Key Points:

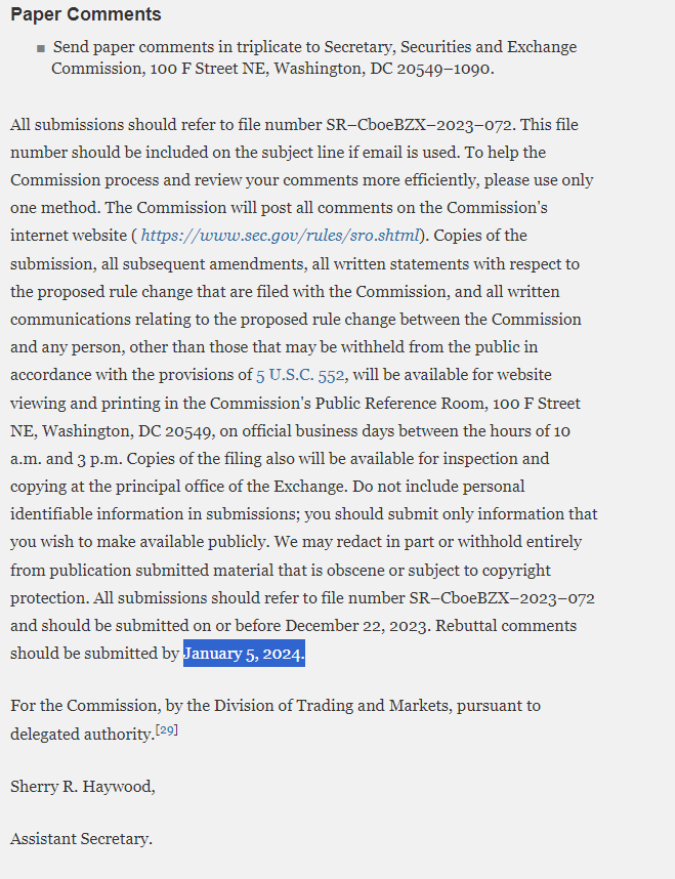

- The US SEC is expected to announce a decision on the approval of a Spot Bitcoin ETF between January 5th and 10th.

- Approval orders for the ETF are likely to be granted between January 8th and 10th.

The Bitcoin ETF approval date of SEC is expected to fall between January 5th and 10th. If approved, it would be the first of its kind in the US and could have a significant impact on the digital asset market.

The US Securities and Exchange Commission (SEC) is expected to announce its decision on the approval of a Spot Bitcoin ETF between January 5th and 10th, according to Bloomberg’s James Seyffart.

The SEC has received more than a dozen applications for Spot Bitcoin ETFs, and approval orders are likely to be granted towards the latter stages of the mentioned window, specifically between January 8th and 10th.

Bitcoin ETF Approval Date Expected To Fall Between January 5th and 10th

The anticipation surrounding the potential arrival of a Spot Bitcoin ETF in the United States has been growing for several months. If approved, it would be the first of its kind in the country and could have a significant impact on the digital asset market. Seyffart’s report provides a clearer timeframe for the decision on these applications.

Window is officially Jan 5th to Jan 10th. Really this means that any potential approval orders are going to come on either Monday Jan 8, Tuesday Jan 9, or Wednesday Jan 10. Mark your calendars people. https://t.co/8ob8Y6pgU5

— James Seyffart (@JSeyff) December 1, 2023

Bitcoin’s price has already reacted positively to the speculation, surpassing the $38.8K mark for the first time since 2022. Standard Chartered has even predicted that the approval of a Bitcoin ETF could lead to over 160% gains, potentially pushing the price of Bitcoin to $100,000 by the end of 2024.

The SEC has faced delays in making a decision on the Bitcoin ETF in the past, but many expect a change in the early months of 2024. With the reported approval window aligning with predictions, the industry is eagerly awaiting the outcome of the SEC’s ruling.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.