• Bybit Recovers $300M in 2025, Blocks Millions of Attacks

• Oil firms on Hormuz risk; Asia inflation in focus

• Launch of the Digital Asset Mastery Training Series

• Palantir sees $280M Thiel sale filing per SEC Form 4

• Iran Oil Prices Surge as Strait of Hormuz Tensions Escalate: War Premium, Gold Rally, and Global Market Impact

• Gold Price Analysis: War Premium, Oil Shock and the Structural Bid Into 2026

• Bitcoin steadies as 38% of altcoins near all-time lows

• Bitcoin Nears $70K as US–Iran Military Escalation Drives Macro Volatility

• Oil steadies as IDF readies multi-week Iran campaign

• Federal Reserve balance sheet to shrink slowly under Warsh

Binance Withdrawal Wave Has Ended After $4.3 Billion Settlement

2 mins mins

Key Points:

-

The Binance withdrawal wave sees stability in fund outflows after over $1 billion was lost after founder Changpeng Zhao’s departure and legal challenges.

-

The fallout from the Binance settlement’s $4.3 billion with the US government and CZ’s resignation extends globally.

-

Binance’s efforts to establish a cryptocurrency exchange in Thailand and its promotional activities in the Philippines face legal roadblocks as regulatory scrutiny intensifies.

In the aftermath of Binance’s recent challenges, data monitored by Nansen reveals a shift in fund dynamics. Following a significant Binance withdrawal wave prompted by the departure of founder Changpeng Zhao (CZ) and legal issues, the outflow from the exchange has stabilized.

Binance Withdrawal Wave Has Stabilized Amidst Shifting Tides

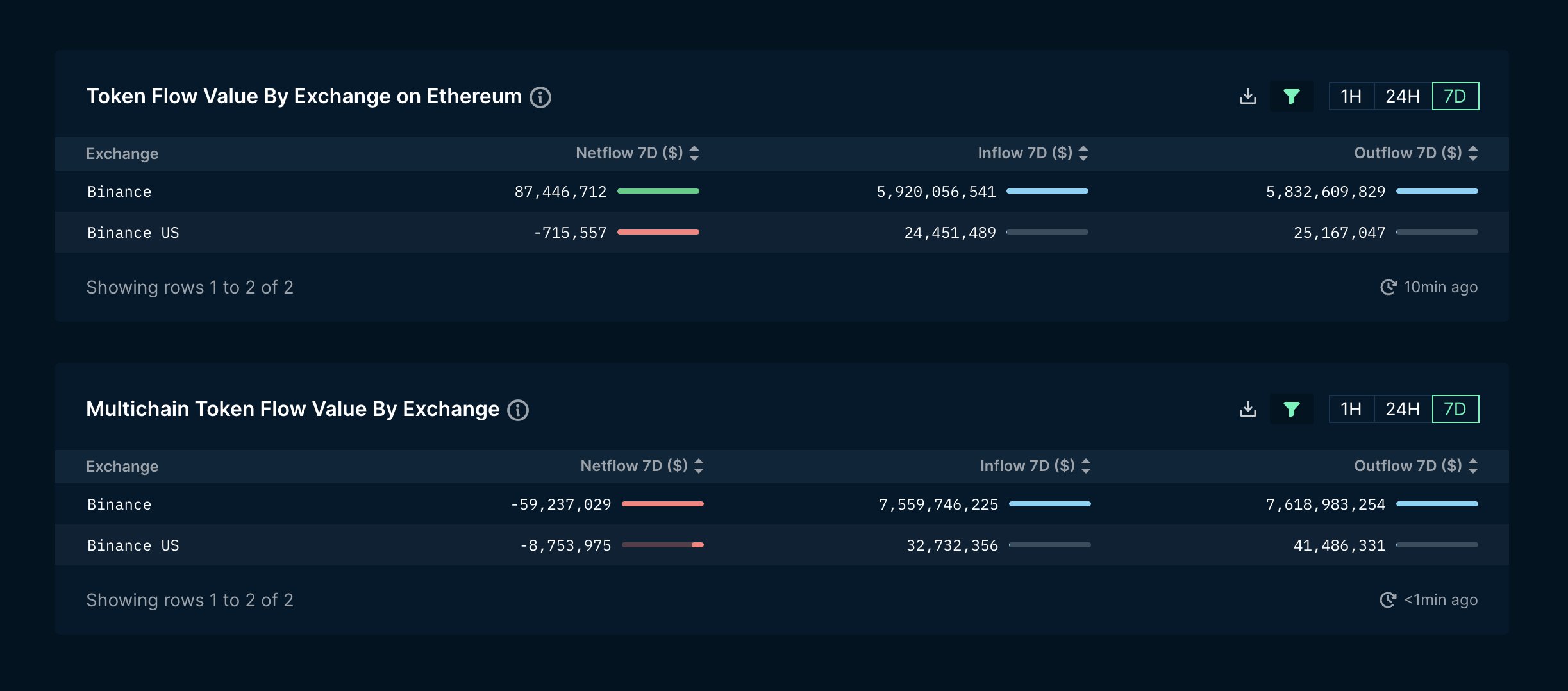

According to Nansen, over the past 7 days, the Ethereum chain experienced a notable $86.7 million net inflow, contrasting with multi-chain tokens witnessing a $68 million net outflow. Despite fluctuations, current exchange holdings, as of the latest data, stand at $65.1 billion, reflecting a marginal dip from the pre-announcement figure of $65.8 billion.

CZ’s resignation led to a remarkable event where the Binance withdrawal wave reached over $1 billion in a 24-hour span, excluding Bitcoin. This incident mirrors a historical pattern observed when the exchange and its founder faced 13 securities violations from the SEC, resulting in a $4.3 billion settlement with the US government.

The consequences of the $4.3 billion deal and CZ’s resignation extend beyond the United States, impacting Binance’s attempts to establish a cryptocurrency exchange in Thailand. Partnering with Gulf Energy, owned by Thai billionaire Sarath Ratanavadi, the venture faces potential legal hurdles.

Meanwhile, in the Philippines, the Securities and Exchange Commission (SEC) has raised concerns about Binance’s promotional activities on social media. In response, the Philippine SEC is gearing up to take action, considering blocking access to Binance to secure the public from unregistered investment products.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.