor Patience!

Key Points:

- SEC’s collaboration with Hashdex signals progress in Bitcoin ETF regulatory landscape

- Unique ETF structure explores physical trading, bringing spot Bitcoin into the mix

- Investors anticipate regulatory clarity, navigating the evolving intersection of crypto and finance.

U.S. Securities and Exchange Commission (SEC) has issued a delay order on Hashdex Bitcoin ETF application, shedding light on the regulatory body’s efforts to collaborate with potential Bitcoin ETF issuers.

James Seyffart highlighted the SEC’s proactive approach in working closely with Bitcoin ETF applicants to refine back-end details and channels.

The SEC met with @hashdex on Monday the 27th and then the SEC issued a delay order the next day on their application. This is another in a continuing flow of indications that the SEC is working hard with potential #Bitcoin ETF issuers on backend details and plumbing. pic.twitter.com/emF7LBpsD5

— James Seyffart (@JSeyff) November 30, 2023

This move reflects the SEC‘s commitment to fostering a comprehensive and secure framework for the integration of cryptocurrency exchange-traded funds.

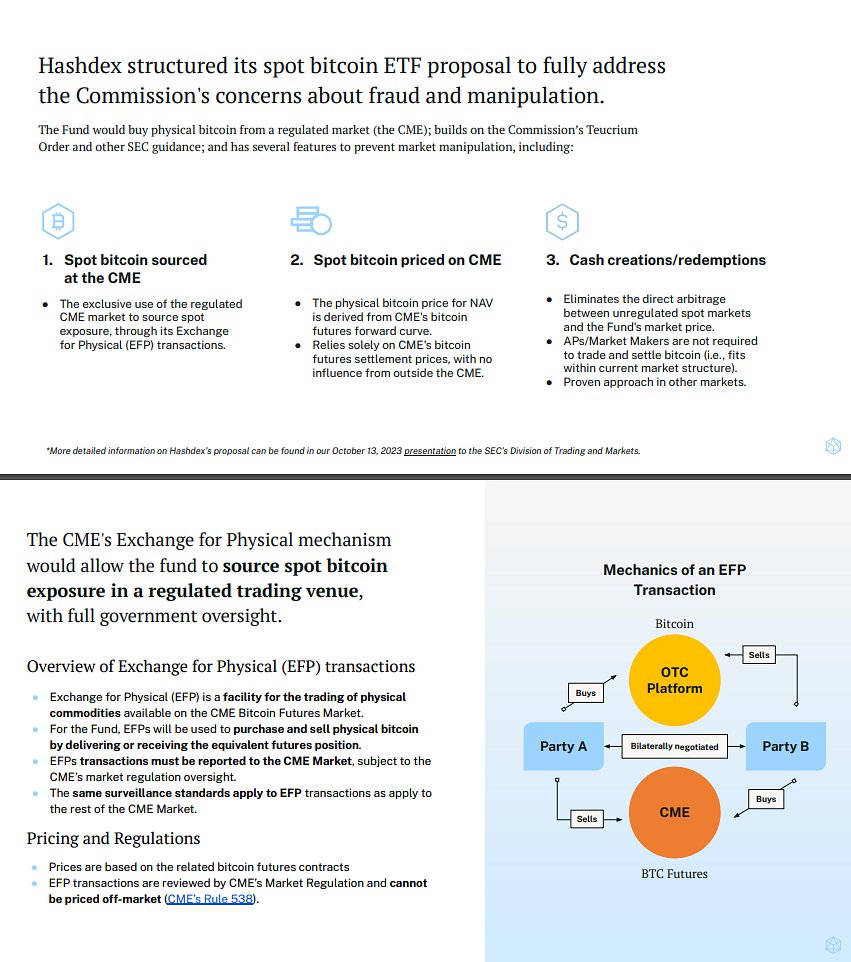

Hashdex’s application, in particular, has drawn attention for its innovative approach, focusing on physical trading through CME futures to incorporate spot Bitcoin into the ETF structure. This unique strategy aims to bridge the traditional finance sector with the evolving landscape of digital assets, providing investors with exposure to spot Bitcoin in a regulated manner.

SEC’s Strategic Delay with Hashdex Unveiled!

The delay order indicates the SEC’s dedication to ensuring that novel and groundbreaking ETF structures, like Hashdex’s proposal, meet the necessary regulatory standards. While the delay may bring a momentary pause, it underscores the importance of thorough consideration and collaboration between regulatory bodies and industry participants.

Hashdex's application is novel and focuses on Exchange for Physical transactions via CME futures to get spot Bitcoin into the ETF structure. pic.twitter.com/UWG9XZdG1w

— James Seyffart (@JSeyff) November 30, 2023

Investors and industry observers are keenly watching this process unfold, recognizing that the SEC’s commitment to collaboration is a positive step toward the eventual approval of Bitcoin ETFs. The evolving nature of cryptocurrency regulations requires a delicate balance between innovation and investor protection, and the SEC’s active engagement with Hashdex and similar applicants signals a constructive approach to achieving this equilibrium.

As discussions continue and regulatory clarity is sought, the crypto community anticipates how Hashdex’s unique approach might shape the future landscape of Bitcoin ETFs, offering investors a regulated avenue to engage with spot Bitcoin within traditional financial frameworks.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.