ARK 21Shares Unleashes Explosive 7th Amendment for Bitcoin ETF Approval!

Key Points:

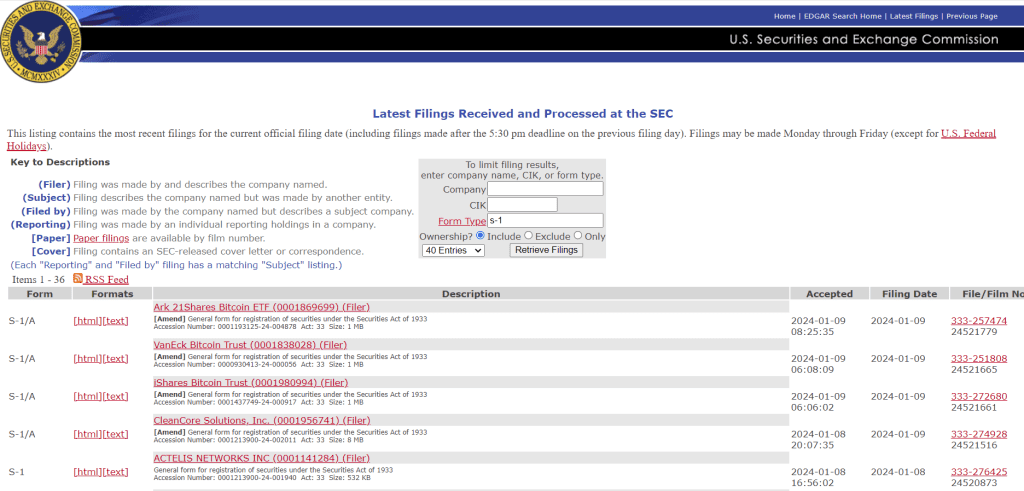

- ARK Invest and 21Shares file amended Form S-1 for spot Bitcoin ETF with the SEC.

- Signals a significant stride in bridging traditional finance and the booming crypto market.

- Investors anticipate increased accessibility and diversification opportunities.

ARK Invest and 21Shares have jointly filed an amended Form S-1 with the U.S. Securities and Exchange Commission (SEC) for the approval of a spot Bitcoin exchange-traded fund (Bitcoin ETF).

This development marks a significant step in the ongoing efforts to introduce more diversified and accessible investment options within the digital asset market.

The amended filing reflects the commitment of both ARK Invest and 21Shares to navigate the regulatory landscape and provide investors with an innovative financial instrument tied to the world’s leading cryptocurrency. The spot Bitcoin ETF, once approved, could open new avenues for investors to gain exposure to Bitcoin without the need for direct ownership or the complexities associated with cryptocurrency custody.

This filing comes at a time when the cryptocurrency market is experiencing heightened interest and acceptance from traditional financial institutions. The collaboration between ARK Invest and 21Shares demonstrates a forward-thinking approach to bridge the gap between traditional finance and the rapidly evolving digital asset space.

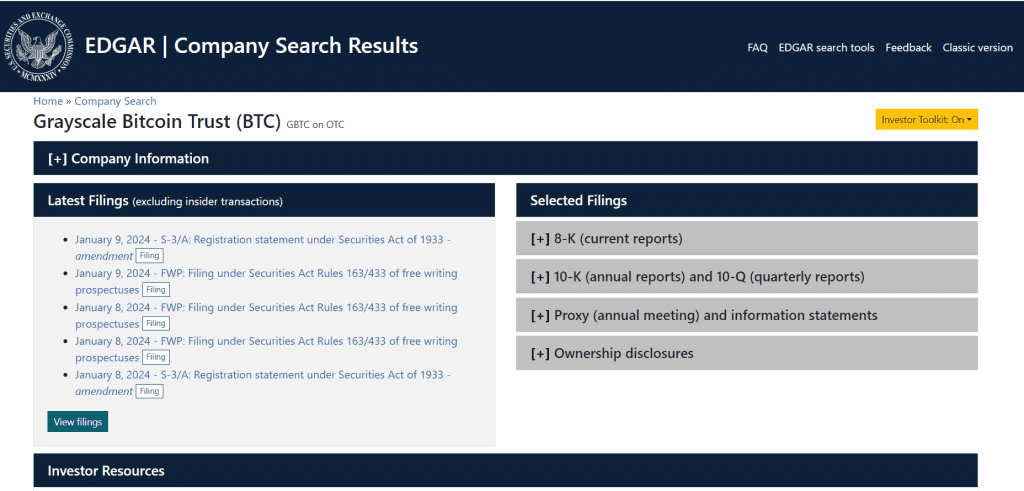

Grayscale Joins Fray with Amended S-3/A Filing!

Grayscale has also made a significant move by filing an amended Form S-3/A. While specific details about the amendments are yet to be disclosed, Grayscale’s continued engagement with the SEC suggests a proactive stance in adapting to the evolving regulatory landscape.

The simultaneous filings by ARK Invest, 21Shares, and Grayscale indicate a collective push within the industry to gain regulatory approval for Bitcoin-related financial products. Investors are closely watching these developments as they anticipate increased opportunities for diversification and exposure to the burgeoning cryptocurrency market.

As these filings progress through the regulatory review process, market participants will be keenly observing any updates from the SEC. The outcome of these filings could have a profound impact on the broader adoption of digital assets within traditional investment portfolios, potentially reshaping the future of cryptocurrency investment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |