Market Overview (Nov 27 – Dec 3): Bitcoin Breaks $40k and MicroStrategy’s Big Purchase

Key Points

- Bitcoin breaks the $40,000 mark, MicroStrategy acquires an additional 16,130 BTC, Binance stops supporting BUSD, and the KyberSwap hack results in $47 million in damages.

- Chairman Powell and Governor Waller provide insights on future interest rates, and upcoming events are relatively quiet.

- Bitcoin confirms a long-term upward trend, notable projects include Pyth Network and Synthetix. Major coin/token unlocks are expected in December.

Discover the Latest Crypto Highlights: Bitcoin Breaks $40K, SEC Poll on ETF, MicroStrategy’s Purchase, Binance’s Changes, and KyberSwap Hack.

Last week’s highlights big news (Nov 27 – Dec 3)

Bitcoin breaks through the $40,000 mark. This milestone showcases the continued growth and increasing popularity of the leading cryptocurrency.

In regulatory news, the U.S. Securities and Exchange Commission (SEC) has announced a community opinion poll for the Franklin and Hashdex Bitcoin Spot ETF. Interested parties have until January 5th to submit their opinions, and the decision deadline for Ark Invest is set for January 10th. This means that the outcome of the proposal will be determined between January 5th and January 10th, bringing much anticipation to the crypto community.

MicroStrategy, a prominent business intelligence firm, has made another significant purchase of Bitcoin. The company has acquired an additional 16,130 BTC, equivalent to approximately $593.3 million, at an average price of $36,785 per bitcoin. MicroStrategy’s continuous accumulation of Bitcoin demonstrates their confidence in the long-term value and potential of the digital asset.

In other news, Binance, one of the largest cryptocurrency exchanges, has announced that it will no longer support Binance USD (BUSD) starting from December 15th. Users are advised to withdraw or convert their BUSD holdings into other currencies before the deadline. After December 15th, withdrawals will be disabled, and any remaining BUSD balance will be automatically converted into First Digital USD (FDUSD).

The recent KyberSwap hack has resulted in over $47 million in damages to user assets. However, Kyber Network, the decentralized finance platform targeted in the attack, has expressed its commitment to working with authorities to identify the responsible party and recover the stolen funds. Notably, Kyber Network has firmly rejected the hacker’s demand to hand over all of its assets and resources.

The project has pledged to fully compensate affected users, and further details regarding the compensation process will be announced within the next two weeks. Kyber Network’s CEO, Victor Tran, has emphasized that the project takes responsibility for the incident and strives to provide the best support to its users.

Macroeconomic (Nov 27 – Dec 3)

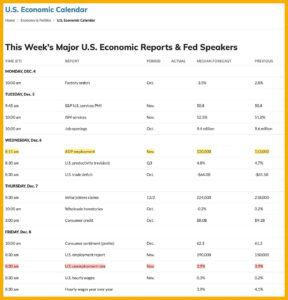

The recent statements from Chairman Powell and Federal Reserve Governor Christopher Waller have shed light on the future direction of interest rates. While Powell believes it is too early to speculate on when interest rates will be cut, he assures that the Fed is ready to tighten further if necessary. On the other hand, Waller, known for his hawkish views, suggests that there will be no more rate hikes and that the Fed is likely to cut rates next year.

However, Waller also acknowledges the possibility of rate cuts next year if inflation continues to decrease over the next three to five months. This marks the first time a Fed official has openly discussed the potential for rate cuts in the future. The strategy outlined by Waller aligns with standard rules and reflects the Fed’s commitment to maintaining appropriate interest rates in response to economic conditions. If inflation continues to decrease as anticipated, there is no reason to keep interest rates high.

Prediction Market Crypto (Nov 27 – Dec 3)

In recent market trends, Bitcoin has confirmed its long-term upward trend, bringing positive news for holders. The clear upward trend suggests that it is favorable to follow the main trend and wait for price corrections or sideways movement to accumulate.

However, it is still advisable to hold a portion of stablecoins in case Bitcoin returns to the $26,000–$30,000 range. Historical data from December indicates that Bitcoin has experienced a decrease in performance in 6 out of 10 months, accounting for 60%. In addition to Bitcoin breaks, several notable projects and activities have caught attention in the past week:

- Pyth Network: In the next 6 months, only 15% of the total supply of $PYTH will be in circulation. With a total of 10 billion tokens and $1.5 billion currently in circulation, the low total supply makes it easier for the token to achieve significant gains. This project is benefiting from the recent price hype of the Solana network and plays a crucial role in the expanding DeFi sector.

- Synthetix $SNX: Synthetix is set to launch V3 at the end of this year, introducing DEX Perp and expanding to the Base network. The use of USDC as a margin asset enhances the trading experience. DEX Perp is gaining market share from centralized exchanges, and the launch of Infinex front-end allows users to experience trading similar to a centralized exchange. Synthetix DAO is also voting to share 20% with Perp V3 integrators, paid in sUSD.

- Cosmos DAO and Synapse DAO: Cosmos DAO is considering reducing ATOM inflation from 14% to 10%. Synapse DAO is discussing the swapping of unrelated tokens to ETH to increase ETH bridge liquidity and reduce SYN emissions.

Lastly, there are several major coin/token unlocks happening in December, which may have a significant impact on the market. Some of the notable unlocks include $IMX, $1INCH, $SUI, $CGPT, $APT, $GFAL, $CYBER, $SEI, $NAKA, $UNI, $APE, $AVAX, $VRTX, $AXL, and $OP.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.