Market Overview (Dec 18 – Dec 24): SEC delays Ethereum ETF, ETHW Core dissolves, and more

Key Points

- BlackRock and Ark Invest enter the Bitcoin Spot ETF market, the SEC delays Ethereum ETF proposal, ETHW Core dissolves, and more.

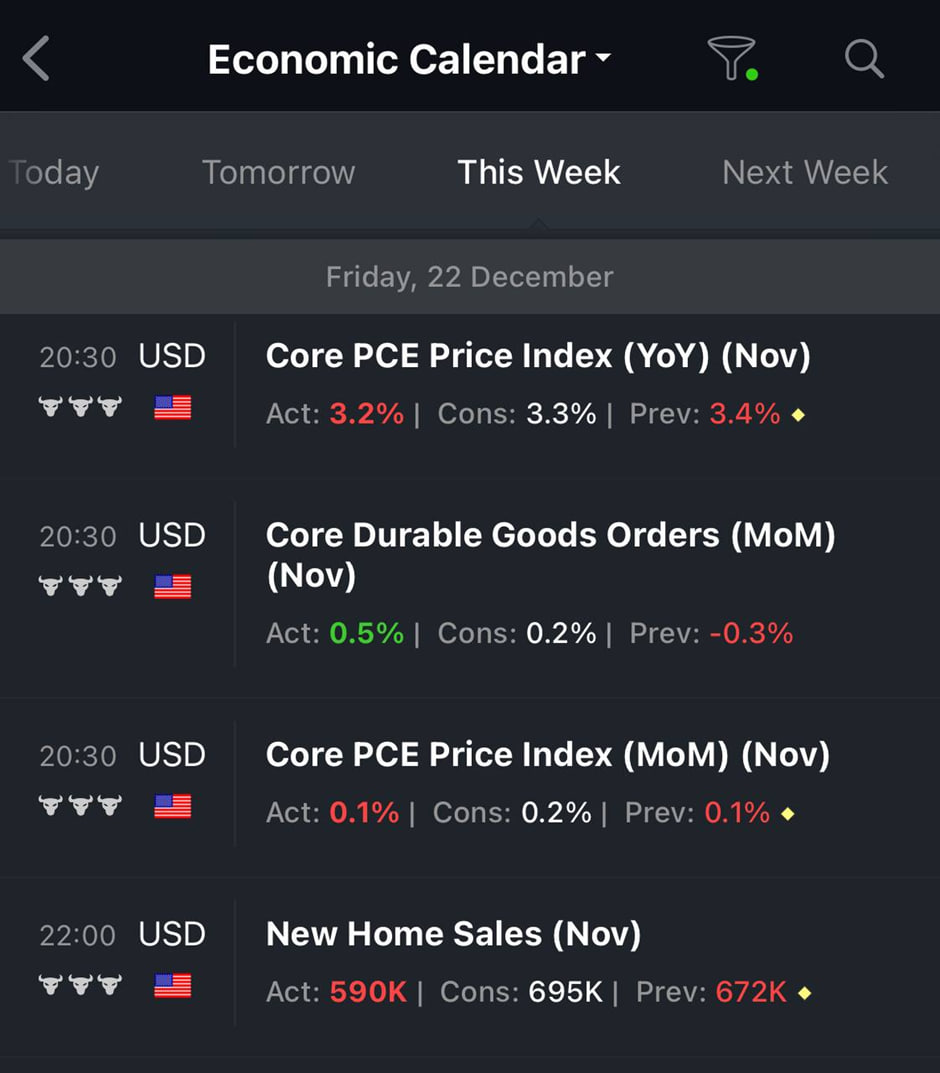

- In macro news, the US inflation index shows an increase in core PCE and an unexpected decrease in personal consumption expenditures.

- Bitcoin’s adjustment may benefit altcoins, and leading trend tokens in various sectors show potential for significant gains.

Discover the latest developments in the cryptocurrency market. Learn about BlackRock and Ark Invest’s entry into the Bitcoin Spot ETF market, the SEC delays Ethereum ETF proposal, the Chinese government’s endorsement of NFTs and DApps, and more.

Last week’s highlights big news (Dec 18 – Dec 24)

BlackRock and Ark Invest have recently made their foray into the Bitcoin Spot ETF market. BlackRock has chosen the ticker symbol IBIT, while Ark Invest has opted for ‘ARKB.’ These moves further validate the growing interest in cryptocurrencies.

Certik has discovered a vulnerability in the OKX wallet app on Apple devices. To address this issue promptly, OKX has released an update for its users.

In a significant move, the Chinese government has announced plans to encourage the development of NFTs and DApps. This endorsement further solidifies the role of blockchain technology in China’s digital transformation journey.

The UK government has recognized the importance of digital assets and aims to strengthen its regulatory framework to foster a thriving crypto ecosystem. To transform the country into a crypto hub, these efforts signal the UK’s commitment to embracing blockchain technology.

The Securities and Exchange Commission (SEC) has delayed the proposal for an Ethereum Spot ETF by Ark and 21 Shares. Although the outcome remains uncertain until May, this development underscores the growing interest.

ETHW Core, a key player in the Ethereum community, has announced its dissolution. During this transition period, the current servers will be temporarily transferred to OneDao for maintenance until a long-term partner is identified.

Circle has launched the EURC stablecoin, backed by the Euro. Operating on the Solana network, EURC aims to facilitate forex transactions and online money transfers. Circle plans to establish EURC as a regulated cryptocurrency token under EU regulations.

Readmore: Bitcoin Spot ETF Explained: All Things You Need To Know!

Macroeconomics (Dec 18 – Dec 24)

The latest data on the inflation index in the United States reveals that the Core Personal Consumption Expenditures (PCE) increased by 3.2%, aligning with expectations. This indicates a rise in overall price levels, impacting consumers and businesses.

Contrary to expectations, the Personal Consumption Expenditures (PCE) showed a decrease, coming in at 2.6% instead of the anticipated 2.8%. This unexpected decline suggests a potential slowdown in consumer spending, which can impact economic growth and market conditions.

Prediction Market Crypto (Dec 18 – Dec 24)

Bitcoin, has been going through a period of adjustment, causing a decrease in its value. However, this adjustment may be a positive sign for altcoins. Historically, during bull cycles, altcoins tend to experience a strong correction of around 30-50% after the initial push wave.

This correction usually takes place over a span of 1-2 weeks. Therefore, if we see a week when the market declines significantly, it might be an opportune time to consider buying altcoins.

In terms of leading trend tokens, we have Ordinals (ORDI, MUBI, TRAC), LIS (SOL, ETH, TIA, AVAX), Memes (BONK, PEPE, DOGE), AI (TAO, OLAS, WLD, FET), Gaming (PRIME, ILV, AURY), DePIN/RWA (RNDR, HNT, MKR), Gambling (RLB, SCS, WINR), DeFi (LDO, JTO, UNI, JUP, SNX), L2s (ARB, OP, BLAST), and zk-stuffs (ZKS, STRK). These tokens represent different sectors and have the potential for significant gains.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.