Centrifuge Review: The First Project to Bring Real World Assets to Blockchain

In the current landscape of blockchain technology and decentralized finance (DeFi), Centrifuge (CFG) stands out as a project commanding significant attention from the investor community. This heightened interest is primarily attributed to Centrifuge’s unique ability to establish a connection between Real World Assets (RWAs) and the expanding realm of DeFi. Today, let’s learn about this project with Coincu through this Centrifuge Review article.

What is Centrifuge?

Centrifuge Protocol is a transformative force, providing businesses with a gateway to tokenize real-world assets and unlock financing opportunities through its innovative Tinlake asset-backed lending decentralized application (dApp).

At its core, Centrifuge empowers businesses to leverage their tangible assets by converting them into digital tokens, enabling seamless collateralization and access to decentralized lending. The Tinlake dApp acts as a conduit, seamlessly connecting users to the broader DeFi ecosystem while facilitating borrowing across various protocols.

Noteworthy is Centrifuge’s strategic choice to build its protocol on the Polkadot network while establishing a bridge to Ethereum through its dApp. This strategic integration positions Centrifuge at the intersection of two major blockchain ecosystems, offering users the benefits of both.

The Ethereum connection enhances accessibility and ensures compatibility with one of the most prominent DeFi environments, while the Polkadot foundation provides swift transaction processing, contributing to overall platform efficiency.

What problems does Centrifuge solve?

Bridging Real World Asset and DeFi

Centrifuge is ushering the multi-trillion-dollar Real World Asset market into the realm of DeFi, offering businesses a transformative pathway to access liquidity previously untapped in the traditional financial landscape. Centrifuge serves as a bridge, connecting the decentralized financial ecosystem to real-world assets and redefining the rules of global trade with a mission to advance economic opportunities globally.

Provide capital for businesses

The vast market of global business-to-business (B2B) spending, estimated at a staggering $180 trillion, comes with a significant challenge: the average payment term of 60 days.

This poses a substantial hurdle, especially for small and medium-sized enterprises (SMEs), requiring financing solutions to navigate this gap. Unlike larger businesses, SMEs often face difficulties achieving sustainable growth due to limited access to timely capital.

Recognizing this challenge, Centrifuge is on a mission to democratize financial access for businesses of all sizes. While existing solutions only scratch the surface of this massive financing need, Centrifuge has introduced the Centrifuge OS.

The result is a revolutionary unlocking of value that was previously inaccessible, providing businesses, especially SMEs, with unprecedented financial access and flexibility. Next, the Centrifuge Review article will go to the highlights of this project.

Highlights of Centrifuge

Abundant TVL Unleashes Real World Assets Potential

Centrifuge has delved into a new echelon of Total Value Locked (TVL) growth, unveiling the Real World Assets TVL category. This initiative marks a paradigm shift by tokenizing tangible assets like bills, real estate, royalties, and more. The potential outcome is staggering, with the capability to introduce trillions of new assets into the DeFi sphere.

The process involves Centrifuge’s innovative approach to convert real-world assets into non-fungible tokens (NFTs) on the Centrifuge Chain. The Real World Assets TVL metric becomes a key indicator, measuring the value of active real-world assets fueling Centrifuge’s financial ecosystem.

Polkadot Prowess and Parachain Pioneering

Centrifuge stands tall as a pioneering project within the Polkadot ecosystem, boasting the highest TVL in the network. Notably, it is set to make history as one of the initial projects to run a Parachain on Polkadot.

The platform’s architecture is strategically built on Polkadot, ensuring swift transactions and minimal fees. Adding to its versatility, Centrifuge’s decentralized application (DApp), Tinlake, is tailored to harness substantial liquidity on the Ethereum network.

The CFG token, integral to Centrifuge’s ecosystem, establishes seamless connectivity with its dedicated bridge to Ethereum. Connecting to Relay Chain helps Centrifuge feel secure about security and focus resources on building the main features of the platform.

