Key Points:

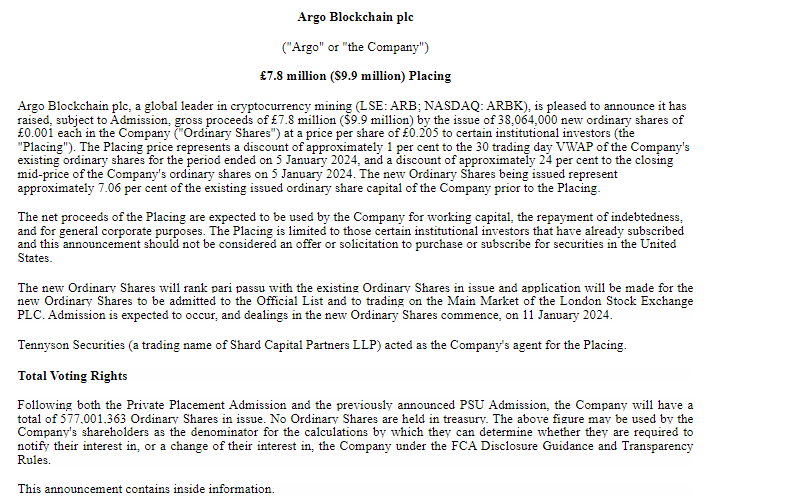

- Argo successfully secures £7.8M via placement of 38,064,000 new shares at £0.205.

- Placement price strategically priced 1% below VWAP, offering financial leverage.

- Funds allocated for working capital, debt repayment, and general corporate purposes.

Argo Blockchain has successfully raised £7.8 million (approximately US$9.9 million) through a placement of 38,064,000 new ordinary shares at £0.205 per share.

The placement, priced at a slight 1% discount to the Volume-Weighted Average Price (VWAP) for the company’s existing shares over the past 30 trading days, and notably 24% lower than the mid-market closing price on January 5, 2024, signals an opportune financial maneuver for the crypto miner.

The newly issued shares will constitute around 7.06% of Argo Blockchain’s total issued ordinary shares before the placement, providing a significant injection of capital. The company plans to allocate the net proceeds from the placement towards working capital, debt repayment, and general corporate purposes, enhancing its financial flexibility and stability.

New Shares Issued at £0.205, Fueling Crypto Expansion!

This placement is exclusively available to specific institutional investors who have subscribed, reinforcing the targeted nature of Argo Blockchain’s fundraising strategy. The new ordinary shares will share equal ranking with the existing ones, and Argo Blockchain has initiated the process for listing them on the main market of the London Stock Exchange. Trading of these new common shares is slated to commence on January 11, 2024, marking a milestone for Argo Blockchain’s financial growth.

Tennyson Securities, operating under the umbrella of Shard Capital Partners LLP, played a pivotal role as the company’s agent for the placement, ensuring a seamless execution of the financial transaction.

The successful placement and strategic use of funds underscore Argo Blockchain’s commitment to capitalizing on market opportunities, enhancing its financial position, and fortifying its position as a key player in the cryptocurrency mining sector. Investors and stakeholders alike can anticipate positive market momentum as the company embarks on this new phase of growth and financial strength.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |