Key Points:

- Binance and CZ reached a settlement with the CFTC, with CZ paying a $150 million fine and Binance paying a $1.35 billion fine and refunding $1.35 billion in trading fees.

- The settlement requires Binance to establish a corporate governance structure to ensure better oversight and compliance.

CFTC vs. Binance ends with CZ paying a $150M fine, Binance will pay a $1.35B fine, refund $1.35B in trading fees, and implement a corporate governance structure.

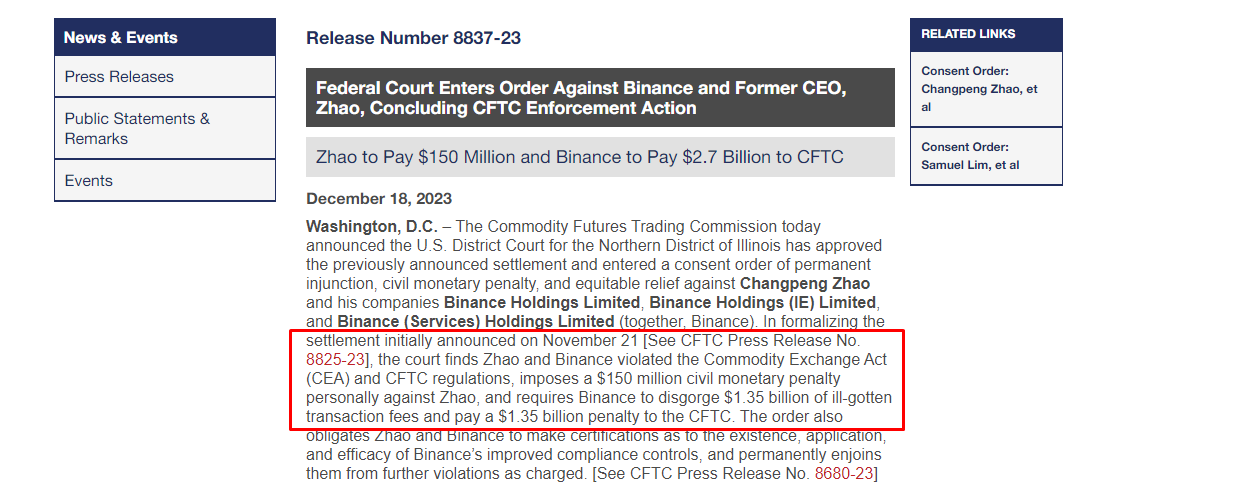

The settlement agreement between Binance and the U.S. Commodity Futures Trading Commission (CFTC) has been approved by Judge Manish Shah, bringing an end to the legal dispute.

As part of the settlement, Binance founder CZ will pay a $150 million fine, while Binance itself will pay a $1.35 billion fine to the CFTC and refund $1.35 billion in illegally obtained trading fees.

The CFTC’s order found that Binance, led by CZ, actively solicited U.S. customers, including trading firms, who engaged in digital asset derivatives on the platform. Binance violated its own Terms of Use by allowing certain prime brokers to bypass KYC procedures and enabling U.S. customers to trade.

In response to the CFTC’s complaint, Binance and CZ have offboarded the identified quantitative trading firms that did not meet the improved onboarding criteria. They have also certified that any customer seeking to onboard, whether through a primary or sub-account, must complete all KYC procedures.

CFTC vs. Binance Ends with $2.7 Billion Penalty

Furthermore, Binance has committed to applying KYC policies and procedures to all existing sub-accounts and offboarding accounts that fail to meet compliance controls.

In addition to the financial penalties, the settlement requires Binance to implement a corporate governance structure that includes a Board of Directors with independent members, a Compliance Committee, and an Audit Committee.

This is aimed at ensuring better oversight and compliance within the organization. With the settlement approved, Binance will need to fulfill its commitments and work towards rebuilding trust and transparency in its operations.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.