In addition, Parachain’s mechanism also allows Centrifuge to connect and interact with other blockchains easily. Besides, Substrate will play an important role in querying data.

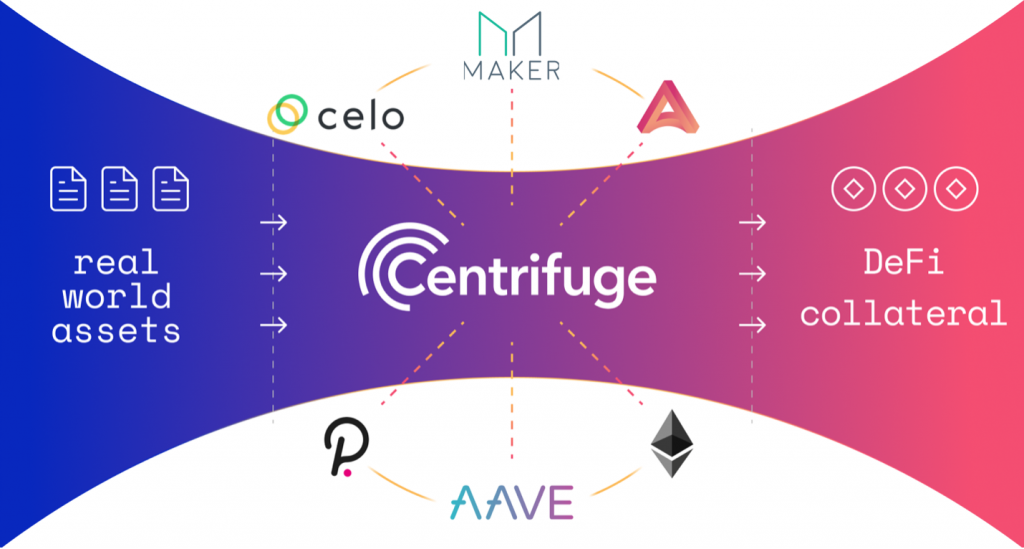

DeFi Integration Steers Centrifuge Towards Innovation

Centrifuge’s influence extends far beyond its proprietary ecosystem through strategic alliances with leading DeFi projects. A notable achievement is the return of real-world assets to MakerDAO’s DAI, a milestone that underlines Centrifuge’s commitment to bridging traditional finance with the decentralized realm.

Simultaneously, the platform is actively engaged in pioneering the first real-world asset marketplace on Aave. The direct integration into other DeFi protocols positions Centrifuge users to enjoy instant liquidity, fortifying the DeFi space against destabilizing events through the introduction of a less variable collateral dynamic.

Deploy testnets

Centrifuge stands as a beacon for developers seeking robust testing environments. The platform is well-suited for deploying testnets, crucial for evaluating the functionality, stability, and performance of applications in a controlled setting. Presently, Centrifuge oversees the operation of two active testnets, each serving distinct purposes in the development lifecycle.

Flint: The Pioneering Testnet

Flint, established as the primary testnet, has been actively operational since November 2019. Serving as the proving ground for previews and Alpha releases, Flint provides developers with a supportive environment to thoroughly test and refine their applications before wider deployment. The longevity and continuous activity of Flint underscore its significance as an integral component of Centrifuge’s development ecosystem.

Amber: Fostering Application Stability

As Centrifuge’s second testnet, Amber takes center stage in assessing the stability of applications poised for Beta release. Developers leverage Amber to subject their creations to rigorous testing, ensuring that they meet applications predefined standards of reliability and performance. The role of Amber in the development pipeline concentrates Centrifuge’s commitment to delivering robust and dependent layer 2 applications to the wider community.

How does Centrifuge work?

In the realm of small business financing, the quest for increased working capital often leads enterprises to approach investors or seek loans from major financial institutions. Yet, these avenues are not always readily accessible to small businesses, despite relatively low default rates on their loan repayments.

Centrifuge steps into this void by harnessing the power of decentralized finance. By utilizing blockchain technology and smart contracts, Centrifuge offers an innovative approach to unlocking working capital for small businesses.

