Key Points:

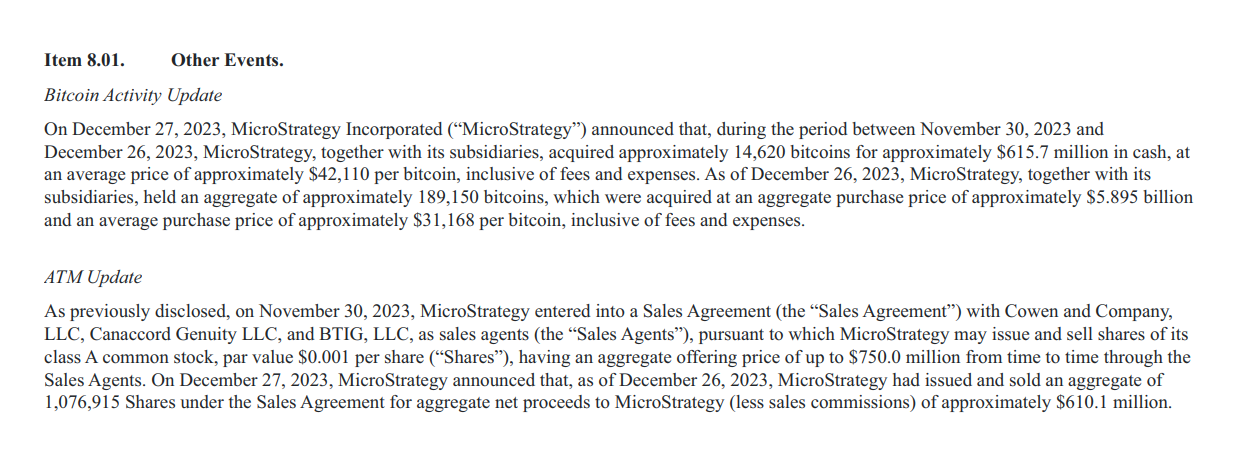

- MicroStrategy recently purchased 14,620 Bitcoins for $615.7 million, bringing their total holdings to 189,150 BTC worth over $8.11 billion.

- Their average purchase price per Bitcoin is $31,168, and they continue to aggressively invest in Bitcoin with no signs of slowing down.

MicroStrategy buys more Bitcoin (14,620) for $615.7 million, bringing their total holdings to 189,150 BTC worth over $8.11 billion.

MicroStrategy, the business intelligence company, has once again made a significant investment in Bitcoin. They recently purchased 14,620 Bitcoins for $615.7 million in cash, at an average price of $42,110 per Bitcoin.

With this latest purchase, MicroStrategy now holds a total of 189,150 BTC, which they have acquired at an approximate price of $5.9 billion, with an average price of $31,168 per Bitcoin.

The latest acquisition is part of MicroStrategy’s ongoing Bitcoin investment strategy, which began in August 2020 with an initial investment of $250 million.

Since then, they have consistently added to their Bitcoin holdings, creating a treasury reserve strategy. At present, their Bitcoin holdings are worth over $8.11 billion.

MicroStrategy Buys More Bitcoin with New $615.7 Million Purchase

Read more: Michael Saylor’s MicroStrategy Bitcoin investment Hits $2.3B profit

MicroStrategy’s continued investment in Bitcoin comes at a time when the market is anticipating the fourth Bitcoin halving and the potential approval of the first spot Bitcoin ETF in the United States.

Despite market fluctuations, MicroStrategy shows no signs of slowing down in their aggressive Bitcoin investment strategy.

The company’s strategy of allocating a significant portion of their treasury reserves to Bitcoin reflects their confidence in the long-term potential of the cryptocurrency.

MicroStrategy’s CEO, Michael Saylor, has been a vocal advocate for Bitcoin, emphasizing its ability to act as a store of value and hedge against inflation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |