Key Points:

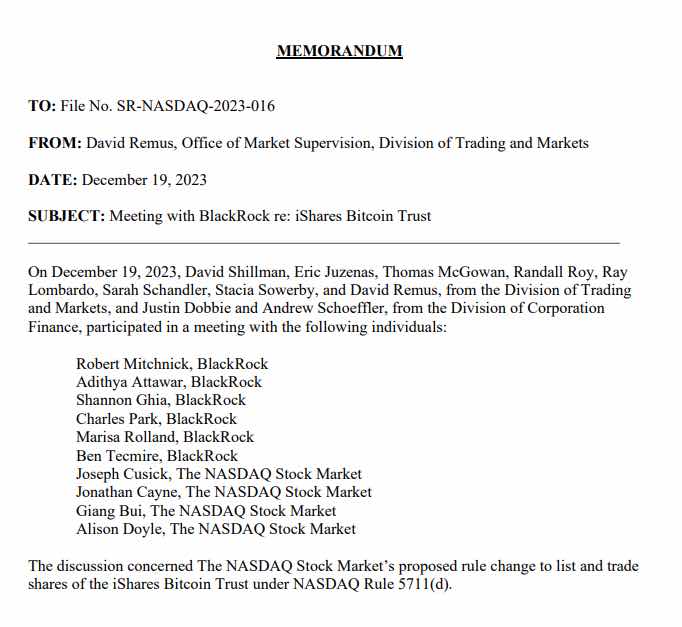

- BlackRock has held its 5th meeting with the SEC to discuss its Spot Bitcoin ETF.

- The meeting focused on the “iShares Bioin Trust under NASDAQ Rules 57119(d)” and SEC Chair Gary Gensler was absent.

According to Watcher Guru, BlackRock’s 5th Meeting with SEC discussed the Spot Bitcoin ETF, marking the fifth meeting for BlackRock. Recent talks and comments fuel anticipation for potential approval next year.

BlackRock has held its 24th meeting with the Securities and Exchange Commission (SEC) to discuss its Spot Bitcoin ETF. This is the fifth meeting specifically for BlackRock.

BlackRock has held its 24th meeting with the Securities and Exchange Commission (SEC) to discuss its Spot Bitcoin ETF. This is the fifth meeting specifically for BlackRock.

The latest meeting focused on the “iShares Bioin Trust under NASDAQ Rules 57119(d)” and SEC Chair Gary Gensler was absent.

However, this marks the third meeting between BlackRock and the SEC in seven business days, suggesting progress in talks. Gensler’s recent comments on reassessing Bitcoin ETFs further fuel speculation.

BlackRock’s 5th Meeting with SEC

The potential approval of a Spot Bitcoin ETF has been a dominant topic in recent months, with over a dozen applications filed. There is high anticipation that the investment product may come to fruition early next year.

On Tuesday, BlackRock submitted a new amendment to its S1 filing with the SEC regarding its Bitcoin ETF application. The amendment states that the asset management firm will adopt a cash-only approach for its ETF, accepting only cash and using it to purchase Bitcoin to create shares.

The US SEC has postponed all its 2023 deadlines for decisions on spot BTC ETFs. If any approvals are made in the new year, it could potentially trigger a significant rally in the entire cryptocurrency market, led by Bitcoin.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.