Enter Centrifuge, a game-changing solution leveraging DeFi to address this persistent challenge. In delving into the intricate dynamics of this financial landscape, we will dissect the issue from both a business and investor perspective with this Centrifuge Review article.

Enterprise Interaction

Centrifuge operates through a streamlined process that connects enterprises seeking working capital with investors looking to fund these ventures. The Tinlake application serves as the catalyst for this synergy, offering a platform for businesses to tokenize their tangible assets and secure the necessary capital through blockchain technology.

Enterprises, functioning as asset originators on Tinlake, utilize the platform to tokenize their real-world valuable assets. Through the Tinlake application, these assets are committed to the blockchain, ensuring transparent and verifiable ownership. The resulting crypto assets, representing the business’s tangible holdings, serve as collateral for loans.

Investor Participation

Investors, in the role of lenders, engage by locking stablecoins like DAI in the Pool on Tinlake. This locked capital is then deployed as loans to businesses, fostering a symbiotic relationship. In return for their participation, investors stand to earn profits based on the capital provided to these businesses.

Prior to committing their capital, investors have the opportunity to conduct thorough research on the businesses available on the platform. This due diligence empowers investors to make informed decisions, assessing the quality and potential of the businesses seeking funding.

Token Options

Investors can choose from two distinct tokens—TIN and DROP—when participating in a Pool. TIN tokens represent higher-risk investments, offering correspondingly higher rewards. On the other hand, DROP tokens, while providing lower returns, are characterized by greater stability.

Flexible Withdrawals

The interest accrued on TIN or DROP tokens is not a fixed commitment; rather, it can be redeemed at any point in time as DAI. This flexibility empowers investors to manage their liquidity according to their preferences.

When investors decide to withdraw, the accumulated interest can be seamlessly converted back to DAI. Next, the Centrifuge Review article will explore the outstanding products of this project.

Centrifuge products

Centrifuge Chain

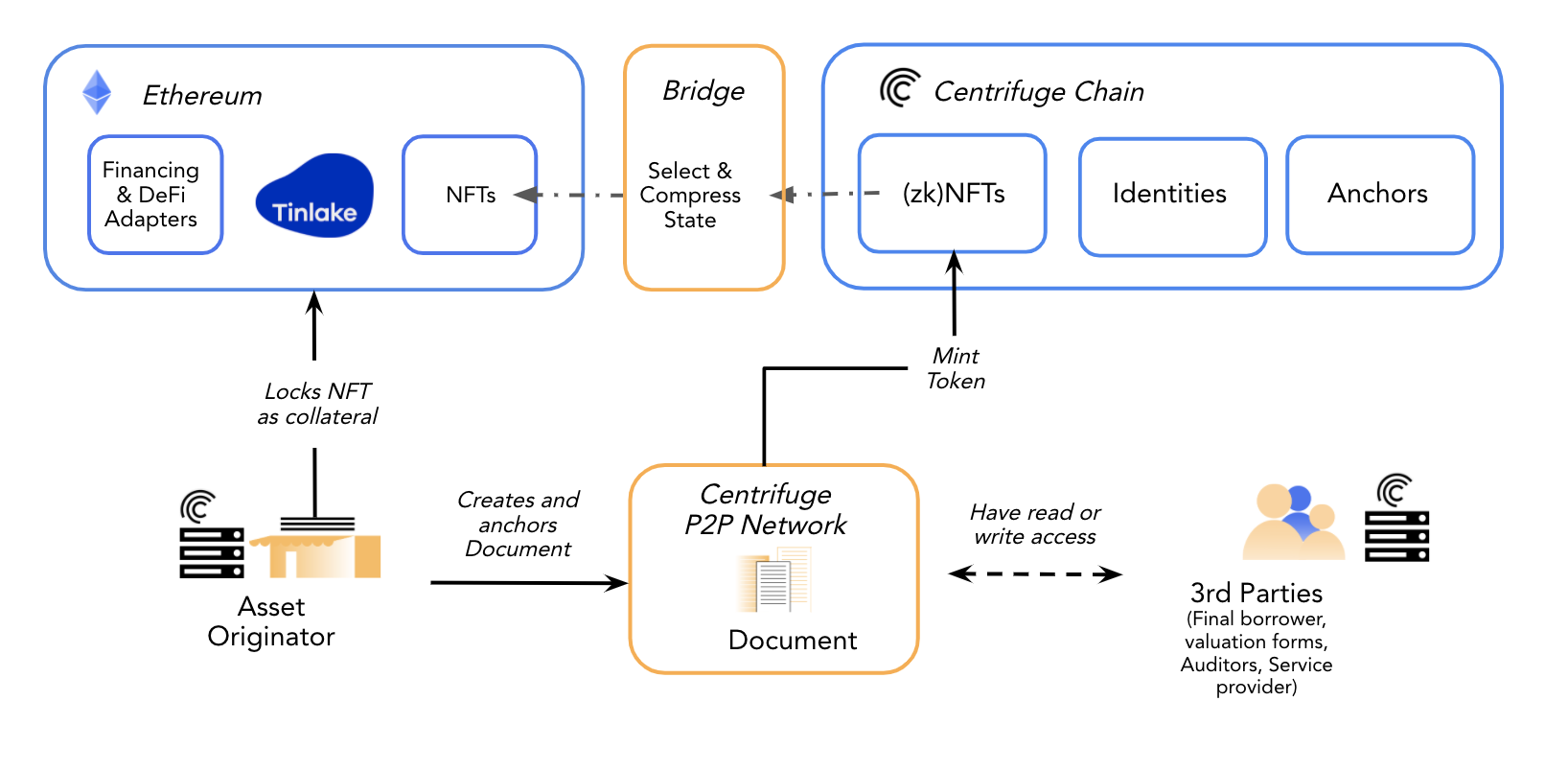

Centrifuge Chain is the gateway for real-world assets to seamlessly join the blockchain ecosystem. Leveraging the power of Substrate Parity and featuring an innovative bridge to Ethereum, Centrifuge Chain positions itself as a catalyst for a more connected and versatile blockchain landscape.

Built on Substrate Parity, Centrifuge Chain gains a significant advantage in speed and employs a consistent approach for specific features. This strategic foundation not only accelerates the project’s development but also sets the stage for increased interoperability within the blockchain space.

How does Centrifuge chain work?

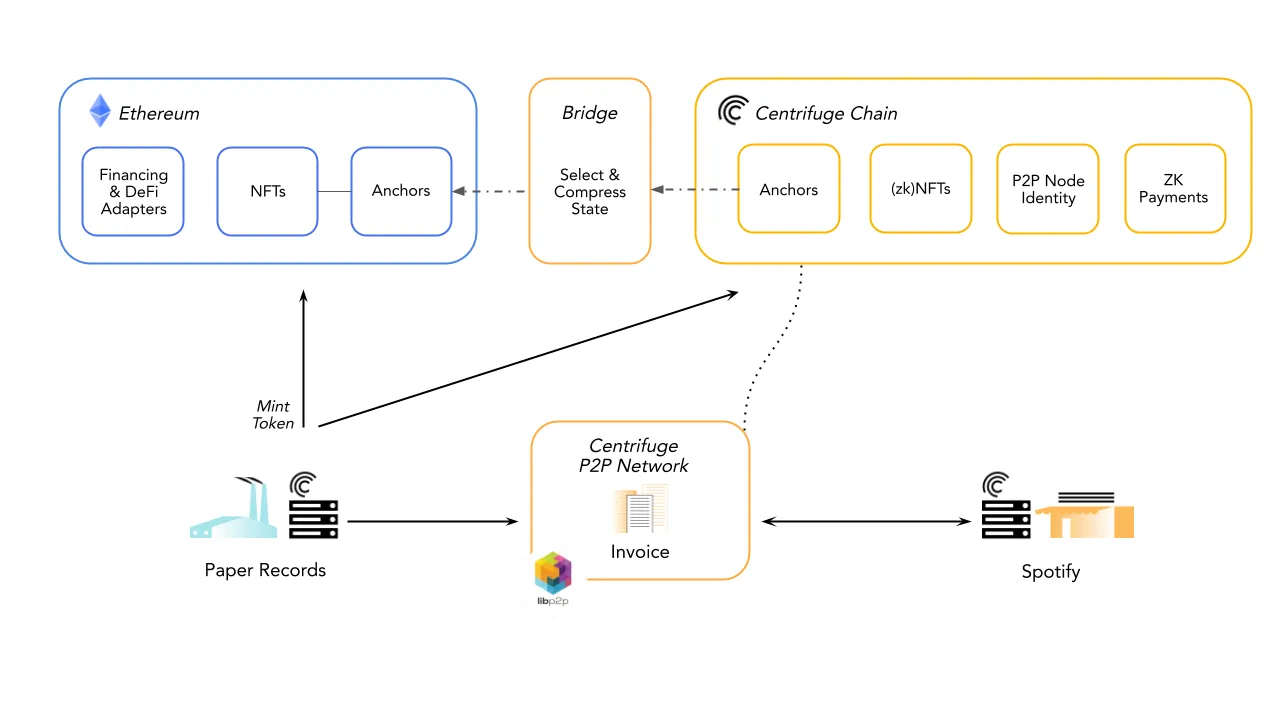

Paper Records initiates the process by utilizing the Centrifuge P2P Network to sign and dispatch invoices to Spotify. In a bid to ensure transparency and authenticity, Spotify, upon receipt of the document, employs Centrifuge Chain as a validation node to verify the correctness of the document with a digital signature. The result is an updated, signed version of the document that is sent back to Paper Records.

The utilization of Centrifuge Chain as a validation node proves to be a game-changer. This feature empowers Paper Records to seamlessly look up Spotify and enables Spotify to reciprocally verify the legitimacy of Paper Records. Importantly, Paper Records leverages Centrifuge Chain to anchor the document hash, complete with both signatures, providing an immutable and secure record of the transaction.

The fact that third parties, ranging from traditional lenders to DeFi lending pools, can now verify the value of these NFTs. The on-chain anchors and identities associated with these NFTs, coupled with access to off-chain documents containing authenticity information, create a comprehensive system for verification.

Tinlake

Tinlake is a dynamic DApp operating on the Ethereum blockchain and is at the forefront of reshaping the landscape of DeFi. With its open-source smart contracts and seamless integration capabilities, Tinlake offers a unique platform for investors and borrowers to collaboratively fund bespoke asset pools.

At its core, Tinlake relies on the Centrifuge framework, leveraging its capabilities to create individual, non-fungible assets that play a pivotal role as collateral for loans within the DeFi ecosystem. The synergy between Tinlake and Centrifuge introduces a novel approach to asset-backed financing on the Ethereum blockchain. We have learned about the 2 core products of Centrifuge, the next article Centrifuge Review will introduce to you the token of this project.

CFG token

Token metrics

- Token Name: Centrifuge

- Ticker: CFG

- Blockchain: Centrifuge Chain

- Token Standard: Updating

- Contract: Updating

- Token Type: Utility, Governance

- Total Supply: 430,011,123 CFG

- Circulating Supply: 360,263,043 CFG

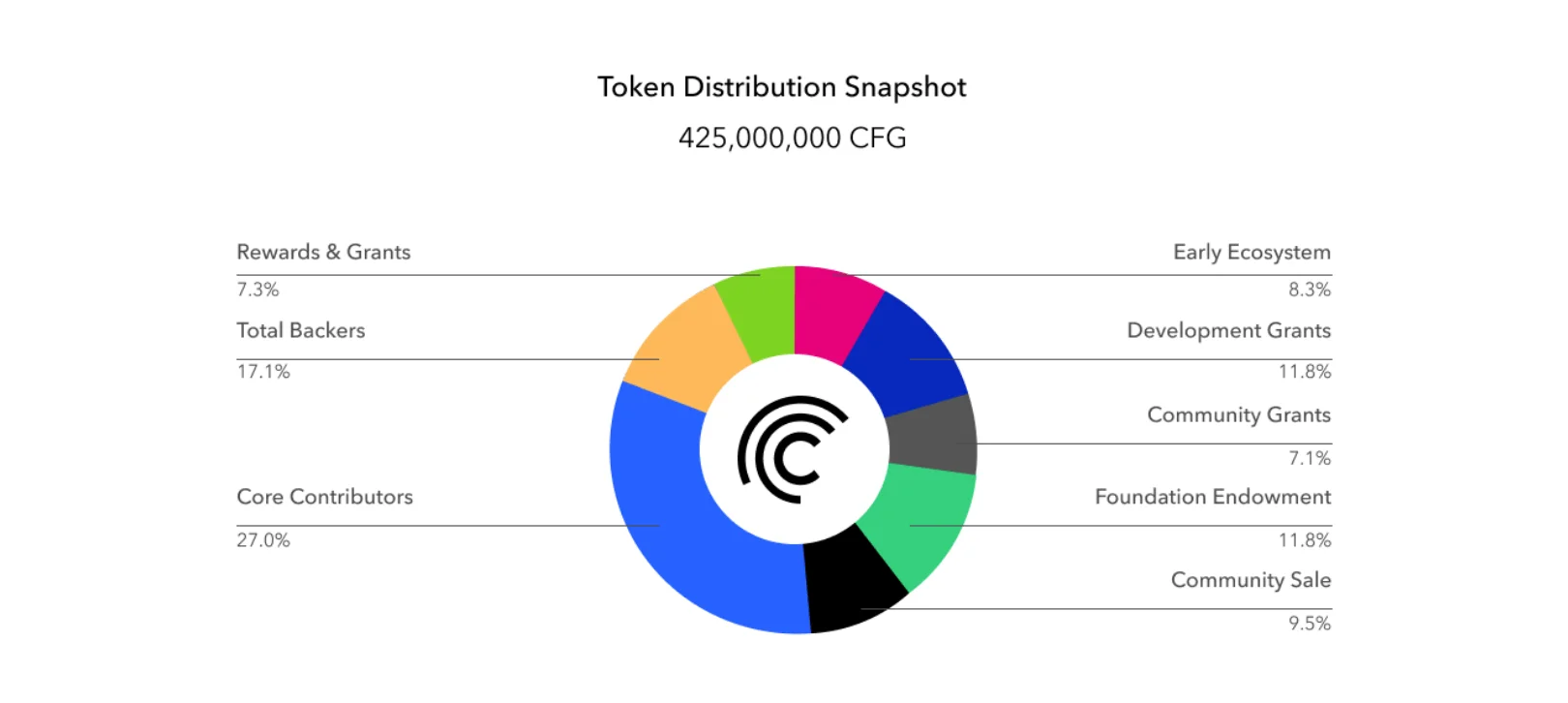

Token allocation

- Early Ecosystem: 8.3%

- Development Grants: 11.8%

- Community Grants: 7.1%

- Foundation: 11.8%

- Community Sale: 9.5%

- Core Contributors: 27%

- Backer: 17.1%

- Reward & Grants: 7.3%

Release schedule

Locked Token Supplies

To instill confidence and commitment, Centrifuge has implemented long-term locks on token supplies. Key contributors and early supporters are subject to a vesting period extending over one year, commencing from July 2021. Simultaneously, the development team’s tokens are not only locked for 48 months but also undergo a vesting process spanning an additional 12 months.

Incentivizing Key Contributors

The vesting schedules for key contributors and early supporters are a testament to Centrifuge’s commitment to aligning incentives. This approach ensures that those who have played a crucial role in the project’s growth are continuously motivated to contribute to its success over an extended period.

Dynamic Token Issuance

Centrifuge introduces a dynamic element to CFG token issuance to promote ongoing engagement and network participation. Approximately 3% of CFG is expected to be minted annually, serving as Proof of Stake (PoS) rewards, DOT lockup rewards (for auctioning Parachain Slots), and liquidity rewards.

Total Supply Stabilization

To stabilize the total supply of CFG, Centrifuge incorporates a mechanism whereby transaction fees, when burned out of circulation, contribute to controlling the overall token supply over time.

Token Use Cases

CFG is a versatile utility token integrated into its platform, empowering users across various aspects of the blockchain ecosystem. This token is used in the following specific cases:

- Use CFG to Become Validators or Delegators: CFG provides a gateway for users to actively engage in the security and decentralization of the Centrifuge network.

- Used as Transaction Fees on the Platform: CFG emerges as the native currency for transactional activities within the Centrifuge ecosystem.

- Used as a Reward for Staking Activities: Staking activities, crucial for network security and stability, become rewarding endeavors for users through CFG.

- Used as a Fee to Deposit NFTs (from Collateral): CFG takes center stage as a fee mechanism for depositing NFTs as collateral.

- Participate in Voting Rights for Changes on the Platform: CFG holders gain a voice in the governance of Centrifuge.

The Centrifuge Review article will continue to explore important information about the project, which is the team behind it.

Core Team

Centrifuge proudly boasts a team composed of diverse talents from renowned organizations, fostering a rich blend of expertise. Among these remarkable individuals stand out Michael Ruzic-Gauthier, the Chief Executive Officer (CEO), and Romina Bungert, the Chief Finance Officer (CFO), both bringing a wealth of experience and accomplishments to the Centrifuge leadership.

Michael Ruzic-Gauthier: Chief Executive Officer (CEO)

Michael Ruzic-Gauthier, at the helm as CEO, is a seasoned professional with a multifaceted background. His journey includes:

- Educational Excellence: Michael holds a master’s degree in biochemistry from Dalhousie University, Canada, a testament to his dedication to academic excellence.

- Investment Collaborator at NetScientific PLC: With a commitment to technology ventures, Michael spent over two years as an investment collaborator at NetScientific PLC. This role allowed him to actively engage in shaping the investment landscape for technology companies.

- Analyst at Berenberg: Michael’s expertise extends to the financial sector, having dedicated over two years as an analyst at Berenberg, one of the oldest banks globally. His analytical prowess contributed to the bank’s longstanding reputation.

Romina Bungert: Chief Finance Officer (CFO)

Romina Bungert, the CFO of Centrifuge, brings strategic financial acumen to the leadership team. Her profile includes:

- Management Mastery: Romina earned her master’s degree in management from ESCP Business School in 2015, showcasing her commitment to mastering the intricacies of organizational leadership.

- COO at Upvest: Prior to joining Centrifuge, Romina served as the Chief Operating Officer (COO) at Upvest, an investment application that successfully raised $42M. Her role in navigating the operational landscape contributed to the platform’s significant financial achievements.

- COO at DSTOQ: Romina’s journey also includes a significant stint as the COO at DSTOQ, an application facilitating global stock investment. Her contributions played a pivotal role in shaping the operational strategies of the platform.

Investor

Centrifuge has secured a substantial boost to its growth trajectory by successfully raising $15.8 million across six rounds of capital infusion. The funding rounds saw participation from a distinguished group of 25 investors, including industry giants such as Coinbase Venture, IOSG Ventures, and Moonwhale Ventures, affirming Centrifuge’s position as a key player in the blockchain space.

Conclusion of Centrifuge Review

Centrifuge helps bring real-world assets to the blockchain by encoding these assets into NFTs. It is also one of the first projects to run Parachain on Polkadot while taking advantage of the huge liquidity source called Ethereum by building bridges. Hopefully, the Centrifuge Review article has helped you have a clearer view of the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.