Key Points:

- Q4 2023 witnessed an 83% spike in CEXs spot trading volume.

- Binance faces a tough Q4 with a declining market share of 30.1%, down from 55% at the beginning of the year.

- Despite obstacles, the crypto market shows resilience, fueled by Bitcoin’s recovery to 19-month highs.

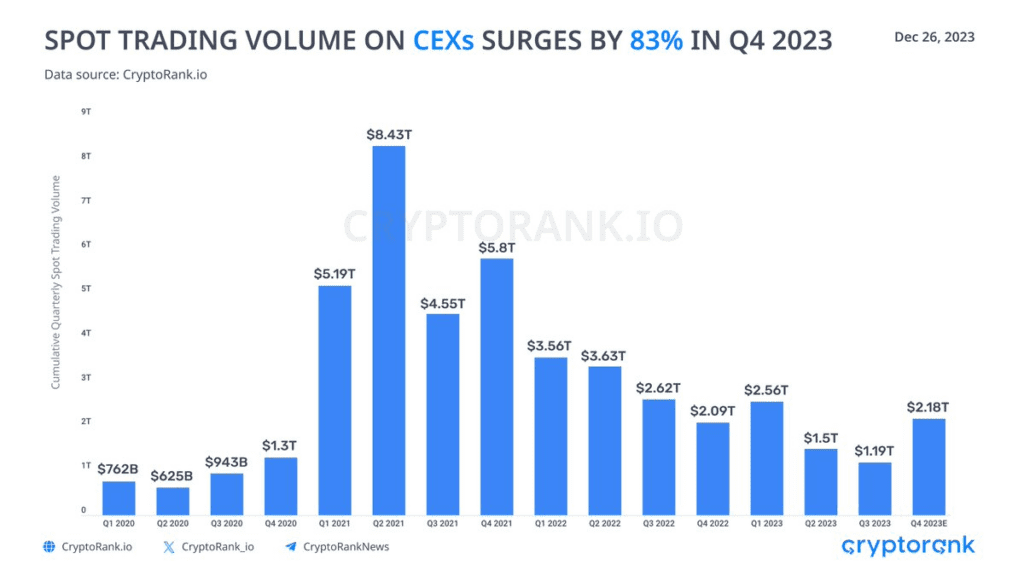

Recent data from Cryptorank, a crypto analysis company, indicates a remarkable 83% surge in spot trading volume on centralized exchanges (CEX) during the fourth quarter of 2023 compared to the challenging third quarter.

Read more: CFTC Vs. Binance Ends: Exchange Agrees To $2.7 Billion Penalty

CEXs Spot Trading Volume Rebounds Amid Regulatory Challenges

The regulatory pressure faced by CEXs, including giants like Coinbase and Binance, from agencies such as the SEC and CFTC during Q3 led to a significant drop in CEXs spot trading volume, plummeting to $1.19 trillion, nearly four times lower than the Q2 2021 peak.

Binance, the world’s largest crypto exchange, faced a tough Q4 as its spot market share declined steadily throughout the year. December figures revealed a diminished market share of just 30.1%, down from the 55% recorded at the beginning of 2023.

The regulatory scrutiny, which extended to Binance’s founder and CEO Changpeng “CZ” Zhao, resulted in a staggering 70% decrease in monthly spot volumes from $474 billion in January to $114 billion in September.

However, despite these challenges, the crypto market witnessed a positive turn, driven by Bitcoin‘s recovery to 19-month highs in November. Retail investors eagerly re-engaged in cryptocurrency trading, leading to a surge in CEXs spot trading volume, with increases of up to 100%.

Notable performers in November included OKX, with a 93% surge to $60.3 billion, and KuCoin, experiencing a 109% increase to $27.5 billion, as reported by Finance Magnates.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |