Key Points:

- SEC Chairman emphasizes caution for those eyeing crypto assets, especially crypto securities.

- Repeated warnings seen as strategic moves ahead of potential regulatory approval for Bitcoin spot ETF.

SEC Chairman Gary Gensler has once again taken to Twitter, delivering a stern warning to potential investors eyeing the crypto market.

In a tweet posted for the second consecutive day, Gensler emphasized caution, particularly for those considering investments in crypto assets. His message highlighted the potential risks associated with these digital assets, signaling a proactive stance from the SEC in safeguarding investor interests.

Gensler’s repeated public statements are raising eyebrows within the crypto community, with many interpreting them as preemptive disclaimers ahead of a possible launch of a Bitcoin spot exchange-traded fund (ETF). The SEC Chair’s strategic communication is seen as an effort to ensure investors are fully aware of the risks inherent in the volatile crypto market.

Gensler’s Tweets Shape Crypto Landscape!

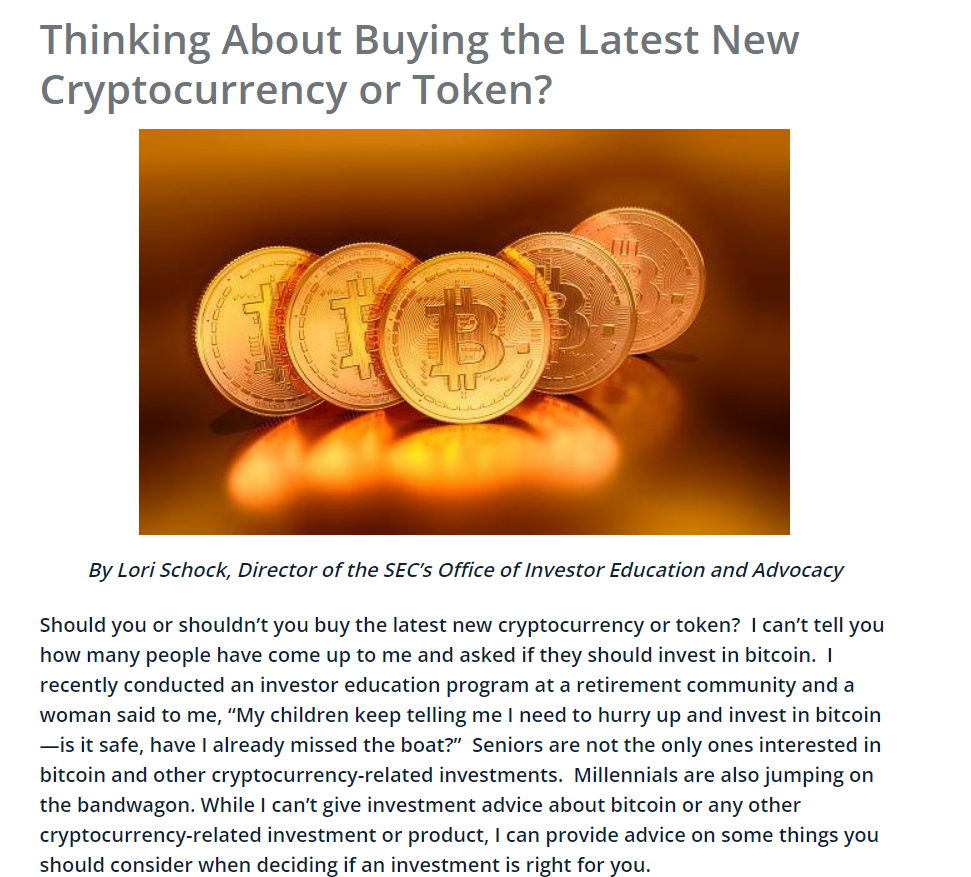

Gensler pointedly mentioned that crypto asset securities might be marketed as new and lucrative opportunities, but they come with serious risks. This explicit caution from the head of the SEC adds weight to ongoing discussions about potential regulatory approvals for Bitcoin-related financial products, particularly ETFs.

The crypto community is closely monitoring these developments, as any indication from the SEC can significantly impact market dynamics. Gensler’s proactive approach aligns with the SEC’s broader mission to protect investors and maintain the integrity of the securities market.

As discussions surrounding the possible launch of a Bitcoin spot ETF gain momentum, Gensler’s warnings are serving as a reminder for market participants to approach crypto investments with a critical eye. The anticipation around regulatory decisions continues to shape the narrative in the crypto space, with investors bracing for potential shifts in the landscape based on the SEC’s stance.

Gensler’s tweets, while concise, carry significant weight in the broader context of crypto regulation. Investors and industry stakeholders are now attuned to regulatory signals, underscoring the evolving relationship between traditional financial oversight and the rapidly expanding world of digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |