Key Points:

-

Gyroscope novel stablecoin is now live on Ethereum, offering a decentralized and secure alternative to traditional stablecoins.

-

Gyroscope’s design features an algorithmic mechanism and segregated vaults to safeguard against de-pegging events and enhance investor protection.

-

Developed by PhDs specializing in stablecoin design and DeFi risk, Gyroscope’s approach supports scalability, with backing assets including stablecoins and various strategies.

In a significant development for the crypto community, Gyroscope’s innovative stablecoin, Gyro Dollar (GYD), has officially launched on the Ethereum (ETH) mainnet, as reported by CoinDesk on Thursday.

Gyroscope Revolutionizes Stablecoins with GYD Launch on Ethereum Mainnet

Gyroscope sets itself apart by presenting an alternative to conventional centralized and algorithmic stablecoin models. The primary goal is to provide crypto investors with a robust shield against stablecoin failures and de-pegging events.

This decentralized, non-custodial stablecoin is fully backed by reserve assets and employs an algorithmic mechanism to maintain a consistent peg to $1. To mitigate the risks associated with backing assets, Gyroscope’s unique design involves segregating them into specialized vaults.

The Gyro Proto, a live beta version of the Gyroscope novel stablecoin mechanism, was previously operational on the Polygon mainnet and is now open for testing by the public.

Gyroscope Novel Stablecoin Introduces Secure and Scalable DeFi Solution

Founded by PhDs renowned for their contributions to stablecoin design and DeFi risk analysis, Gyroscope introduces the Gyroscope Protocol. This technology represents a novel, all-encompassing approach to DeFi infrastructure, addressing critical issues such as risk, adoption, and sustainability, as outlined in seminal papers like Stablecoins 2.0 and the Decentralized Financial Crisis.

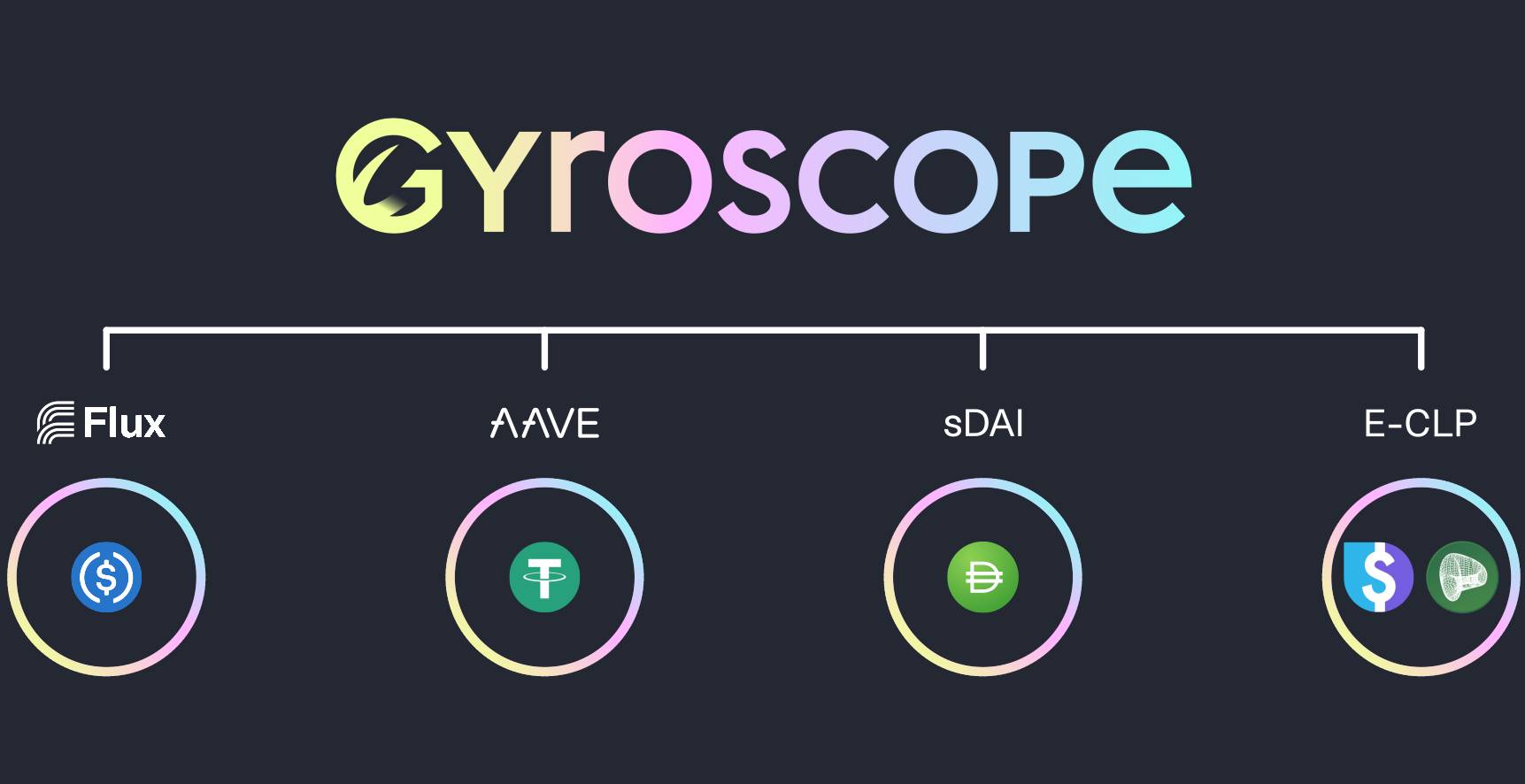

Backing assets for Gyroscope novel stablecoin include stablecoins deployed in strategic initiatives like yield-generating sDAI and USDC in Flux. Furthermore, Gyroscope supports automated market-making (AMM) strategies like LUSD and crvUSD. The scalable nature of this stablecoin allows the reserve to encompass a wide array of strategies and assets as it continues to evolve, according to the Gyroscope team.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.