Key Points:

- SBF’s decision to switch legal representation sparks curiosity ahead of sentencing hearing.

- Mukasey Young LLP takes the reins, raising questions about SBF’s trial strategy.

- Legal shake-up follows reports of dissatisfaction, injecting intrigue into the unfolding courtroom drama.

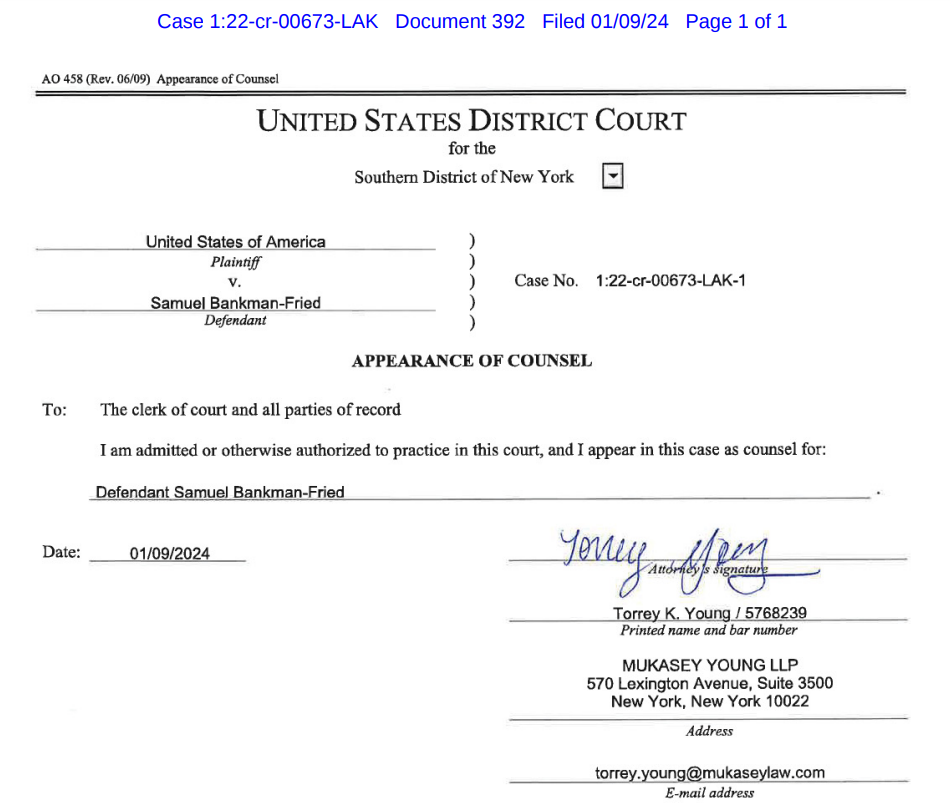

FTX founder Sam Bankman-Fried (SBF) has taken a strategic legal move, submitting notice to the U.S. Federal Court of his decision to hire a new legal team ahead of the sentencing hearing on seven criminal charges.

In a filing on January 9 in the U.S. District Court for the Southern District of New York, Torrey Young and Marc Mukasey from Mukasey Young LLP have officially become SBF’s legal representatives.

The move raises eyebrows within the crypto community, particularly as Sam Bankman-Fried’s original legal team submits a sealed document hinting at a potential appeal against his November conviction. The exact reasons behind the change of legal representation remain unclear, but reports suggest dissatisfaction with SBF’s performance on the witness stand during the trial.

FTX Founder SBF Shuffles Legal Deck Ahead of Sentencing on Criminal Charges!

David Mills, a professor at Stanford Law School, went on record stating that SBF was “the worst person he has ever seen for cross-examination.” The unexpected shift in legal representation indicates a strategic maneuver by SBF to navigate the legal complexities surrounding the charges he faces.

Initially anticipated to undergo a second criminal trial in March, where five additional charges awaited him, recent reports suggest that U.S. prosecutors opted not to pursue further investigation, citing public interest considerations. SBF’s potential sentencing remains a matter of concern, with the looming possibility of facing years in prison if convicted.

The development marks a critical juncture for SBF and FTX, a major cryptocurrency exchange he co-founded. As legal proceedings unfold, the crypto industry watches closely, recognizing the potential impact on the regulatory landscape and the broader implications for cryptocurrency exchanges and their founders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |