Key Points:

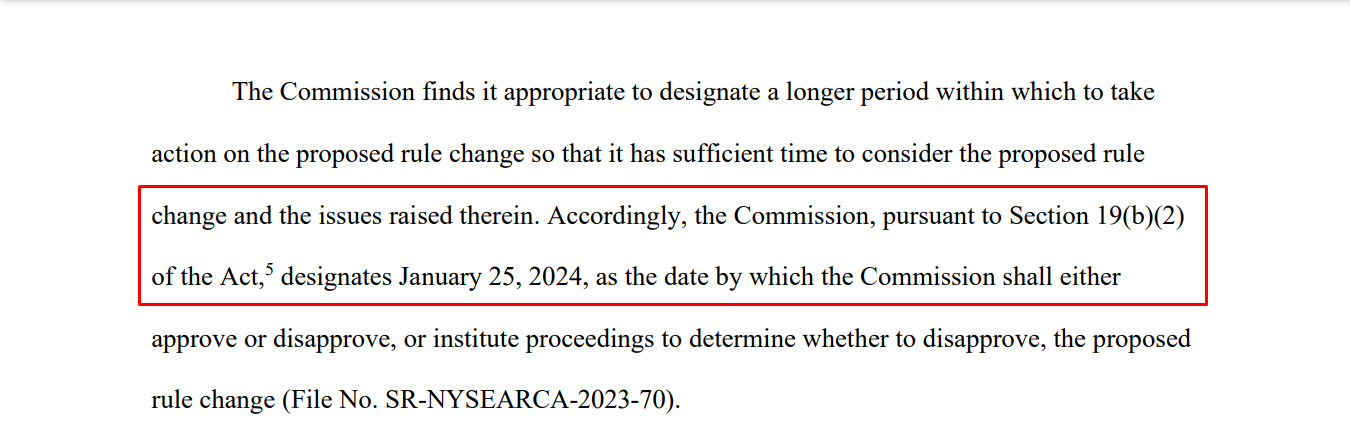

- The SEC has postponed the decision on Grayscale’s application to convert its Ethereum Trust into an ETF, extending the decision period by 45 days.

- The Grayscale Ethereum Trust is the largest Ethereum investment vehicle globally, representing 2.5% of all circulating ETH.

Grayscale Ethereum Spot ETF delayed by the SEC again, extending the deadline to January 25, 2024. Grayscale Ethereum Trust is the largest Ethereum investment vehicle globally, representing 2.5% of all circulating ETH.

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Grayscale’s application to convert its Ethereum Trust into an Ethereum spot exchange-traded fund (ETF). The decision period for the proposed fund has been extended by 45 days, with a new deadline set for January 25, 2024.

Grayscale Investments, in partnership with NYSE Arca, filed the proposal to transform its Grayscale Ethereum Trust (ETHE) into an ETF on October 2, 2023. The Grayscale Ethereum Trust is currently the largest Ethereum investment vehicle globally, accounting for 2.5% of all circulating ETH.

Grayscale Ethereum Spot ETF Delay

Since its launch in 2019, the conversion into a spot ETF has been the final stage of the trust’s intended lifecycle. The proposed conversion has the potential to attract increased investor participation, considering that the trust currently manages $5 billion in assets.

Previously, BlackRock has also filed its Spot Ethereum ETF with Nasdaq. The introduction of Spot ETFs aims to provide broader access to cryptocurrencies for average investors, aligning with the growing mission of asset managers like BlackRock and Grayscale. However, the SEC has been actively opposing the launch of such ETFs.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.